-

Opps!

This language contents are not available!

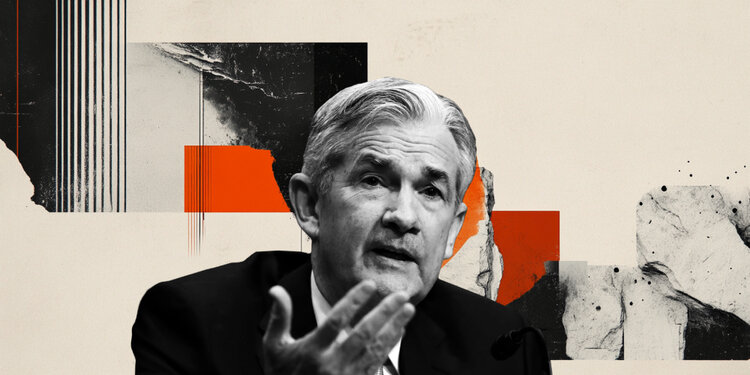

Fed's Bostic: labor is good, but inflation still needs monitoring

Federal Reserve (Fed) Bank of Atlanta President added his own soundbites to the noise machine of Fed headlines on Wednesday, noting that despite still-strong labor figures, US inflation continues to remain a sticking point, especially after US Consumer Price Index (CPI) inflation figures ticked higher in January.

Key highlights

The labor market is performing incredibly well.

The latest inflation numbers show careful monitoring still needed.

The deployment of AI will likely mean fewer workers are needed in some industries.

GDP more resilient than expected.

Perhaps could get further towards neutral this year but am less confident when the next step will come.

Patience suggests the next cut will happen later in order to have time to get more information.

It's difficult to have confidence in any forecast given policy uncertainty across so many dimensions.

If the economy evolves as expected, could get to 2% inflation in early 2026 and, at that point, would want to be close to neutral.

Neutral likely around three to 3.5%.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.