Dow Jones Industrial Average trims recent losses, but still has a steep hill to climb

- The Dow Jones recovered around 520 points on Friday.

- Despite the last-minute pullback, the Dow remains down 1,400 points for the week.

- Equities shrugged off one of the worst consumer sentiment prints in years.

The Dow Jones Industrial Average (DJIA) fought back at the brink on Friday, clawing back roughly 520 points following a string of bad losses that saw the Dow Jones crumble 3,373 points, or -7.66% peak-to-trough, over a two-week period. Friday’s broad recovery in equities may be poorly timed, however: University of Michigan (UoM) consumer outlook indicators saw their deepest plunge in years on Friday, and the pain from souring consumer sentiment may hit further down the line.

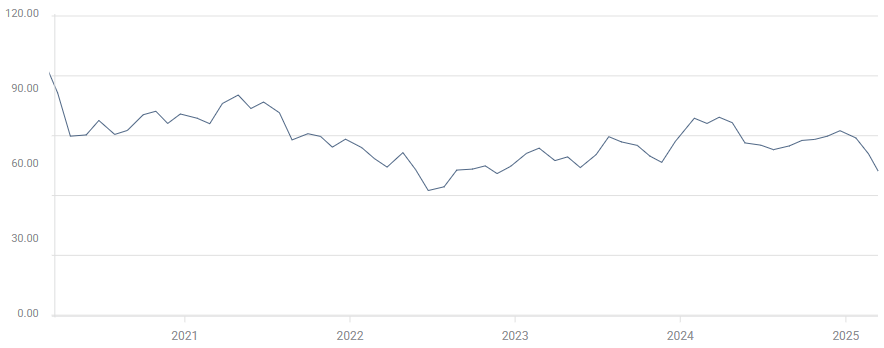

The UoM Consumer Sentiment Index for March tumbled to its lowest print in over two years, slumping to 57.9 as the Trump administration’s aspirations of a global trade war with everyone at the same time begins to punch holes in US consumers’ outlook. Median market forecasts had expected a slight downturn in the key consumer index, expecting a decline to 63.1 from 64.7.

UoM Consumer Sentiment Index (March)

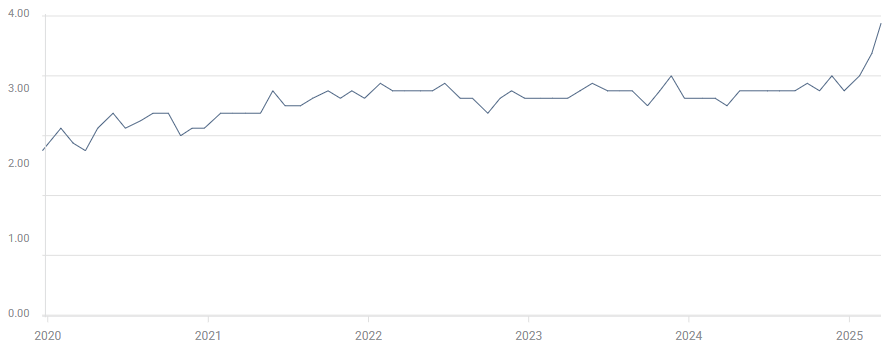

March’s UoM consumer inflation outlook also rocketed higher, with the 5-year estimate reaching 3.9%, and the indicator’s highest monthly gain in over four decades. UoM one-year inflation expectations also surged to a two-year high of 4.9%, anchoring consumer inflation fears well above the Federal Reserve’s (Fed) 2% annual target.

UoM 5-year Consumer Inflation Expectation (March)

Crumbling consumer confidence bodes poorly for economic activity in the US, as noted by chief economist for Comerica Bank Bill Adams:

"The pullback in confidence is becoming a real threat to consumer spending which, as is often repeated, accounts for two thirds of U.S. economic activity."

To their credit, rate markets remain stubbornly attached to the idea of a Q2 rate cut from the Fed. According to the CME’s FedWatch Tool, rate traders are still pricing in nearly 80% odds of another quarter-point rate trim from the Fed in June. Fed Chair Jerome Powell and the other members of the Federal Open Market Committee (FOMC) are expected to stand pat on rates at next week’s rate call and again in May.

Dow Jones news

Most of the securities listed on the Dow Jones Industrial Average are finding room on the high side on Friday as investors stretch their buying buttons. However, gains are concentrated in tech rally favorites and US banking giants. Nvidia (NVDA) has rebounded 4.5%, climbing above $120 per share as the tech rally darling struggles to snap a recent losing streak that dragged the silicon puncher off of record highs above $150.

Read more: JPMorgan, Goldman Sachs, American Express gain on US budget bill prospects

Dow Jones price forecast

A Friday splurge has snapped a four-day losing streak on the Dow Jones, but the major equity index remains on the bearish side of the 200-day Exponential Moving Average (EMA) near the 42,000 major price handle. The Dow Jones came within inches of hitting correction territory after failing to chalk in new highs since November’s peak just north of 45,000, and stock traders will be looking to extend a fresh bullish leg after briefly testing chart territory below 41,000.

Dow Jones daily chart

Economic Indicator

Michigan Consumer Sentiment Index

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Fri Mar 14, 2025 14:00 (Prel)

Frequency: Monthly

Actual: 57.9

Consensus: 63.1

Previous: 64.7

Source: University of Michigan

Consumer exuberance can translate into greater spending and faster economic growth, implying a stronger labor market and a potential pick-up in inflation, helping turn the Fed hawkish. This survey’s popularity among analysts (mentioned more frequently than CB Consumer Confidence) is justified because the data here includes interviews conducted up to a day or two before the official release, making it a timely measure of consumer mood, but foremost because it gauges consumer attitudes on financial and income situations. Actual figures beating consensus tend to be USD bullish.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.