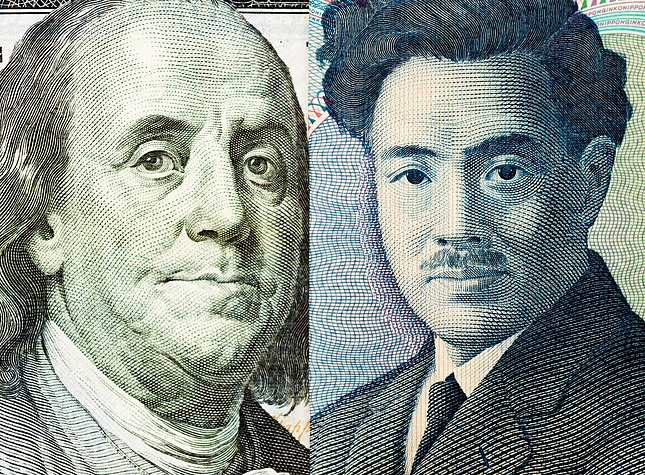

Australian Dollar remains subdued as US Dollar holds ground ahead of PCE Inflation

- The Australian Dollar holds losses as the PBoC decided to keep its one-year Loan Prime Rate unchanged at 3.1%.

- Australia's Private Sector Credit rose by 0.5% MoM in November, marking the fastest monthly growth in four months.

- The US Dollar appreciated following better-than-expected economic figures released on Thursday.

The Australian Dollar (AUD) retraces its recent gains from the previous session against the US Dollar (USD) following the People’s Bank of China’s (PBoC) monetary policy decision on Friday. China’s central bank decided to keep its one- and five-year Loan Prime Rates (LPRs) unchanged at 3.10% and 3.60%, respectively, in the fourth quarterly meeting.

Australia's Private Sector Credit grew by 0.5% month-over-month in November, aligning with expectations. This followed a 0.6% increase in October, which marked the fastest monthly growth in four months. On an annual basis, Private Sector Credit rose by 6.2% in November, the highest growth rate since May 2023, up slightly from 6.1% in October.

The Aussie Dollar faces pressure as traders increasingly anticipate that the Reserve Bank of Australia (RBA) may begin cutting its 4.35% cash rate as early as February, amid mounting signs of an economic slowdown. Attention now shifts to the release of the RBA's latest meeting minutes due next week.

The US Dollar strengthened after the US Gross Domestic Product (GDP) Annualized reported a 3.1% growth rate in the third quarter, surpassing both market expectations and the previous reading of 2.8%. Additionally, Initial Jobless Claims dropped to 220,000 for the week ending December 13, down from 242,000 in the prior week and below the market forecast of 230,000.

Traders will likely observe the US Personal Consumption Expenditures (PCE) data, scheduled to be released by the US Bureau of Economic Analysis on Friday.

Australian Dollar declines due to increased risk aversion following Fed’s hawkish rate cut

- Australia's 10-year government bond yield trades around 4.52%, mirroring an increase in US bond yields following the Federal Reserve's hawkish stance.

- Australia’s Consumer Inflation Expectations rose to 4.2% in December from 3.8% in the previous month, marking the highest level since September.

- At its December meeting on Wednesday, the Federal Reserve (Fed) implemented a hawkish 25 basis point (bps) rate cut, lowering its benchmark lending rate to a two-year low of 4.25%-4.50%. However, it indicated a slower pace of additional cuts in the coming year.

- The Fed’s Summary of Economic Projections, or ‘dot-plot,’ showed only two rate cuts in 2025, down from four cuts projected in September. Additionally, during the press conference, Fed Chair Jerome Powell clarified that the Fed would be cautious about further cuts as inflation would remain stubbornly above the central bank’s 2% target.

- National Australia Bank (NAB) maintains its forecast for the first Reserve Bank of Australia rate cut at the May 2025 meeting, though they acknowledge February as a possibility. NAB's report indicates that the Unemployment Rate is expected to peak at 4.3% before easing to 4.2% by 2026 as the economy stabilizes. The Q4 trimmed mean inflation is projected at 0.6% quarter-on-quarter, with a gradual easing expected, reaching 2.7% by late 2025.

- Australia's Westpac Consumer Confidence fell 2% to 92.8 points in December, reversing two months of positive momentum.

- On Tuesday, the US Census Bureau reported that US Retail Sales rose 0.7% MoM in November, compared to the 0.5% prior increase. Meanwhile, the Retail Sales Control Group increased 0.4% from the previous decline of 0.1%.

- Reuters cited two sources on Tuesday that China is set to target economic growth of around 5% in 2025. This decision follows a meeting among top Chinese officials at the Central Economic Work Conference last week. The growth target remains the same as this year, which China is expected to achieve.

- China's foreign exchange regulator, the State Administration of Foreign Exchange (SAFE), reported a net outflow of $45.7 billion from China's capital markets in November. Cross-border portfolio investment receipts totaled $188.9 billion, while payments reached $234.6 billion, resulting in the largest monthly deficit on record for this category.

Australian Dollar remains above 0.6200, with a potential upward correction

AUD/USD trades near 0.6230 on Friday, with daily chart analysis pointing to a persistent bearish bias as the pair continues to decline within a descending channel pattern. However, the 14-day Relative Strength Index (RSI) remains below the 30 mark, signaling oversold conditions and suggesting the potential for an upward correction in the near term.

On the downside, the AUD/USD pair may test the descending channel's lower boundary near the 0.6130 level, highlighting a key support area in the current bearish trend.

The AUD/USD pair will likely encounter primary resistance near the nine-day Exponential Moving Average (EMA) at 0.6310, followed by the 14-day EMA at 0.6346. A further hurdle lies at the descending channel’s upper boundary around 0.6390. A decisive breakout above this channel could propel the pair toward the eight-week high of 0.6687.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.07% | 0.15% | -0.08% | 0.22% | 0.29% | 0.23% | 0.00% | |

| EUR | -0.07% | 0.09% | -0.10% | 0.16% | 0.22% | 0.16% | -0.06% | |

| GBP | -0.15% | -0.09% | -0.20% | 0.06% | 0.11% | 0.07% | -0.13% | |

| JPY | 0.08% | 0.10% | 0.20% | 0.31% | 0.37% | 0.29% | 0.10% | |

| CAD | -0.22% | -0.16% | -0.06% | -0.31% | 0.06% | 0.00% | -0.19% | |

| AUD | -0.29% | -0.22% | -0.11% | -0.37% | -0.06% | -0.07% | -0.26% | |

| NZD | -0.23% | -0.16% | -0.07% | -0.29% | -0.01% | 0.07% | -0.20% | |

| CHF | -0.00% | 0.06% | 0.13% | -0.10% | 0.19% | 0.26% | 0.20% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

Core Personal Consumption Expenditures - Price Index (MoM)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The MoM figure compares the prices of goods in the reference month to the previous month.The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Dec 20, 2024 13:30

Frequency: Monthly

Consensus: 0.2%

Previous: 0.3%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.