Gold price stagnates ahead of US jobless claims data

- XAU/USD holds firm as speculation grows over Trump’s potential tariff rollback.

- Gold fluctuates around $2,910 amid mixed economic signals and policy uncertainty.

- US ADP jobs data disappoints, while ISM Services PMI shows inflation risks persist.

- Traders eye US Nonfarm Payrolls data Friday for Fed rate-cut clues.

Gold price remains firm on Wednesday amid speculation that the President of the United States (US), Donald Trump, could roll back some tariffs, at least duties on automobiles linked to the USMCA free trade agreement. Nevertheless, uncertainty remains, and XAU/USD trades at $2,919, virtually unchanged.

Bullion prices had been seesawing around the $2,910 mark during the North American session as the news flow continued. The Federal Reserve (Fed) revealed the Beige Book in anticipation of the upcoming monetary policy, stating that overall economic activity rose, yet prices are higher amid Trump trade policies.

Data-wise, ADP revealed that private hiring in February slowed sharply compared to January’s figures. Meanwhile, according to February's latest ISM Services PMI, businesses continued to expand healthily. Despite this, fears that inflation could reaccelerate remained, as Prices Paid, a sub-component of the PMI, jumped above the 60 level, hinting that producers are paying higher prices, which could stoke a second round of inflation.

Meanwhile, recently revealed US data sparked recessionary fears. The Atlanta Fed GDPNow Model projects the Gross Domestic Product (GDP) for Q1 2025 at -2.8%, down from 1.6% estimated on Monday.

Regarding geopolitics, an aide of Ukraine President Zelensky discussed steps to achieve peace with the US National Security Advisor as Ukraine and the US agreed on a meeting soon.

This could push Gold prices lower, alongside higher US Treasury bond yields. Traders will be eyeing Friday's release of February’s Nonfarm Payrolls figures, with analysts projecting 160K jobs added to the workforce.

Daily digest market movers: Gold price consolidates amid mixed US data

- The US 10-year Treasury note climbs four basis points (bps) to 4.28%.

- US real yields, as measured by the US 10-year Treasury Inflation-Protected Securities (TIPS) yield, are rising four and a half bps up to 1.935%.

- The ADP National Employment Change report showed that US private sector hiring increased by 77K in February, significantly missing the 140K forecast and falling well below January’s strong 186K gain.

- Meanwhile, the ISM Services PMI expanded to 53.5 in February, exceeding expectations of 52.6 and improving from January’s 52.8, signaling continued growth in the services sector.

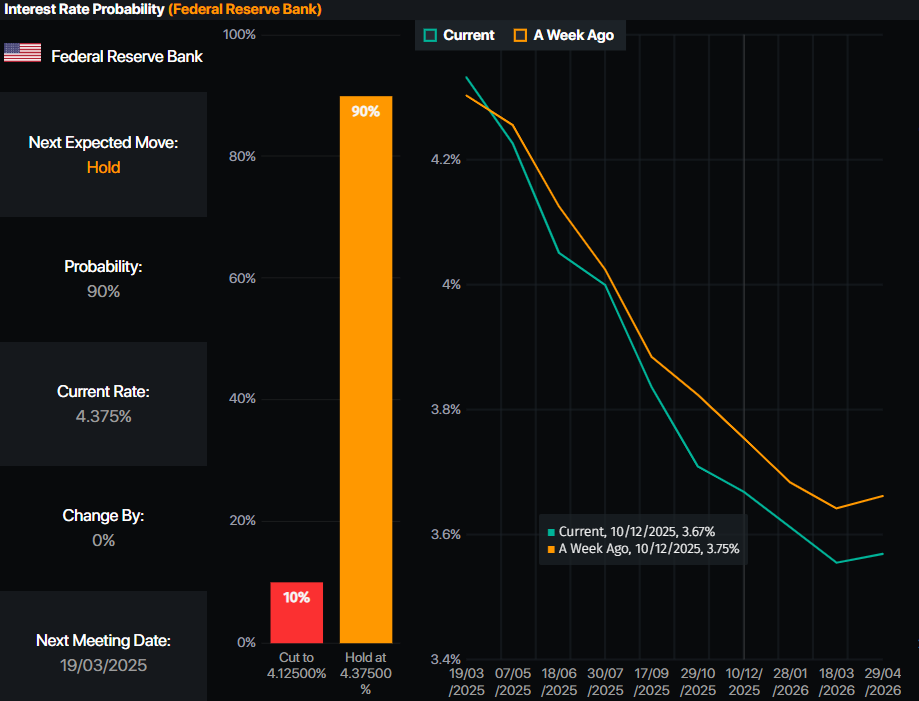

- Money market traders had priced in 71.5 basis points of easing in 2025, down from Tuesday’s 81 bps, via data from the Prime Market Terminal.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price holds firm above $2,900

Gold prices stalled on Wednesday after registering two consecutive bullish days. Nevertheless, momentum is shifted to the upside, with the Relative Strength Index (RSI) trending up in bullish territory. That said, Bullion’s path of least resistance is a continuation of the uptrend.

XAU/USD next resistance would be $2,950, followed by the record high at $2,954. A breach of the latter can expose the $3,000 mark. On the other hand, a daily close below $2,900, could put the uptrend at risk and open the door for a “healthy” pullback.

That said, Gold’s first support would be the February 28 low of $2,832, followed by the $2,800 figure.

Economic Indicator

Initial Jobless Claims

The Initial Jobless Claims released by the US Department of Labor is a measure of the number of people filing first-time claims for state unemployment insurance. A larger-than-expected number indicates weakness in the US labor market, reflects negatively on the US economy, and is negative for the US Dollar (USD). On the other hand, a decreasing number should be taken as bullish for the USD.

Read more.Next release: Thu Mar 06, 2025 13:30

Frequency: Weekly

Consensus: 235K

Previous: 242K

Source: US Department of Labor

Every Thursday, the US Department of Labor publishes the number of previous week’s initial claims for unemployment benefits in the US. Since this reading could be highly volatile, investors may pay closer attention to the four-week average. A downtrend is seen as a sign of an improving labour market and could have a positive impact on the USD’s performance against its rivals and vice versa.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.