Gold sees recovery rally halt near $2,912 after a spring higher in the European session on Tuesday

- Gold sees profits halt for now, just a sigh away of 1% gains on Tuesday.

- A possible German defense spending deal hit the US Dollar and support Gold in its turn.

- Traders are erasing a weekly loss and are sending Gold into green numbers for this week.

Gold’s price (XAU/USD) trades above $2,910 at the time of writing on Tuesday and has overturned this week's loss into a profit for now, ahead of the US trading session. The surge is the result of a domino effect originated by the headline from the German Green coalition leaders, who said this morning to have given the green light to a deal on defense spending. That boosted confidence in the Euro (EUR) and triggered a new leg lower in the US Dollar Index (DXY), which opened the door for Bullion to surge.

Meanwhile, traders are still cautious after a tariff war is spiraling out of control outside the United States (US). Canada has hit several Chinese imports, which met with counter-tariffs from China on Canadian goods such as canola Oil. The demands from US President Donald Trump are being met for now as Canada and Mexico can see further easing on their own tariffication if they also impose levies on Chinese goods.

Daily digest market movers: Fed futures for May start to turn

- US President Donald Trump’s signals that the economy could first suffer as he reshapes trade policy with tariffs stoked concerns about a potential recession. The precious metal, a traditional haven asset, can face selling pressure during sudden market selloffs, Bloomberg reports.

- Thailand’s currency, Thai Bhat (THB), has received a boost this year from a rally in Gold prices. Strategists warn though that the rally will not be enough to protect the country from tariff risks. The THB is up around 1.2% against the US Dollar this year, more than double the gain of a broad gauge of Asian currencies. A key reason is Thailand’s role as a Gold-trading hub in the region, which boosted confidence in the currency, Bloomberg reports.

- The CME Fedwatch Tool sees a 95.0% chance for no interest rate changes in the upcoming Fed meeting on March 19. However, the chances of a rate cut at the May 7 meeting increase to 47.8%.

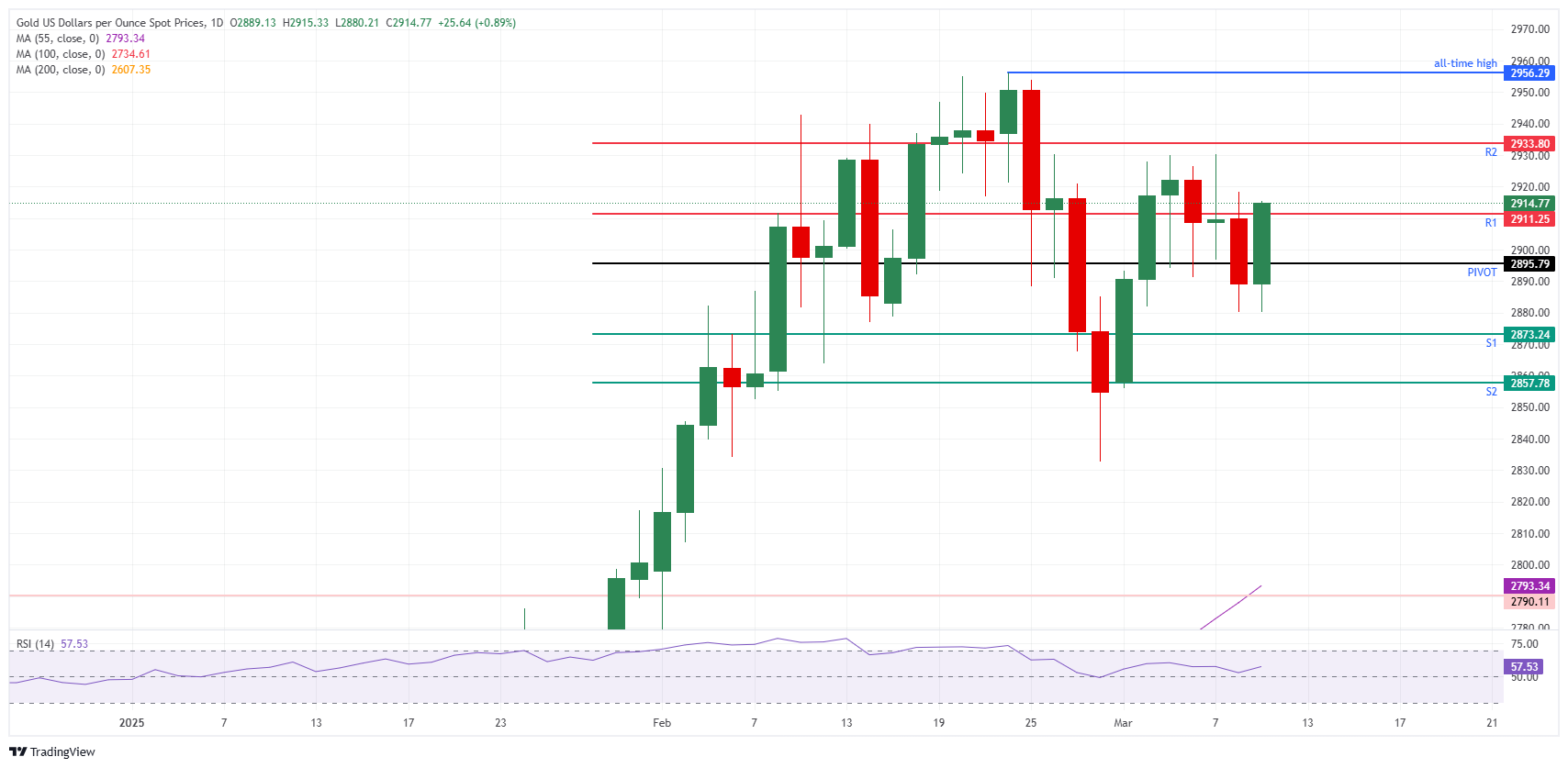

Technical Analysis: With a little help from a friend

For once, it is not a headline on tariffs which is boosting the precious metal. This time, it is a domino effect where a weaker US Dollar opens the door for Gold to move higher. There are not yet aspirations for a new all-time high, but it is good to see the initial weekly loss erased and Gold returning to flat on the week.

Gold is back above the $2,900 round level and, from an intraday technical perspective, it is back above the daily Pivot Point at $2,895. At the time of writing, Gold is knocking on the door of the R1 resistance near $2,910. Once through there, the intraday R2 resistance at $2,933 comes into focus on the upside, converging with last week’s highs.

On the downside, the firm support stands at $2,880, which has held Gold’s price on Monday and Tuesday. In case that level breaks, look at the S1 support around $2,873. A small leg lower could target $2,857, the convergence of the S2 support and the March 3 low.

XAU/USD: Daily Chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.