US Dollar softens after hitting a fresh year-to-date high in the USD Dollar Index

- The Trump trades in the green, trying to secure a fifth day of gains.

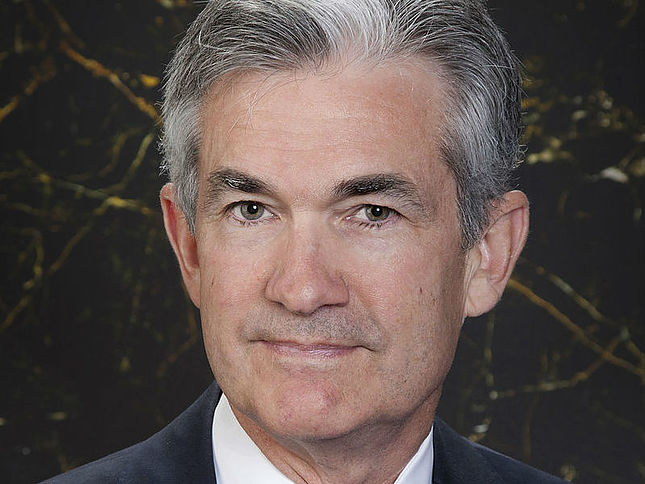

- Traders are on edge over Fed Chairman Powell and his view on the interest rate cut in December.

- The US Dollar index jumped to a fresh year-to-date high around 107.00 and fades before hitting a fresh yearly high.

The US Dollar (USD) adds to more gains in the Trump trade rally, good for a fifth consecutive trading day with the US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, reaching the highest level seen since November 1, 2023, above 107.00. The additional push comes after major news agencies reported on Wednesday evening that the Republicans had secured enough seats for a majority in the House of Representatives after already winning the Senate. Thus, The “Red Sweep” has materialized, and President-elect Donald Trump will face very few issues or struggles to get any package through both political decision bodies.

The US economic calendar includes the weekly Initial Jobless Claims and the Producer Price Index (PPI) inflation data for October. No big shakeups there after PPI numbers came in a touch higher, roughly in line with US October Consumer Price Index (CPI) economist expectations from Wednesday. Instead, expect some nervousness from Federal Reserve (Fed) Chairman Jerome Powell’s speech after several Fed members questioned this week whether a December rate cut is still valid under current market conditions.

Daily digest market movers: Everything is there

- Macroeconomic data for this Thursday has been published:

- Weekly Initial Jobless Claims for the week ending on November 8 came in lower than expected at 217,000 where an uptick to 223,000 was expected.

- The Producer Price Index (PPI) data for October came in a touch higher than expected:

- The monthly headline PPI was in line of expectations at 0.2% against the 0.1% from last month. Core PPI was in line of the survey as well, coming in at 0.3%, from 0.2% previously.

- The yearly headline PPI accelerated to 2.4%, surpassing the 2.3% expectation and higher than the 1.9% from last month. Yearly Core PPI jumped to 3.1%, above the 3.0% expectation and higher than the previous 2.9%.

- Three Federal Reserve members and the Fed Chairman itself are set to speak this Thursday:

- At 12:00 GMT, Federal Reserve Governor Adriana Kugler (2024 FOMC voting member) delivers a speech about central bank independence and economic outlook at the Latin American and Caribbean Economic Association 2024 meeting in Montevideo, Uruguay.

- Richmond Fed President Tom Barkin discusses the economy with Jodie W. McLean, secretary of the Real Estate Roundtable board of directors at around 14:00 GMT.

- At 20:00 GMT, Federal Reserve Chair Jerome Powell participates in a panel discussion titled "Global Perspectives" about the economic outlook at an event hosted by the Federal Reserve Bank of Dallas.

- New York Fed President John Williams closes off this Thursday by delivering keynote remarks on "Intermediating Impact: Making Missing Markets" at a New York Fed event at 21:15 GMT.

- Equities are having issues to hold on to gains. Europe is able to do so while US futures are marginally turning flat to negative.

- The CME FedWatch Tool is pricing in another 25 basis points (bps) rate cut by the Fed at the December 18 meeting by 82.5%. A 17.5% chance is for rates to remain unchanged. While the rate-cut scenario is the most probable, traders have pared back some of the rate-cut bets compared with a week ago.

- The US 10-year benchmark rate trades at 4.42%, softening after hitting a fresh year-to-date high printed at opening at 4.48%.

US Dollar Index Technical Analysis: Fading from here

The US Dollar Index (DXY) extends gains this week after President-elect Donald Trump will have his presidency with full support from the Senate and the House of Representatives after Republicans secured enough seats. The only element now in the balance is whether December will still have a rate cut, while everything else known is priced in for now.

From now on, the 107.00 round level comes into play for the rest of the week. A fresh year-to-date high has already been printed. A full one-year high could be reached once 107.35 gets taken out.

On the downside, a fresh set of support is coming live. The first support is 105.89, the closing level on Tuesday. A touch lower, the pivotal 105.53 (April 11 high) should avoid any downturns towards 104.00 for now.

US Dollar Index: Daily Chart

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.