EUR/USD looks to regain 1.0200 and beyond

- EUR/USD regains marginal upside traction around 1.0200.

- EMU Sentix index improves a tad for the current month.

- Next risk event in the pair will be the release of the US CPI.

The single currency manages to regain some traction in an uneventful start of the week, lifting EUR/USD briefly above the 1.0200 mark although losing momentum afterwards.

EUR/USD remains stuck within the 1.0100-1.0300 range

EUR/USD advances tepidly on Monday and stays close to the 1.0200 neighbourhood, as investors appear prudent ahead of the publication of key US inflation figures later in the week.

In addition, the upside bias in the dollar seems to have fizzled out following Friday’s strong advance after the stellar results from the US jobs report. It is worth recalling that Friday’s sharp climb in the buck came in response to further pricing in by market participants of a large rate hike at the FOMC event in September.

According to CME Group’s FedWatch Tool, the probability of a 75 bps rate hike next month is now at nearly 68%.

On the latter, Fed’s M.Bowman (permanent voter, hawk) suggested over the weekend that 75 bps rate hikes are possible until inflation runs out of steam. She said she finds few, if any, signs that the move higher in consumer prices has reached a top, while she also sees the possibility that the Fed’s hiking cycle could slow or halt the job growth.

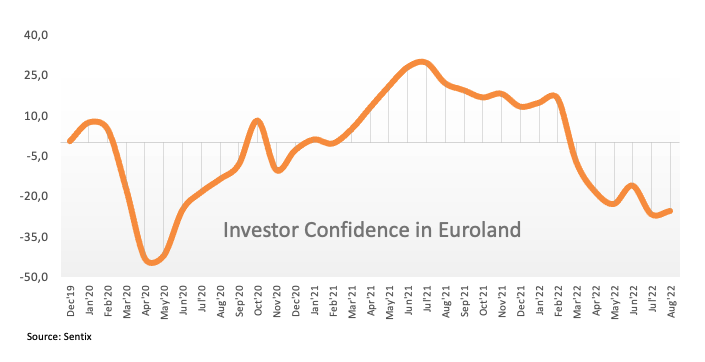

In the domestic calendar, EMU’s Investor Confidence tracked by the Sentix Index “improved” a little to -25.2 in August.

What to look for around EUR

EUR/USD so far keeps the 1.0100-1.0300 range unchanged against the backdrop alternating risk appetite trends.

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerges the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges and the incipient slowdown in some fundamentals.

Key events in the euro area this week: EMU Sentix Index (Monday) – Germany Final Inflation Rate (Wednesday) – EMU Industrial Production (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of monetary conditions. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is gaining 0.02% at 1.0182 and faces the next up barrier at 1.0293 (monthly high August 2) seconded by 1.0394 (55-day SMA) and finally 1.0615 (weekly high June 27). On the flip side, a break below 1.0096 (weekly low July 26) would target 1.0000 (psychological level) en route to 0.9952 (2022 low July 14).

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.