Dow Jones Industrial Average gains ground as investors shrug off new tariff threats

- The Dow Jones rose on Thursday, testing near 44,750.

- Equities are cautiously optimistic after PPI numbers softened inflation blow.

- Markets continue to shrug off US President Donald Trump’s tariff threats.

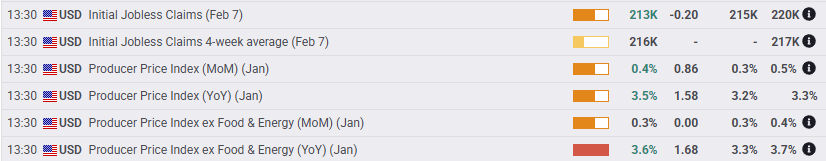

The Dow Jones Industrial Average (DJIA) found some room on the high side on Thursday, rising around 350 points and testing the 44,750 level. Equities were jarred by some steep upside revisions in Producer Price Index (PPI) inflation figures, but the overall print hit a decidedly softer tone than this week’s Consumer Price Index (CPI) inflation figures. A spike in inflation fears has subsided, and rate markets are now pricing in revisions to when the Federal Reserve (Fed) is expected to deliver its next rate cut.

United States (US) President Donald Trump delivered his latest batch of tariff threats on Thursday. "Reciprocal tariffs" on most of the US' closest trading partners are now on the block, alongside specific flat tariffs against Canada and Mexico, as well as punitive import taxes on things like automobiles, microchips, and pharmaceuticals. Markets are getting used to brushing off trade war threats from Donald Trump, and this represents the fourth consecutive time that the Trump administration’s threats of imposing steep import taxes on foreign goods have been announced and then put off until some point in the future.

Core US PPI inflation clocked in at 3.6% YoY in January, well above the forecast of 3.3%. The previous period also saw a sharp revision higher to 3.7% from 3.5%, but the overall tick lower post-revision helped to assuage market fears of a resurgence of widespread inflation pressures. According to the CME’s FedWatch tool, rate markets are now pricing in better-then-even odds that the Fed will deliver at least a 25 bps rate trim in September compared to Wednesday’s forecast of December.

Dow Jones news

The Dow Jones saw a late bullish break across the board on Thursday, and nearly every single listed security is finding room on the green side for the day. Nvidia (NVDA) rallied 3.0% to $135 per share on stronger-than-expected microchip demand, giving the overall tech sector a leg up. Merck & Co (MRK) fell 1.35% to $84.50 per share.

Dow Jones price forecast

44,500 is becoming familiar territory for the Dow Jones. The mega-cap index has been churning within a choppy range between 45,000 and 44,000 since mid-January with bidders unable to find a foothold into fresh record highs, but short pressure is still unable to knock the DJIA lower.

Price action is still leaning in favor of buyers with bids churning north of the 50-day Exponential Moving Average (EMA) near 43,850. The gap between intraday prices and the long-run 200-day EMA near 41,800 has closed in recent weeks, but the Dow Jones is still trending well above its long-term average, outpacing the 200-day EMA since November of 2023. The Dow Jones has closed higher for all but three of the last 14 consecutive months.

Dow Jones daily chart

Economic Indicator

Producer Price Index ex Food & Energy (YoY)

The Producer Price Index ex Food & energy released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Those volatile products such as food and energy are excluded in order to capture an accurate calculation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Last release: Thu Feb 13, 2025 13:30

Frequency: Monthly

Actual: 3.6%

Consensus: 3.3%

Previous: 3.5%

Source: US Bureau of Labor Statistics

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.