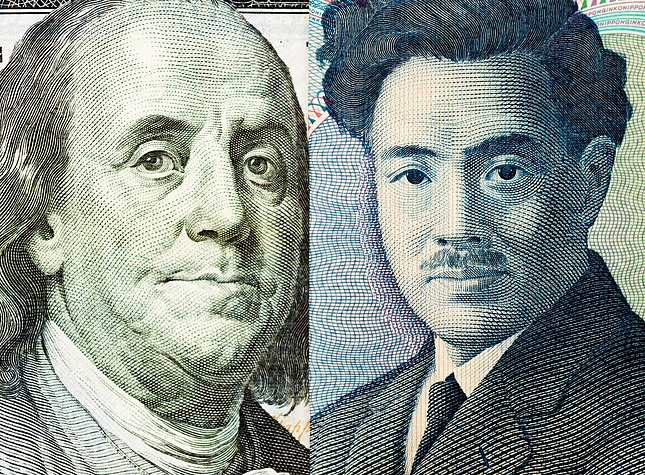

Japanese Yen clings to intraday gains; USD/JPY retreats further from multi-month peak

- The Japanese Yen attracts some buyers after a stronger-than-expected Japan’s National CPI.

- A weaker risk tone and retreating US bond yields also lend support to the lower-yielding JPY.

- The Fed’s hawkish shift favors the USD and should act as a tailwind for the USD/JPY pair.

The Japanese Yen (JPY) attracts some buyers after touching a five-month low against its American counterpart during the Asian session on Friday, though any meaningful recovery seems elusive. Higher-than-expected Japanese Consumer Price Index (CPI) released earlier today keeps the door open for another interest rate hike by the Bank of Japan (BoJ) in early 2025. Furthermore, the risk-off mood, along with a modest pullback in the US Treasury bond yields, provides a modest lift to the safe-haven JPY.

Meanwhile, the Federal Reserve's (Fed) hawkish signal, that it would slow the pace of interest rate cuts in 2025, should act as a tailwind for the US bond yields. This, along with the recent widening of the US-Japan rate differential, might hold back traders from placing bullish bets around the lower-yielding JPY. Traders now look to the US Personal Consumption Expenditure (PCE) Price Index, which might influence the US Dollar (USD) price dynamics and provide some impetus to the USD/JPY pair.

Japanese Yen is underpinned by stronger inflation data from Japan and haven flows

- The Bank of Japan decided on Thursday to keep the short-term rate target unchanged in the range of 0.15%-0.25% and offered few clues on how soon it could push up borrowing costs.

- Data released by the Japan Statistics Bureau this Friday showed that the National Consumer Price Index (CPI) climbed 2.9% YoY in November, compared to the previous reading of 2.3%.

- Additional details of the report revealed that the National CPI ex Fresh food arrived at 2.7% YoY during the reported month versus 2.3% in October and was above expectations of 2.6%.

- Moreover, CPI ex Fresh Food, Energy rose 2.7% YoY in November, compared to the 2.3% rise recorded in the previous month, keeping hopes alive for a potential rate hike in January or March.

- In fact, BoJ Governor Kazuo Ueda reiterated the central bank's resolve to keep raising interest rates from their current very low levels if the economy and prices move in line with its forecasts.

- The Federal Reserve indicated on Wednesday that policymakers see the fed funds rate falling to 3.9% in 2025, suggesting two quarter-point rate cuts compared to four projected in September.

- The yield on the benchmark 10-year US government bond shot to its highest level in more than six months on Thursday, lifting the US Dollar to a two-year peak and undermining the Japanese Yen.

- The focus now shifts to the US Personal Consumption Expenditure (PCE) Price Index, or the Fed's preferred inflation gauge, which should provide a fresh impetus to the USD/JPY pair.

USD/JPY faces rejection near the 158.00 mark; bullish potential remains intact

From a technical perspective, the overnight strong move up beyond the previous multi-month top, around the 156.75 area, was seen as a fresh trigger for bullish traders. That said, the Relative Strength Index (RSI) has moved on the verge of breaking into the overbought territory on the daily chart. This makes it prudent to wait for some near-term consolidation or a modest pullback before positioning for any further gains.

Any meaningful slide below the 157.00 mark, however, now seems to find some support near the 156.75 region. Some follow-through selling could pave the way for a deeper corrective fall and drag the USD/JPY pair to the 156.00 round figure. The next relevant support is pegged near the 155.50 horizontal zone, below which spot prices could drop to the 155.00 psychological mark. The latter should act as a key pivotal point, which if broken decisively might shift the near-term bias in favor of bearish traders.

On the flip side, bullish traders might now wait for a move beyond the 158.00 mark before placing fresh bets. The USD/JPY pair might then accelerate the positive move toward the 158.45 intermediate hurdle before aiming to reclaim the 159.00 round figure. The momentum could extend further towards the 159.60-159.65 region en route to the 160.00 psychological mark and the 160.20 hurdle. The latter coincides with the top boundary of the multi-month-old ascending channel and should act as a strong barrier.

Economic Indicator

Personal Consumption Expenditures - Price Index (YoY)

The Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The YoY reading compares prices in the reference month to a year earlier. Price changes may cause consumers to switch from buying one good to another and the PCE Deflator can account for such substitutions. This makes it the preferred measure of inflation for the Federal Reserve. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Dec 20, 2024 13:30

Frequency: Monthly

Consensus: 2.5%

Previous: 2.3%

Source: US Bureau of Economic Analysis

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.