Mexican Peso weakens ahead of Banxico policy meeting

- The Mexican Peso trades lower in its major pairs the day before the Bank of Mexico policy meeting.

- The consensus expectation is for the bank to cut interest rates by 0.25% to 10.50%.

- USD/MXN pulls back from resistance as it steadily climbs within its rising channel.

The Mexican Peso (MXN) trades lower in its major pairs on Wednesday, ahead of the Bank of Mexico (Banxico) September policy meeting on Thursday, which is the main event for the currency this week.

The Peso may be losing ground as the positive effects of the stimulus measures announced by the People's Bank of China (PBoC) which gave emerging market currencies a boost on Tuesday fade. The measures revived the carry trade, which positively benefits the Peso given its relatively high interest rates – the Bank of Mexico's official rate is 10.75%.

Mexican Peso traders await Banxico’s decision

The Mexican Peso weakens against its most heavily-traded peers as traders brace for the Banxico policy meeting on Thursday.

The consensus is for the central bank to cut interest rates by 25 basis points (bps), bringing the official rate down to 10.50% from 10.75% currently.

In a recent survey of 25 economists by Bloomberg, 20 expected a 25 bps cut whilst only one expected no-change.

There is also a growing wild-card bet for a larger 50 bps (0.50%) cut after Mexico’s inflation data, released on Tuesday, registered a deeper-than-expected slowdown in September. Four out of the 25 economists polled by Bloomberg prior to the inflation data expected a 50 bps cut – and this has probably increased after the release.

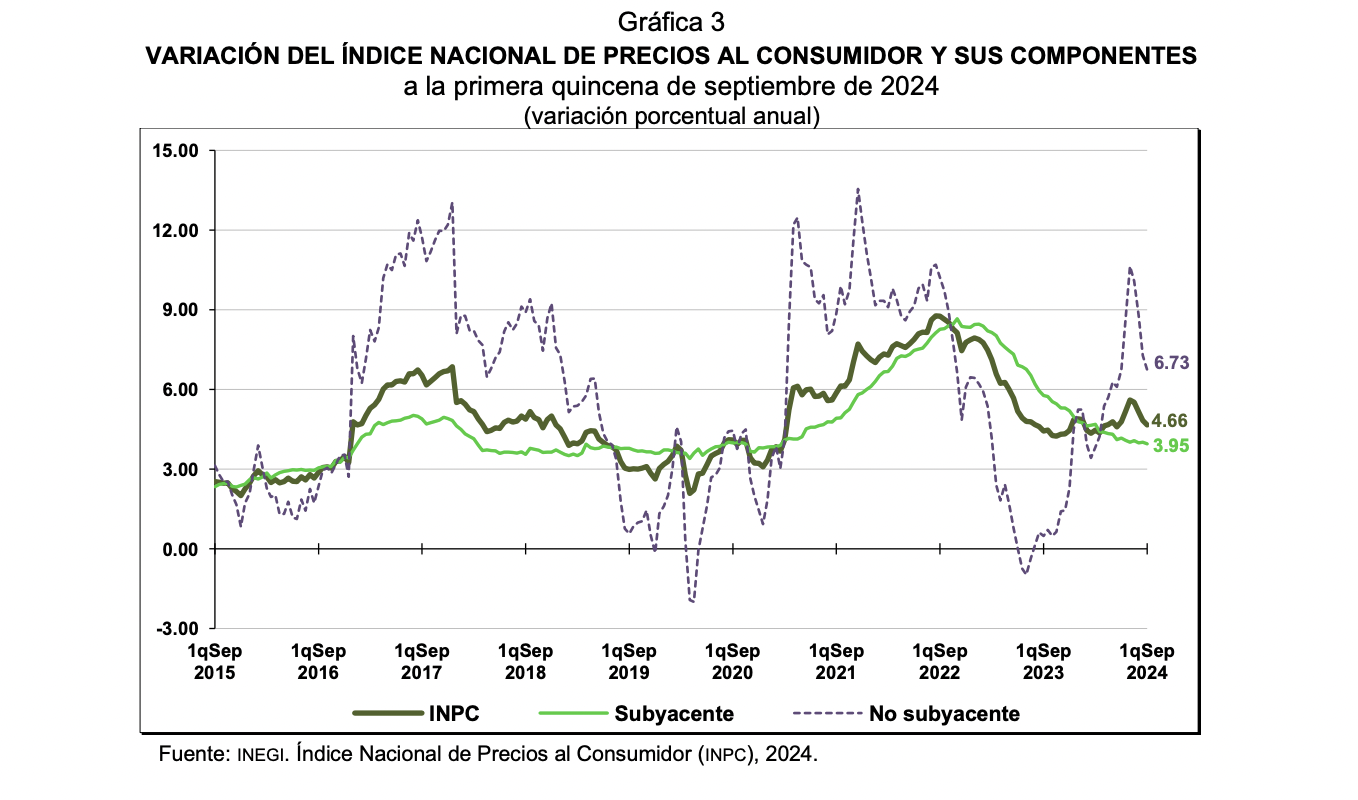

Data out on Tuesday showed headline inflation (INPC) over the last 12 months fell to 4.66% in Mexico in mid-September, and core inflation (Subyacente) to 3.95%, according to data from The Instituto Nacional de Estadística Geografía (INEGI).

At the same time, a greater-than-expected growth in Mexico’s economic activity data for July suggests Banxico may take a more cautious approach, favoring a 25 bps cut over a 50 bps reduction.

“Earlier figures revealed a 3.8% year-on-year expansion in Mexico's economic activity in July, rebounding from a 0.6% decline in the previous month and surpassing market forecasts of a 1.8% rise. This was the sharpest growth in three months and the third-highest increase this year, potentially providing Banxico with more room to moderate its monetary easing, thus lending support to the Peso,” reported Trading Economics.

At the August meeting, Banxico decided to cut interest rates by 0.25%. The fact that the decision was a close call, with only three members voting for the cut versus two who wanted to keep rates unchanged, further makes it unlikely the central bank will opt for a larger 0.50% reduction.

“The larger-than-expected fall in Mexican inflation in the first half of September, to 4.7% y/y, supports our view that Banxico will continue its easing cycle with another 25bp cut on Thursday,” says Kimberley Sperrfechter, Emerging Markets Economist at Capital Economics in a note on Wednesday.

The market is more dovish, however, arguing a higher risk of a 50 bps cut exists, given it expected 75 bps of easing over the next three months and 250 bp of total easing over the next 12 months, according to Dr. Win Thin, Global Head of Markets Strategy and Brown Brothers Harriman (BBH).

Technical Analysis: USD/MXN pulls back from resistance within rising channel

USD/MXN edged higher on Monday to touch resistance (August 22-23 swing high) at 19.52 before pulling back down. It is now once more rising. Overall, it is in a medium and long-term uptrend within a rising channel.

USD/MXN Daily Chart

There is a possibility USD/MXN has begun a short-term uptrend within the channel. If so, the bias is for higher prices since it is a principle of technical analysis that “the trend is your friend”.

A close above 19.53 (August 23 swing high) on a 4-hour basis would provide bullish confirmation that the pair is in a short-term uptrend.

The 50-day Simple Moving Average is bolstering support at the base of the channel.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.