EUR/USD Price Analysis: Pair in multi-year lows, sellers advance

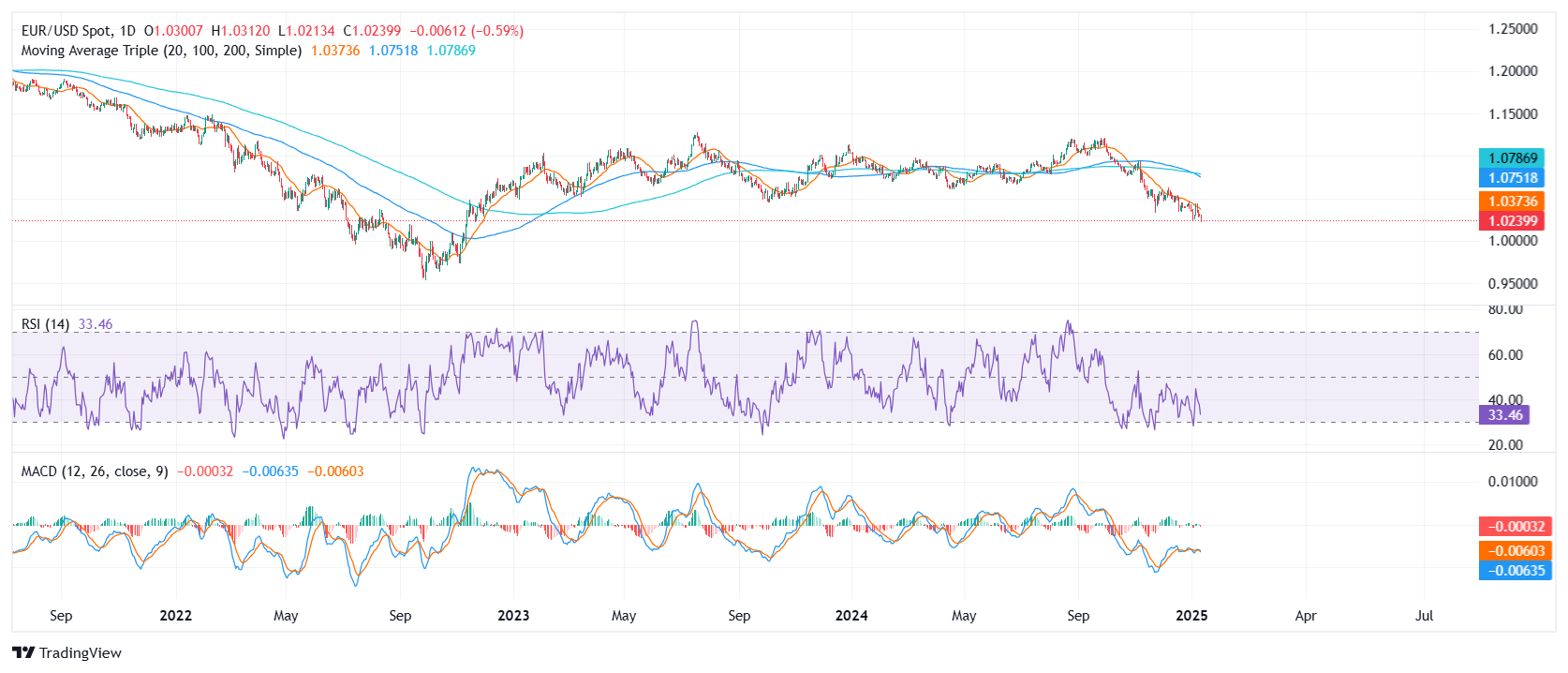

- EUR/USD falls for the fourth consecutive session before a modest uptick to 1.0310 on Friday.

- RSI hovers at 33, edging closer to oversold territory amid persistent bearish pressure.

EUR/USD deepened its descent into fresh lows not seen since November 2022, briefly dipping below 1.0250 on Friday and the pair tallies four-day losing streak, reflecting an overall negative tone in recent sessions. Sellers appear to be firmly in control, with any bullish attempts thus far failing to generate a meaningful shift in direction.

Technical indicators underscore the prevailing downside risk. While the Relative Strength Index (RSI) at 33 is nearing oversold territory, its downward trajectory suggests that buyers lack conviction. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram has turned more bearish, printing rising red bars and pointing to an acceleration in negative momentum.

In terms of key levels, immediate support emerges near the 1.0250 mark, and a break beneath that floor would expose the 1.0220 region or potentially lower. On the flip side, if EUR/USD manages to climb above 1.0350, it could alleviate some selling pressure and open the door toward the 1.0380 resistance area, where a more sustained recovery attempt may gain traction.

EUR/USD daily chart

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.