BoC on route to fourth straight interest-rate cut as inflation falls below target

- Bank of Canada (BoC) is expected to cut its policy rate by 50 bps.

- The Canadian Dollar remains on the defensive against the US Dollar.

- Headline inflation in Canada dropped below the bank’s 2% target.

- The BoC will also release its Monetary Policy Report (MPR).

There is broad anticipation that the Bank of Canada (BoC) will cut its policy rate for the fourth consecutive meeting on Wednesday. Unlike previous moves, there seems to be a consensus for a 50 basis point rate cut this time, taking the benchmark interest rate to 3.75%.

Since the beginning of the year, the Canadian Dollar (CAD) has weakened against the US Dollar (USD), with USD/CAD reaching an almost two-year high near 1.3950 in early August. Following a period of quite a significant appreciation in August, CAD has since then embarked on a firm downward path that currently flirts with the mid-1.3800s against its North American counterpart.

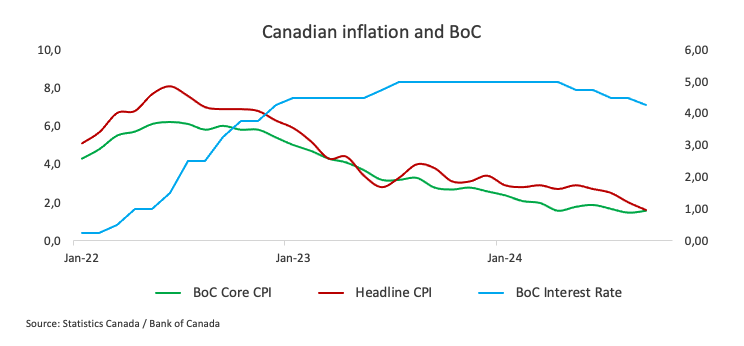

In September, Canada's annual inflation rate, measured by the headline Consumer Price Index (CPI), broke below the central bank’s 2% target for the first time since the Covid-19 pandemic, showing prices rising by 1.6% over the last twelve months. The BoC's core CPI, despite rebounding marginally last month, remained well below the bank’s threshold.

It is worth noting that the BoC aims to maintain consumer prices around the midpoint of the 1%-3% range.

A dovish cut appears well on the horizon

Despite the anticipated rate cut, the central bank's overall stance is expected to lean towards the bearish side, particularly against the backdrop of declining inflation, further cooling of the labour market, and GDP running below the bank’s latest forecasts.

So far, swaps markets in Canada see around a 70% chance of a half-point rate reduction on Wednesday.

According to a BoC survey released on October 11, Canadian firms reported continued weak demand and slow sales growth, though they noted a marginal improvement in conditions during the third quarter. The survey also suggested that rate cuts could potentially provide a further boost to these conditions.

Following the rate cut on September 4, the Minutes published on September 18 revealed that the bank’s Governing Council was divided on the inflation outlook ahead of its decision to cut rates for the third consecutive time. The BoC stated that it was balancing the effects of two conflicting forces on inflation: the ongoing high costs of shelter and services and a slowing economy coupled with rising unemployment.

According to the Minutes, council members expressed the view that if the economy and labour market did not improve as expected in response to lower borrowing costs, it could be necessary to reduce the policy rate more rapidly.

At his latest remarks on September 24, BoC Governor Tiff Macklem indicated that, given the bank’s ongoing progress in bringing inflation back towards the 2% target, further rate cuts are a reasonable expectation. Macklem emphasized the bank’s goal of keeping inflation near the middle of its 1%-3% control range. "We need to stick the landing," he said, adding that the bank is aiming for stronger economic growth to help absorb the remaining slack in the economy.

Previewing the BoC’s interest rate decision, analysts at Standard Chartered noted: “We now expect the Bank of Canada (BoC) to lower the policy rate by 50bps (instead of 25 bps) at both the October and December meetings, taking the year-end rate to 3.25% (3.75% prior). The September headline inflation undershoot and diminishing inflationary pressure from shelter prices are likely to open the door for faster easing. Falling inflation expectations and continued slack in the economy further bolster the case for 50bps moves.”

When will the BoC release its monetary policy decision, and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision at 13:45 GMT on Wednesday, followed by a press conference from Governor Macklem at 14:30 GMT.

With no major surprises anticipated, the impact on the Canadian Dollar (CAD) is expected to stem more from the central bank’s messaging than the actual interest rate decision.

Pablo Piovano, Senior Analyst at FXStreet, notes that USD/CAD has been in a strong upward trend since late September, with the pair hitting October tops near 1.3850 so far this week. The strong rebound came almost exclusively on the back of the robust recovery of the US Dollar (USD).

Pablo adds: "The immediate target emerges at the 2024 peak at 1.3946 recorded on August 5."

He concludes: "Occasional bearish attempts could prompt USD/CAD to retest the provisional 100-day SMA at 1.3664, ahead of the more significant 200-day SMA at 1.3622, all prior to the September bottom of 1.3418 seen on September 25.”

Economic Indicator

BoC Press Conference

After Bank of Canada (BoC) meetings and the release of the Monetary Policy Report, the BoC Governor and Senior Deputy Governor hold a press conference at which they field questions from the media. The press conference has two parts – first a prepared statement is read out, then the conference is open to questions from the press. Hawkish comments tend to boost the Canadian Dollar (CAD), while a dovish message tends to weaken it.

Read more.Next release: Wed Oct 23, 2024 14:30

Frequency: Irregular

Consensus: -

Previous: -

Source: Bank of Canada

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.