BoE's Bailey indicates that interest rates are expected to decline gradually

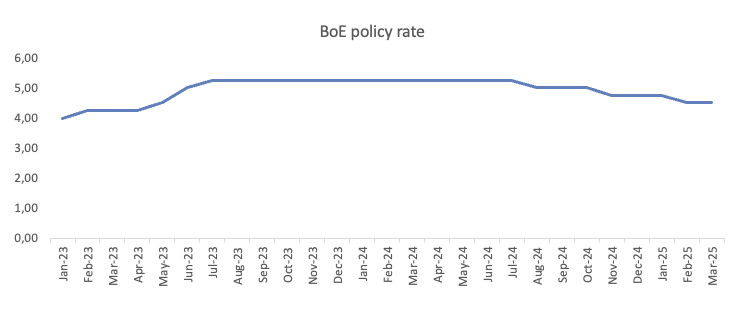

The Bank of England (BoE) kept its policy rate unchanged at 4.50% in its March meeting, as widely anticipated. However, the decision wasn't unanimous — while eight policymakers backed the hold, just one (Swati Dhingra) pushed for a 25 basis point cut.

BoE policy statement takeaways

Policy statement keeps phrase: "A gradual and careful approach to removing policy restraint remains appropriate."

No presumption monetary policy is on a pre-set path over the next few meetings.

Governor Bailey: There is a lot of economic uncertainty at the moment.

Bailey: We still think that interest rates are on a gradually declining path.

Staff forecast Q1 GDP +0.25% QQ (Feb forecast: +0.1%).

Inflation to peak at 3.75% in Q3 2025 (Feb forecast: +3.7%).

Global trade policy has intensified, other geopolitical uncertainties have also increased.

MPC will pay close attention to any consequent signs of more lasting inflation pressure.

GDP has been slightly stronger than expected in Feb, surveys suggest weak growth and especially employment plans.

Domestic and wage pressures are moderating but still somewhat elevated, energy prices higher than last year.

Monetary policy will need to continue to remain restrictive for sufficiently long.

Possible that labour costs have been a driver of recent pickup in non-energy goods prices.

Market reaction to BoE policy announcements

Following the BoE's decision, GBP/USD bounced off daily lows in the 1.2940-1.2930 band, trimming part of its initial losses and flirting once again with the 1.2980 zone.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.44% | 0.23% | -0.15% | 0.33% | 1.12% | 1.37% | 0.55% | |

| EUR | -0.44% | -0.23% | -0.56% | -0.12% | 0.67% | 0.92% | 0.11% | |

| GBP | -0.23% | 0.23% | -0.35% | 0.09% | 0.90% | 1.15% | 0.31% | |

| JPY | 0.15% | 0.56% | 0.35% | 0.46% | 1.25% | 1.48% | 0.74% | |

| CAD | -0.33% | 0.12% | -0.09% | -0.46% | 0.80% | 1.04% | 0.20% | |

| AUD | -1.12% | -0.67% | -0.90% | -1.25% | -0.80% | 0.26% | -0.58% | |

| NZD | -1.37% | -0.92% | -1.15% | -1.48% | -1.04% | -0.26% | -0.86% | |

| CHF | -0.55% | -0.11% | -0.31% | -0.74% | -0.20% | 0.58% | 0.86% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

This section below was published as a preview of the Bank of England's (BoE) interest rate decision at 07:00 GMT.

- The Bank of England is expected to hold its policy rate at 4.50%.

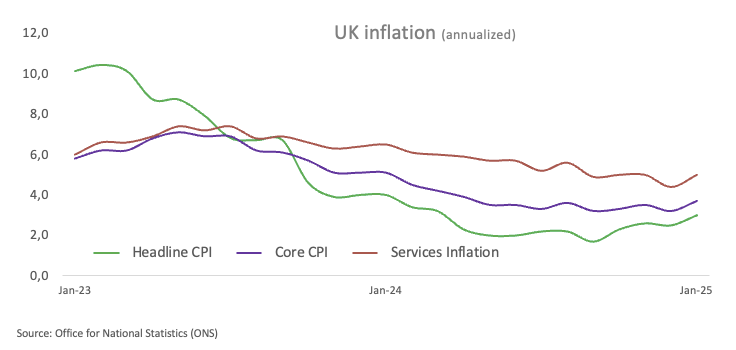

- UK inflation figures remain well above the BoE’s target.

- GBP/USD extends its rally past the psychological 1.3000 barrier.

The Bank of England (BoE) is set to reveal its monetary policy decision on Thursday, marking the second meeting of 2025.

Expectations are high among market watchers that the central bank will keep its benchmark rate at 4.50%, following a 25 basis point reduction in the previous month.

Alongside the decision, the BoE will publish the meeting Minutes and the Monetary Policy Report.

Barring any surprises in the interest rate decision, all eyes will then shift to the bank’s forward guidance and economic outlook.

Follow our Live Coverage of the BoE interest rate decison

UK economic outlook: Stubborn inflation, fading growth

The Bank of England (BoE) lived up to expectations in February, delivering a hawkish rate cut backed unanimously by the nine-member Monetary Policy Committee (MPC).

Meanwhile, fresh data from the Office for National Statistics (ONS) revealed an unexpected uptick in the UK’s annual headline inflation, which climbed to 3.0% in January from 2.5% in December. Core inflation, which excludes food and energy costs, also rose, hitting 3.7% over the last 12 months.

In addition, growth figures painted a less optimistic picture. The UK’s Gross Domestic Product (GDP) unexpectedly shrank by 0.1% in January. Furthermore, downbeat Industrial and Manufacturing Production data also added to the gloomy picture, while the S&P Global Manufacturing PMI remained stuck in contraction territory during the same month.

Following these disheartening prints, the swaps market now sees around 56 basis points of easing by the BoE through year-end.

At the BoE’s latest monetary policy gathering, Governor Andrew Bailey explained that global economic uncertainty played a key role in the decision to add the word "careful" to the bank's future interest rate guidance.

At a news conference, he remarked that this uncertainty was "two-sided" — suggesting it could either hinder the disinflation process or, conversely, accelerate it.

"It could lead to conditions which actually make the path of disinflation less assured," Bailey noted, before adding that it "frankly could also... lead to conditions which have the opposite effect and lead to it being a faster path for disinflation."

How will the BoE interest rate decision impact GBP/USD?

As previously mentioned, investors widely anticipate the BoE keeping its interest rate unchanged on Thursday at 12:00 GMT.

With that in mind, the British Pound (GBP) will likely stand pat to the decision, but it could show some reaction to how rate-setters vote.

Ahead of the event, GBP/USD managed to trespass, albeit briefly, the psychological 1.3000 barrier, with the pair closely following USD dynamics as well as developments in the US tariff narrative.

Pablo Piovano, Senior Analyst at FXStreet, noted that GBP/USD managed to break above the critical 1.3000 hurdle earlier in the week, coming under some renewed downside pressure since then.

“Once Cable clears its 2025 high of 1.3009 (set on March 18), it could embark on a potential visit to the November 2024 top at 1.3047”, Piovano added.

“On the downside, the 200-day SMA at 1.2795 serves as the initial safety net, supported by the transitory 100-day SMA at 1.2621 and the weekly low of 1.2558 (February 28). If selling pressure accelerates, the pair could dip toward the 55-day SMA at 1.2552, followed by deeper support at the February trough of 1.2248 (February 3) and the 2025 bottom at 1.2099 (January 13)”, Piovano concluded.

(This story was corrected on March 20 at 11:59 GMT to remove all references to BoE Governor Andrew Bailey's press conference, as there is no press conference scheduled for today.)

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.