Dow Jones Industrial Average climbs on Wednesday, adds 300 points

- The Dow Jones added another 300 points during calm Wednesday markets.

- US ADP payroll figures point to net job gains that are better than expected.

- US ISM PMI figures came in softer than expected, but investors are shrugging off the bad print.

The Dow Jones Industrial Average (DJIA) climbed 300 points on Wednesday, bolstered by a general improvement in market sentiment. Firmer-than-expected prints in jobs preview data ahead of Friday’s upcoming Nonfarm Payrolls (NFP) report helped to keep markets buoyed, adding to gains as investors recover from an early-week plunge sparked by trade war threats from US President Donald Trump that came up empty for a third time in a row.

The ADP Employment Change amount from January exceeded expectations, suggesting 183K net new jobs were added according to payroll services provider ADP. The figure came in above the revised print of 176K from December, flouting the median market forecast of 150K.

US ISM Services Purchasing Managers Index (PMI) survey results missed the mark, easing to 52.8 from a revised 54.0, flubbing the market’s expected uptick to 54.3. The softer figure dampened sentiment somewhat, but only briefly as traders look for reasons to hit the buy button.

Dow Jones news

Most of the Dow Jones is testing into the high side as broad-market sentiment generally improves. Familiar market favorites Amgen (AMGN) and Nvidia (NVDA) are climbing on Wednesday, gaining 5.5% and 4.5%, respectively. Amgen beat the street on Q4 financial results, reported late on Tuesday, and the biotech firm is trading back above $300 per share.

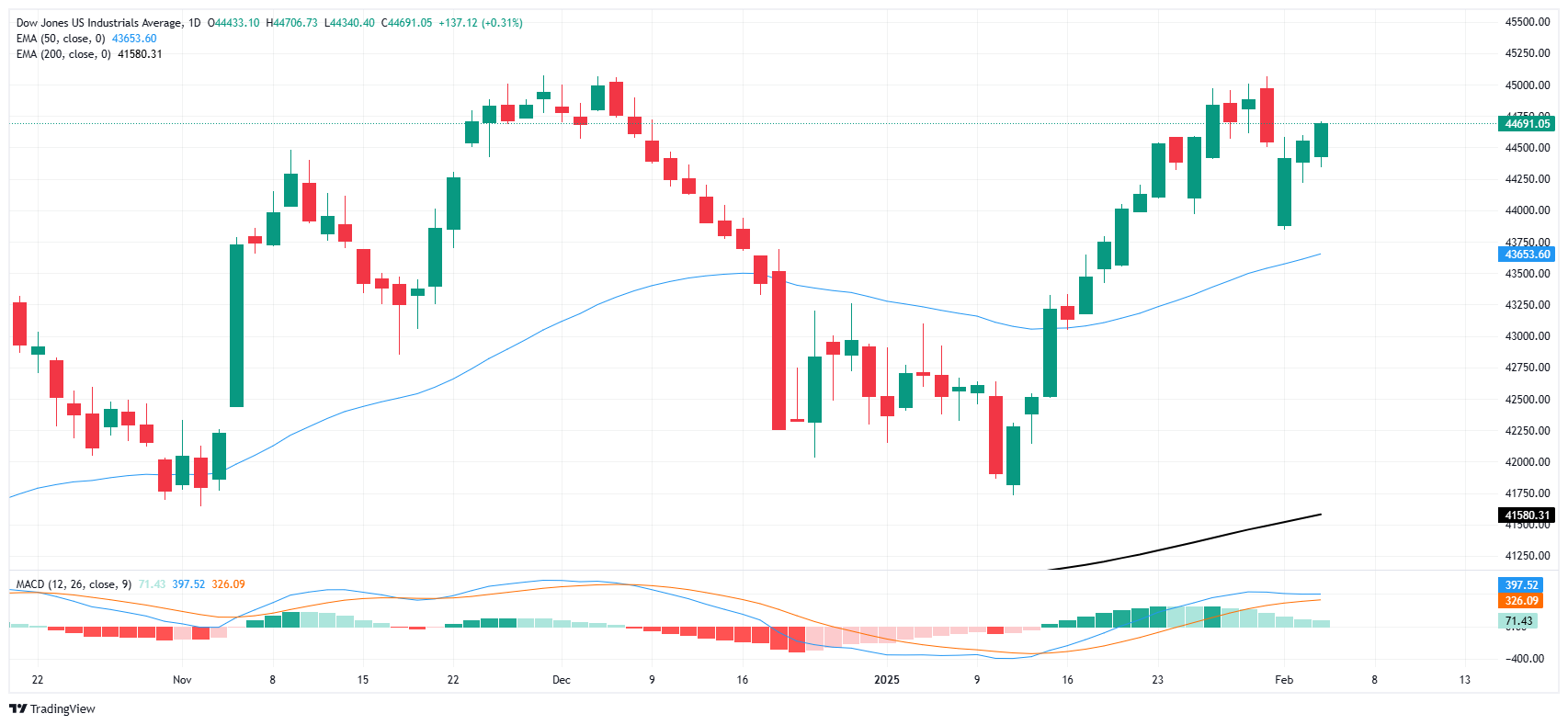

Dow Jones price forecast

The Dow Jones is grinding its way back toward 44,800, with price action drifting into the top-end after kicking the trading week off just south of the 44,000 major price handle. The Dow is set to snap its latest pullback with a three-straight bull run, and the immediate target for bidders will be the 45,000 handle that lies ahead.

Dow Jones daily chart

Economic Indicator

ISM Services PMI

The Institute for Supply Management (ISM) Services Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US services sector, which makes up most of the economy. The indicator is obtained from a survey of supply executives across the US based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the services economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that services sector activity is generally declining, which is seen as bearish for USD.

Read more.Last release: Wed Feb 05, 2025 15:00

Frequency: Monthly

Actual: 52.8

Consensus: 54.3

Previous: 54.1

Source: Institute for Supply Management

The Institute for Supply Management’s (ISM) Services Purchasing Managers Index (PMI) reveals the current conditions in the US service sector, which has historically been a large GDP contributor. A print above 50 shows expansion in the service sector’s economic activity. Stronger-than-expected readings usually help the USD gather strength against its rivals. In addition to the headline PMI, the Employment Index and the Prices Paid Index numbers are also watched closely by investors as they provide useful insights regarding the state of the labour market and inflation.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.