-

Opps!

This language contents are not available!

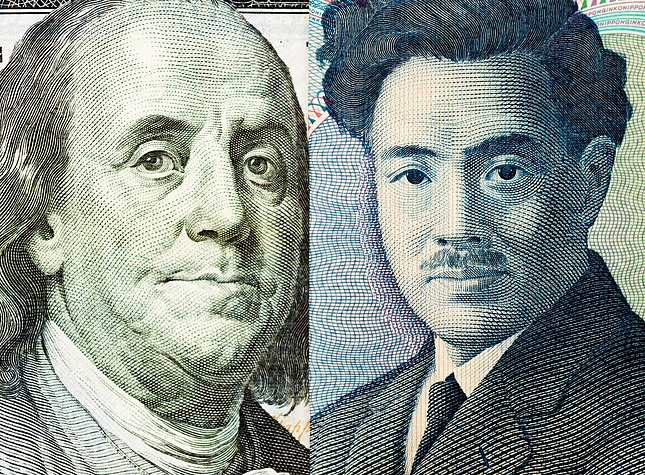

Goods prices in Japan are now also weakening – Commerzbank

At first glance, this morning's national inflation figures from Japan could be seen as positive for further interest rate hikes. The annual rate excluding fresh food and the rate excluding fresh food and energy were slightly higher than expected. However, a look at the underlying data confirms our recent analyses: seasonally adjusted goods prices fell sharply in September, pushing down the annual rate, Commerzbank’s FX analyst Michael Pfister notes.

Japanese intervention game might resume

“This was probably due to the yen's strong appreciation, which is pushing down imported inflation. On the other hand, seasonally adjusted services prices have been rising by around 0.1% per month for several months. This is significantly lower than in other G10 economies, where these more ‘domestic’ price pressures account for most of the rate of price increases. This remained the case in September.”

“In addition, a large base effect from the annual rate of goods prices is likely to be removed from the calculation of the year-on-year rate next month, which should push the inflation rate down further. Readers may point out that the yen has depreciated again in the meantime. That is true, but import prices have continued to fall recently, presumably because the yen is still significantly stronger than it was at the beginning of July. In short, another month has passed without confirmation of the Bank of Japan's story of a sustained stabilisation of Japanese inflation.”

“On a side note, the yen was able to strengthen a bit this morning anyway, as officials said that the recent moves were ‘one-sided’ and ‘sudden’. It was probably only a matter of time before such statements were made, after all USD/JPY broke through the 150 level yesterday. The fear is that unless the USD weakens again in the coming weeks, the intervention game will resume.”

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.