-

Opps!

This language contents are not available!

DXY: Dragged lower by UST yields – OCBC

USD continued to trade lower, owing to the precipitous fall in UST yields and continued moderation in US exceptionalism. DXY was last at 106.27 levels. US data - ISM mfg, new orders and employment - continued to surprise to the downside overnight, OCBC's FX analysts Frances Cheung and Christopher Wong note.

Consolidation likely with risks skewed to the downside

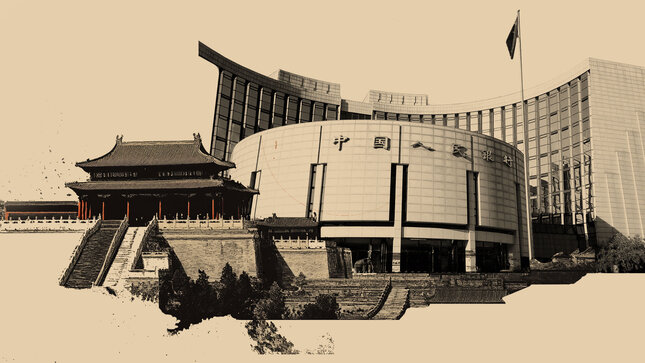

"Today, Trump’s 25% tariff on Canada and Mexico alongside 10% additional tariff on Chinese imports come into effect, with no room for negotiations. China’s state-backed media Global Times reported that China is preparing countermeasures that include both tariffs and a series of non-tariff measures, and US agricultural and food products will most likely be listed (timing uncertain)."

"Canada and Mexico have also pledged retaliatory tariffs in response. A tit-for-tat can undermine sentiments and lead to demand for safe haven proxy, including USTs and JPY. High-beta risk proxy FX including AUD, NZD stayed under pressure but selected AxJ FX, including THB and IDR found a breather thanks to softer UST yields."

Daily momentum turned flat while RSI fell. Consolidation likely with risks skewed to the downside. Support at 106.35 (38.2% fibo retracement of Oct low to Jan high), 106.10 before 105.00/20 levels (50% fibo, 200 DMA). Resistance here at 107.30 (21 DMA), 107.80/108 levels (23.6% fibo, 50 DMA) before 108.50.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.