Gold treads water above $2,900 – Will NFP spark a breakout?

- Gold consolidates ahead of key US Nonfarm Payrolls report.

- XAU/USD remains above $2,900 but struggles as US 10-year yield hits 4.286%.

- Trade tensions escalate as Canada and China retaliate against Trump’s tariffs.

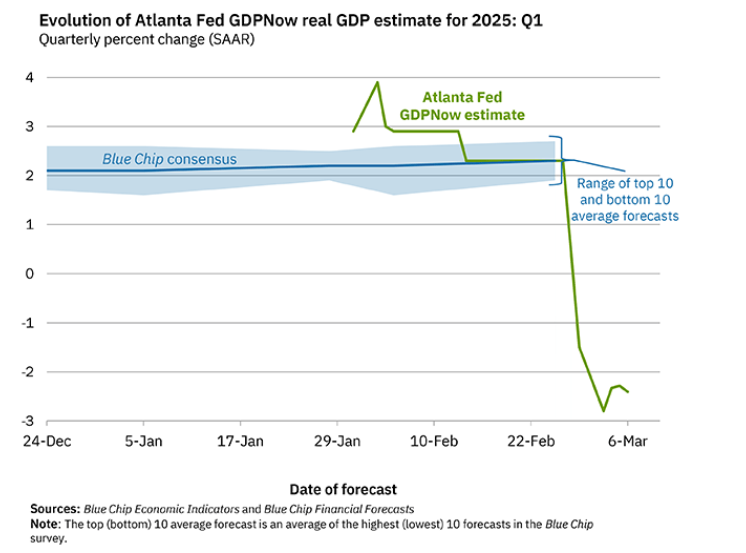

- Atlanta Fed GDPNow model revises Q1 2025 forecast to -2.4%, up from -2.8%.

Gold halted its three-day rally due to investors booking profits ahead of the crucial US Nonfarm Payrolls report. The rise of US Treasury bond yields also made holding the non-yielding metal less appealing. At the time of writing, the XAU/USD trades at $2,918, virtually unchanged.

The yellow metal consolidated above the $2,900 figure, capped by the earlier rise of the US 10-year Treasury bond yield to a one-week high, before paring those gains to stand at 4.286%.

Uncertainty surrounds the financial markets, spurred by controversial trade policies proposed by the President of the United States (US), Donald Trump. Tariffs imposed on US allies and adversaries triggered retaliation by Canada and China. Meanwhile, Mexico got a one-month delay of tariffs until April 2, after Trump and Mexico’s President Claudia Sheinbaum discussed additional improvements in fentanyl and illegal migration.

Data in the US was mixed on Thursday. The Challenger jobs report showed that layoffs rose sharply to levels not seen since the last two recessions. Meanwhile, the number of Americans filing for unemployment benefits dipped beneath projections, tempering recession fears sparked by Challenger, Gray, and Christmas data.

Following the data, the Atlanta Fed GDPNow Model projects the Gross Domestic Product (GDP) for Q1 2025 at -2.4%, up from the -2.8% contraction estimated on Wednesday.

Bullion traders will be eyeing Friday's release of February’s Nonfarm Payrolls figures, with analysts projecting 160K jobs added to the workforce.

Daily digest market movers: Gold price consolidates amid mixed US data

- US real yields, as measured by the US 10-year Treasury Inflation-Protected Securities (TIPS) yield, which correlates inversely to Gold prices, are flat at 1.946%, a headwind for XAU/USD prices.

- US Initial Jobless Claims for the week ending March 1 rose to 221K but remained below the 235K forecast and the previous week's 242K.

- Challenger Job Cuts in February surged from 49.8K to 172K, largely due to DOGE-related actions. Data from Challenger, Gray & Christmas revealed that the federal government was responsible for 62,242 of these layoffs.

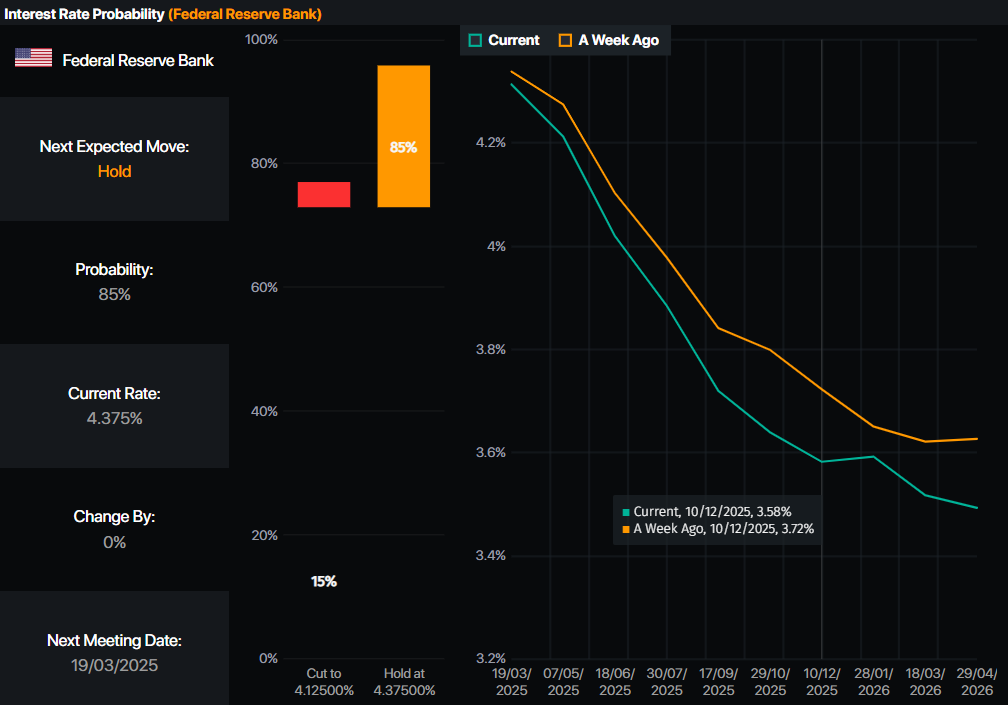

- Money market traders had priced in 74 basis points of easing in 2025, up from 72 bps on Wednesday, via data from the Prime Market Terminal.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price holds firm above $2,900

Gold price consolidates for the second straight day, printing two Doji candles, indicating that neither buyers nor sellers are in charge. Momentum, as depicted by the Relative Strength Index (RSI), shows buyers losing some steam, yet the RSI is in bullish territory.

That said, the path of least resistance is skewed to the upside. XAU/USD's next resistance would be $2,950, followed by the record high at $2,954. A breach of the latter can expose the $3,000 mark.

On the other hand, a daily close below $2,900 could risk the uptrend and open the door for a “healthy” pullback. Gold’s first support would be the February 28 low of $2,832, followed by the $2,800 figure.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Mar 07, 2025 13:30

Frequency: Monthly

Consensus: 160K

Previous: 143K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.