Gold consolidates Tuesday's losses with markets digesting latest tariff move from President Trump

- An outlier day for Gold this Tuesday with losses on the quote board.

- The Trump administration seeks to corner China and toughens its semiconductor restrictions.

- Gold heads back to $2,935, though remains to look heavy with an overall market rout.

Gold’s price (XAU/USD) has hit a new all-time high on Monday at $2,956, just hours before the Trump administration issued more details on upcoming tariffs. The precious metal trades at around $2,940 at the time of writing on Tuesday, after US President Donald Trump’s administration communicated it plans to impose more limitations on China’s technological developments. A tougher stance on semiconductor restrictions and pressuring other allies to corner China is part of that strategy.

The news creates a negative tone in markets this Tuesday. Traders are fleeing into bonds as a safe haven, which is pressuring yields for more downside (inverse correlation bond price to yield). Equities are also being slaughtered, with red numbers across the board from Asia to Europe, including US equity futures. Except for three Federal Reserve (Fed) members who are set to speak, not much is expected on Tuesday ahead of the Personal Consumption Expenditures (PCE) due on Friday.

Daily digest market movers: Fed remains silent

- The Trump administration plans to expand its limitations on China's technological developments, including tougher semiconductor curbs and pressuring allies to install restrictions on China's chip industry. Trump’s goal is to prevent China from developing a domestic semiconductor industry that could boost its AI and military capabilities, Bloomberg reports.

- The CME FedWatch tool shows an uptick in chances for an interest rate cut by the Federal Reserve (Fed) in June by 25 basis points (bps), growing to 50.0%, while odds for a rate pause have diminished to only 32.6%, backed by the drop in US yields this Tuesday.

- Investors are looking ahead to January’s Personal Consumption Expenditures Price Index, the Fed preferred inflation gauge, set to release on Friday, for clues on monetary policy, with the indicator expected to cool to its slowest since June, Reuters reports.

- Fed Vice Chair for Supervision Michael Barr will give a speech on key financial stability issues in New Haven, Connecticut, United States at 16:45 GMT.

- Richmond Fed President Tom Barkin will give a speech called "Inflation Then and Now", followed by a Q&A at an event hosted by the Rotary Club of Richmond, expected around 18:00 GMT.

- At 21:15 GMT, President of the Federal Reserve Bank of Dallas Lorie Logan will speak on the future of the central bank balance sheet at the Bank of England's annual BEAR research conference in London, United Kingdom.

Technical Analysis: US session to become interesting

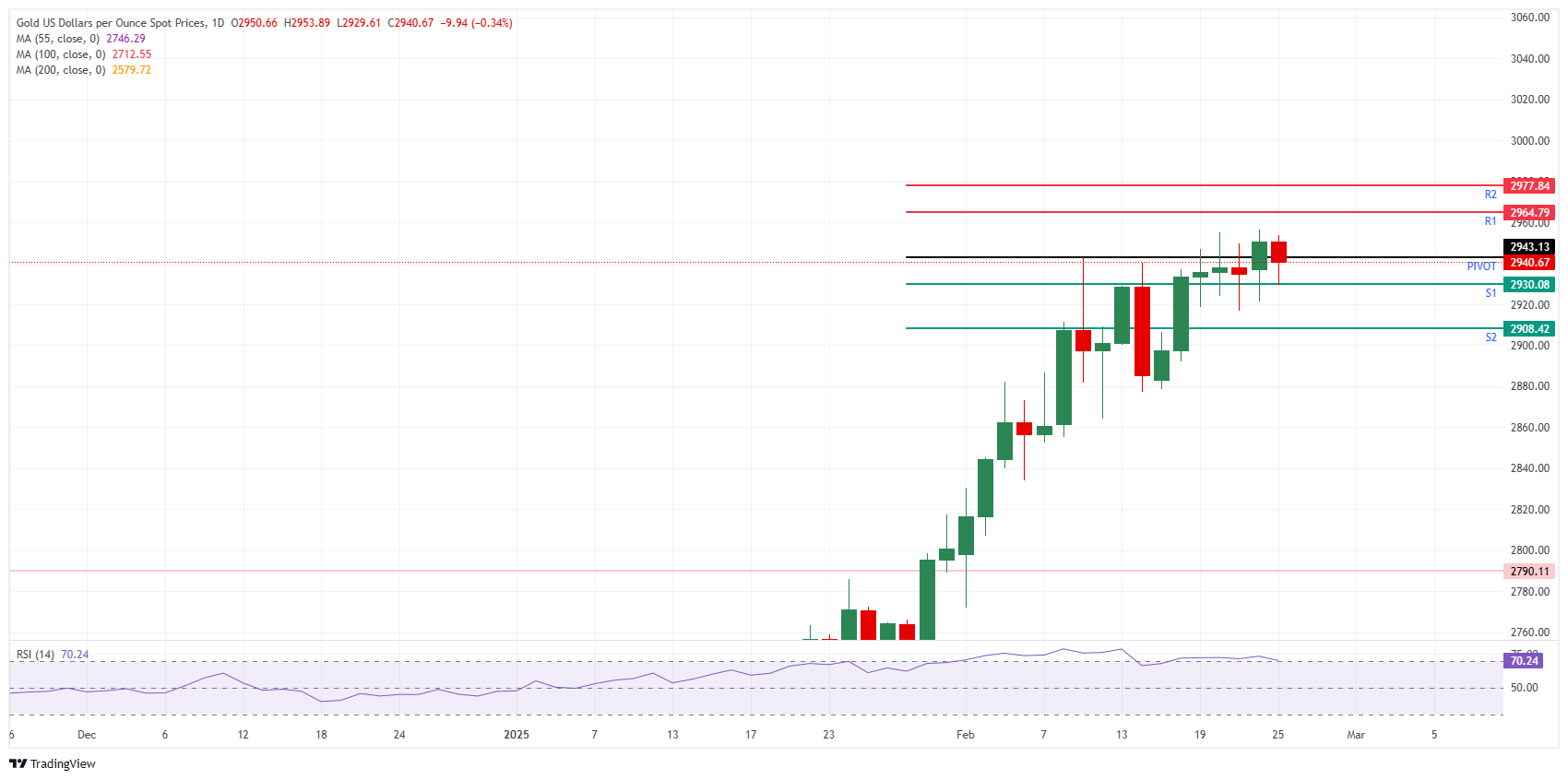

A quick drop below the daily Pivot Point near $2,943 is signalling a bit of an issue for Gold on Tuesday. Selling pressure is present, and it looks like buyers already tried to get Gold back above the daily Pivot in early Asian trading but failed. The S1 support at $2,930 has held for now, though once that level breaks, the S2 support only comes in at $2,908.

On the upside, the all-time high at $2,956 remains the main level to watch. On the way up, the daily R1 resistance at $2,964 comes in after that. Further up, the R2 resistance stands at $2,977 before considering the $3,000 mark.

On the downside, the S1 support comes in at $2,930, which roughly coincides with Monday’s low in the US session. In case that level does not hold, the $2,900 big figure comes into play with the S2 support at $2,908.

XAU/USD: Daily Chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.