What is a Trading Account?

A trading account is an instrument used in finance to trade futures, commodities, options, and stocks. Choosing the proper method of account opening would be beneficial. On a Forex platform, what kind of trading account can be opened? You can open a number of different types of accounts to begin trading on the forex market.

Today, with the help of this comprehensive blog, we will help you to understand what is a trading account, the types of trading accounts, the importance of a trading account, and the steps to open a trading account. Also, this blog will help you decide what type of account to trade for your first participation.

So, let’s get started!

What is a Trading Account?

You can buy, sell, or exchange stocks, commodities, futures, and options with this trading account. You must open a trading account in order to begin stock market investing or even become a trader. Any of the brokers will allow you to open an account, but there are a few things you should know before doing so.

Investors are able to trade independently using this trading account. You can profit from your investments thanks to it as well.

Through your account, you are able to invest in any asset. The kinds of assets you can trade with this account are unrestricted. A trading account example is used by professionals who want to trade on the financial markets. However, novices who want to try out market speculation can also use it.

Why do you Need a Trading Account?

A trading account can be used for many things. Here, in this section, we are going to mention the reasons for opening a trading account.

Buying And Selling Securities

To purchase and sell securities like stocks, bonds, and options, you need a trading account. Having a trading account allows you to carry out trades in accordance with your investment strategy and profit from market swings. A trading account offers the required framework to carry out your desired activities, whether you want to start a long-term investment portfolio or engage in short-term trading.

Portfolio Diversification

Portfolio diversification allows you to keep money safe and make more money with your existing investments. If you have a trading account on a leading Forex platform, then you can easily invest in Bonds, Stocks, etc. This is the easiest way to invest your money without any risk for your investments.

Learning And Skill Development

When you open your trading account, you will get plenty of chances to learn and get better day by day. Also, as you start trading your money, you gain real-life experience by learning how it works. Moreover, this hands-on experience makes you a smarter investor as you have already learned from different instances and opinions.

Investment Research And Analysis

Once you open trading on a Forex platform, they provide you with a bunch of helpful tools to understand how trading works in an easy way. These tools can include charts, signs of when to buy and sell, and much more deep information about the financial market. With the help of these tools, you can easily discover the finest opportunities to invest your money.

Access To Financial Markets

Having an exchange account is extraordinary in light of the fact that it allows you to participate in the finance market. With a trading account, you can engage in the stock market, bond market, foreign currency market, and more. This implies you can put resources into various things and take advantage of chances when the market changes.

Risk Management

At a certain point when you invest money, risk management becomes crucial. Having a trading account on a trusted Forex platform allows you to set rules that safeguard your investments. The risk management strategies can involve various events i.e., If you start losing too much money, sell it, or on the other hand if you are gaining enough, sell it. These events help you manage the risk of losing your money.

Flexibility And Convenience

Trading requires careful risk management. To safeguard your money, you can create risk limits using a trading account, such as stop-loss and take-profit orders. All of these measures make trades happen easily. However, you follow the rules you set beforehand. This strategy ensures that your earned money is safe and allows you to stop losing too much money while you are trading.

Types of Trading Account

There are different types of trading possible in the share market through various trading accounts. Here, we are going to mention the types of trading accounts facilitated by Inveslo. Let’s take a quick look:

What is a Standard STP Account?

The Standard Account is for different types of traders who use traditional trading. It's a good choice for traders as it offers competitive spreads without charging any commission. This account is safer because it has fewer risks and keeps your trading safe.

Traders using the Standard Account have the flexibility to engage in transactions using standard lots, providing a familiar and standardized strategy. Moreover, the account makes sure that traders can easily see how much their trades will cost because it shows all the prices clearly. The Standard Account is well-suited for traditional traders who are looking for transparency, minimal risk, and reliability factors on the trading journey.

Why Choose A Standard STP Account?

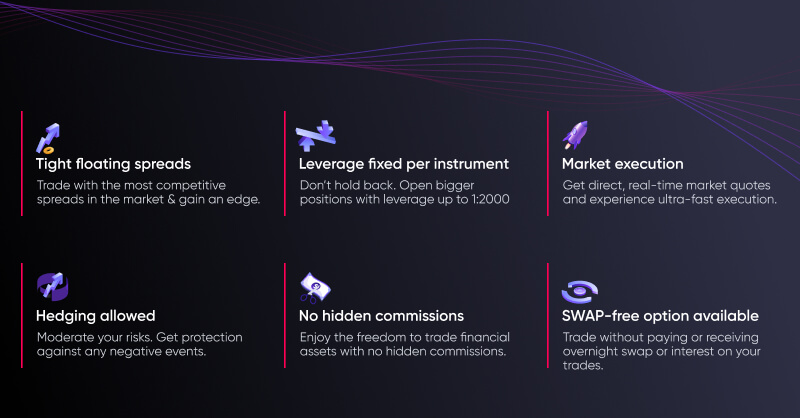

A standard account is ideal for anyone who wishes to access the markets with low initial capital, whether they are experienced traders or novices. As shown in the image mentioned below following are the reasons to choose a standard account:

Standard Account Specifications

Here, in this section, we are going to outline the specifications of the Standard STP account. Let’s take a quick look:

|

Standard STP Account |

$100 minimum deposit |

|

Trading Platforms |

MetaTrader 4 |

|

Account Currency |

USD / EUR |

|

Commission |

Zero |

|

Spread |

From 2.1 |

|

Maximum Volume in Lots per Trade |

30 |

|

Maximum Number of Orders |

100 |

|

Step Lot |

0.01 |

|

Trading Instruments |

Majors, Minors, Exotics, Spot Metals, Spot Indices, Spot Energies |

|

Pricing |

5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD |

|

Margin Call |

80% |

|

Hedge Margin |

50% |

|

Stop Out |

50% |

ECN – Commission-free Account

A trading account known as ECN, or Electronic Communication Network, gives buyers and sellers a direct line of communication with liquidity providers. As a result, trading can take place without a middleman.

The key advantages of an ECN Commission Free Account are that you get NO-Commission in addition to the finest market quotes, the quickest market execution, and the lowest spreads. Furthermore, there is no trading cap. This implies that traders can have an infinite number of open positions and pending orders.

Professional traders seeking high liquidity and ideal trading circumstances are best suited for this account.

Reasons to Choose an ECN - Commission-Free Account

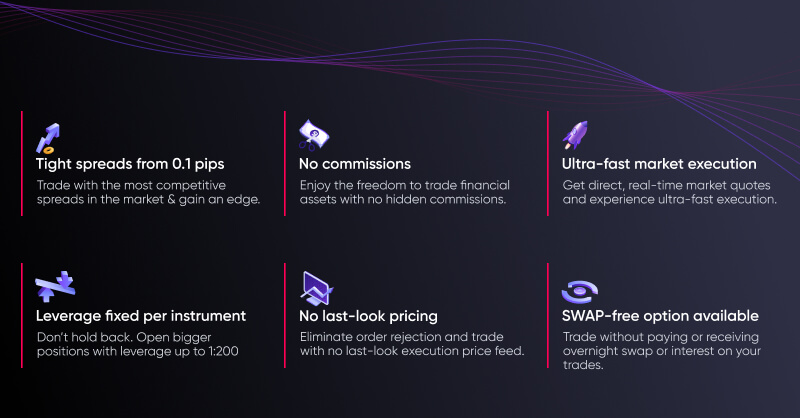

You have greater flexibility and complete transparency with Inveslo's ECN Commission Free Account while paying no commission costs. The finest bid and ask prices from the liquidity providers are among the best trading conditions offered by this account. As shown in the image mentioned below following are the reasons to choose an ECN - commission-free account:

ECN - Commission Free Account Specifications

Here, in this section, we are going to outline the specifications of the ECN - Commission free account. Have a quick glimpse:

|

ECN Commission Free Account |

$250 minimum deposit |

|

Trading Platforms |

MetaTrader 4 |

|

Account Currency |

USD / EUR |

|

Commission |

Zero |

|

Spread |

From 1.9 |

|

Maximum Volume in Lots per Trade |

100 |

|

Maximum Number of Orders |

Unlimited |

|

Step Lot |

0.01 |

|

Trading Instruments |

Majors, Minors, Exotics, Spot Metals, Spot Indices, Spot Energies |

|

Pricing |

MT4: 5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD |

|

Margin Call |

80% |

|

Hedge Margin |

50% |

|

Stop Out |

50% |

ECN Trading Account

A trading account known as ECN, or Electronic Communication Network, gives buyers and sellers a direct line of communication with liquidity providers. As a result, trading can take place without a middleman.

The key advantages of having an ECN Account are that you may instantly get the best market quotes, the quickest execution, and the lowest spreads. Additionally, there is no trade cap. This implies that traders can have an unlimited number of open positions and pending orders.

Professional traders seeking high liquidity and ideal trading circumstances are best suited for this account.

Why Choose an ECN Account for Trading?

You will have more trading flexibility and transparency with Inveslo's ECN Accounts. The liquidity providers' best bid and ask prices are available on this account. As shown in the image mentioned below following are the reasons to choose an ECN account for trading:

ECN Account Specifications

With an ECN account, you receive greater flexibility, the ability to scalp, maximum liquidity without the middleman's intervention, and impressive returns from the best possible trading conditions. Now here, in this section, we are going to outline the specifications of the ECN - Commission free account. Take a quick look:

|

ECN Account |

$500 minimum deposit |

|

Trading Platforms |

MetaTrader 4 |

|

Account Currency |

USD / EUR |

|

Commission |

$3 per lot per side |

|

Spread |

From 0.1 |

|

Maximum Volume in Lots per Trade |

100 |

|

Maximum Number of Orders |

Unlimited |

|

Step Lot |

0.01 |

|

Trading Instruments |

Majors, Minors, Exotics, Spot Metals, Spot Indices, Spot Energies, Cryptos |

|

Pricing |

5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD |

|

Margin Call |

80% |

|

Hedge Margin |

50% |

|

Stop Out |

50% |

What is a Premium Trading Account?

A premium account is appropriate for seasoned traders who are prepared to put down a minimum of $20,000. The account enables traders to initiate large-volume positions. Additionally, the trading circumstances and tools have been put up to go along with your trading methods and techniques.

This account offers the ease of super-quick execution, professional trading tools, and an all-around enhanced trading experience. The ideal option for you if you are confident in your trading knowledge and abilities is a Premium Account.

Reasons to Choose a Premium Account for Trading?

Experienced traders have access to premier trading environments and conditions with Inveslo's Premium Account. Position sizing is extremely flexible with this account. As shown in the image mentioned below following are the reasons to choose a platinum account for forex trading:

Premium Account Specifications

Our premium account is the ideal option for you if you're an experienced trader searching for professional trading tools, dynamic leverage, and a flexible trading environment. Now here, in this section, we are going to outline the specifications of the premium account. Have a quick look:

|

Premium Account |

$20000 minimum deposit |

|

Trading Platforms |

MetaTrader 4 |

|

Account Currency |

USD / EUR |

|

Commission |

Zero |

|

Spread |

From 0.1 |

|

Maximum Volume in Lots per Trade |

250 |

|

Maximum Number of Orders |

Unlimited |

|

Step Lot |

0.01 |

|

Trading Instruments |

Majors, Minors, Exotics, Spot Metals, Spot Indices, Spot Energies |

|

Pricing |

5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD |

|

Margin Call |

80% |

|

Hedge Margin |

50% |

|

Stop Out |

50% |

How to Open a Trading Account?

To begin your journey in Forex trading by opening a real account, follow these step-by-step processes:

Step 1: Choose a Reputable Broker

The first and most important step is to choose a reputable and licensed broker, such as Inveslo, who matches your trading requirements and preferences. Do extensive research, considering elements like trading platforms, customer assistance, fees, and the range of trading instruments.

Step 2: Register Using the Official Website of the Broker

After deciding on a broker, visit their official website and look for the registration form. Your name, email address, phone number, and any other required information should be provided as necessary. Complete the form completely, then send it.

Step 3: Log in to Your Personal Account

After completing the registration process, you will be sent login information (username and password). To access your personal account on the broker's website, log in using the credentials you were given.

Step 4: Select the Type of Account

You will normally discover a list of the many account kinds that the broker offers inside your personal account. Choose the account type that best fits your trading objectives and financial resources by comparing the features and advantages of each. Once a decision has been made, select "Open Account" to continue.

Step 5: Make a Deposit as per Account’s Minimum Deposit Requirement

You must deposit money into your freshly created real account before you can start trading. Based on your financial resources and risk tolerance, determine your initial budget. Brokers typically offer a variety of deposit options, including electronic wallets, credit/debit cards, and bank transfers. Choose the option that is most convenient for you, then adhere to the prompts to make the deposit.

Step 6: Fund Your Account

The money will be credited to your real trading account after the deposit is complete. Depending on the deposit method selected and the broker's policies, this process could take some time. You are prepared to start trading as soon as the funds have been successfully credited.

Step 7: Start Trading

Now that your real account has been created and funded, you can access the broker's trading platform. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the most widely utilized platforms. To use the trading platform, enter the specified login and password. For security reasons, it is advised that you change your password right away when you log in.

Conclusion

Trading accounts act as the connecting link between people and a well-known forex platform called Inveslo and the hectic world of trading in the intricate world of finance. Their broad and diverse range of functions includes everything from carrying out deals and diversifying portfolios to speculating, hedging, and making money.

Moreover, it is necessary to understand whatever we have mentioned above about trading accounts including what is trading account, the types of trading accounts, the importance of trading accounts, and the step-by-step process to open a trading account effortlessly. Thus, as per our experts, it is highly recommended that if you are new in the trading arena then you should start with a demo trading account. So, what are you waiting for? Visit Inveslo.com and open your elite demo trading account to enter the financial market like a bull!