Australian Dollar holds gains as US Dollar remains softer ahead of US Retail Sales

- The Australian Dollar appreciates as US Dollar Index pulls back from yearly highs.

- The Aussie Dollar may face challenges due to recent weak economic data.

- RBA Governor Bullock stated that current interest rates will remain unchanged until the bank gains confidence in the inflation outlook.

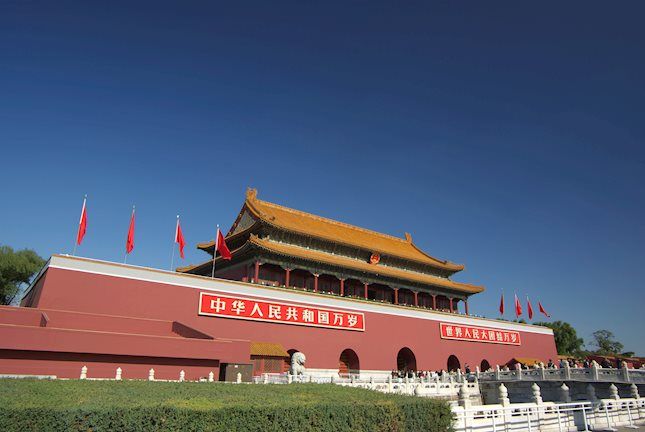

The Australian Dollar (AUD) holds ground near three-month lows against the US Dollar (USD) on Friday. The recent downward trend in the AUD/USD pair is largely due to key economic data from Australia released on Thursday. Additionally, the AUD remained uninfluenced by mixed economic data from its close trading partner China.

China’s Retail Sales rose 4.8% year-over-year in October, surpassing the expected 3.8% and the 3.2% increase seen in September. Meanwhile, the country’s Industrial Production grew by 5.3% YoY, slightly below the forecasted 5.6% but higher than the 5.4% growth recorded in the previous period.

The National Bureau of Statistics (NBS) shared its economic outlook during its press conference, noting an improvement in China's consumer expectations in October. The bureau plans to intensify policy adjustments and boost domestic demand, highlighting that recent policies have had a positive impact on the economy.

However, the decline of the Aussie Dollar may be limited due to less dovish remarks from Reserve Bank of Australia (RBA) Governor Michele Bullock on Thursday. Bullock stated that current interest rates are sufficiently restrictive and will stay at this level until the central bank gains confidence in the inflation outlook.

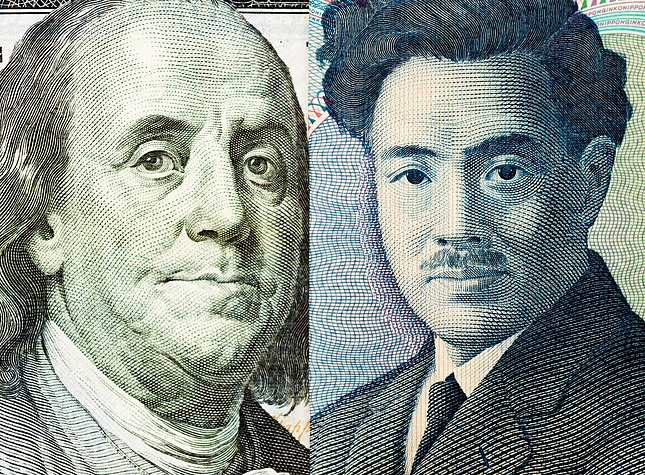

The US Dollar Index (DXY), which tracks the US Dollar's performance against six major currencies, has pulled back from its yearly high of 107.06 recorded on Thursday. This decline is attributed to a slowdown in "Trump trades." At the time of writing, the DXY trades near 106.80.

Markets are now focused on US October Retail Sales data, set to be released on Friday, along with comments from Federal Reserve officials. On Thursday, Fed Chair Jerome Powell noted that the recent performance of the US economy has been "remarkably good," allowing the Fed room to gradually lower interest rates.

Australian Dollar halts its losing streak as US Dollar corrects downwards

- The US Producer Price Index (PPI) rose by 2.4% year-over-year in October, up from a revised 1.9% increase in September (previously 1.8%) and surpassing market expectations of 2.3%. Meanwhile, the Core PPI, which excludes food and energy, climbed 3.1% YoY, slightly above the anticipated 3.0%.

- Australia’s seasonally adjusted unemployment rate held steady at 4.1% in October for the third month in a row, matching market expectations. However, employment change data revealed only 15.9K new jobs added in October, which fell short of the anticipated 25.0K.

- Australia's Consumer Inflation Expectations dropped to 3.8% in November, down from 4.0% in the previous month, reaching the lowest level since October 2021.

- Federal Reserve (Fed) Bank of St. Louis President Alberto Musalem commented on Wednesday that persistent inflation challenges make it difficult for the Fed to continue easing rates. Musalem redirected attention to the overall strength of the US labor market, seeking to alleviate concerns about inflation's resistance to the Fed's downward pressure efforts.

- Federal Reserve Bank of Kansas City President Jeffrey Schmid highlighted potential challenges in lowering interest rates. Schmid also criticized market participants who continue to hold out hope for a return to near-zero rates, calling their expectations unrealistic.

- US Consumer Price Index (CPI) increased by 2.6% year-over-year in October, in line with market forecasts. Meanwhile, the core CPI, which excludes the more volatile food and energy components, rose by 3.3% as expected.

- Australia's Prime Minister Anthony Albanese shared in a radio interview on Wednesday that he discussed trade with US President-elect Donald Trump during a phone call last week. Albanese informed Trump that the United States holds a trade surplus with Australia and emphasized that it is in Washington's best interest to "trade fairly" with its ally. Meanwhile, the defense minister underscored Australia's significant investment in security.

- Last week, China's latest stimulus measures fell short of investor expectations, further dampening demand prospects for Australia’s largest trading partner and weighing on the Australian Dollar. China announced a 10 trillion Yuan debt package to alleviate local government financing pressures and support struggling economic growth. However, the package stopped short of implementing direct economic stimulus measures.

Technical Analysis: Australian Dollar falls to near 0.6500, RSI approaches oversold zone

AUD/USD trades near 0.6460 on Friday. An analysis of the daily chart shows short-term downward pressure, as the pair remains below the nine-day Exponential Moving Average (EMA). Additionally, the 14-day Relative Strength Index (RSI) is slightly above 30, indicating potential oversold conditions. If the RSI dips below 30, it could signal an oversold situation, suggesting a possible upward correction.

The AUD/USD pair may find a key level near 0.6400 for support. A break below this psychological threshold could amplify downward pressure, potentially driving the pair toward the yearly low of 0.6348, last touched on August 5.

The immediate resistance lies at the psychological level of 0.6500. A break above this could lift the pair toward the nine-day EMA at 0.6525, followed by the 14-day EMA at 0.6553. Surpassing these EMAs may pave the way for a move toward the three-week high of 0.6687.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.19% | -0.12% | 0.08% | 0.02% | -0.23% | -0.22% | -0.16% | |

| EUR | 0.19% | 0.06% | 0.25% | 0.21% | -0.04% | -0.06% | 0.02% | |

| GBP | 0.12% | -0.06% | 0.20% | 0.15% | -0.11% | -0.11% | -0.04% | |

| JPY | -0.08% | -0.25% | -0.20% | -0.04% | -0.30% | -0.31% | -0.24% | |

| CAD | -0.02% | -0.21% | -0.15% | 0.04% | -0.27% | -0.25% | -0.19% | |

| AUD | 0.23% | 0.04% | 0.11% | 0.30% | 0.27% | 0.00% | 0.05% | |

| NZD | 0.22% | 0.06% | 0.11% | 0.31% | 0.25% | 0.00% | 0.06% | |

| CHF | 0.16% | -0.02% | 0.04% | 0.24% | 0.19% | -0.05% | -0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

Retail Sales (MoM)

The Retail Sales data, released by the US Census Bureau on a monthly basis, measures the value in total receipts of retail and food stores in the United States. Monthly percent changes reflect the rate of changes in such sales. A stratified random sampling method is used to select approximately 4,800 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms across the country. The data is adjusted for seasonal variations as well as holiday and trading-day differences, but not for price changes. Retail Sales data is widely followed as an indicator of consumer spending, which is a major driver of the US economy. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Fri Nov 15, 2024 13:30

Frequency: Monthly

Consensus: 0.3%

Previous: 0.4%

Source: US Census Bureau

Retail Sales data published by the US Census Bureau is a leading indicator that gives important information about consumer spending, which has a significant impact on the GDP. Although strong sales figures are likely to boost the USD, external factors, such as weather conditions, could distort the data and paint a misleading picture. In addition to the headline data, changes in the Retail Sales Control Group could trigger a market reaction as it is used to prepare the estimates of Personal Consumption Expenditures for most goods.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.