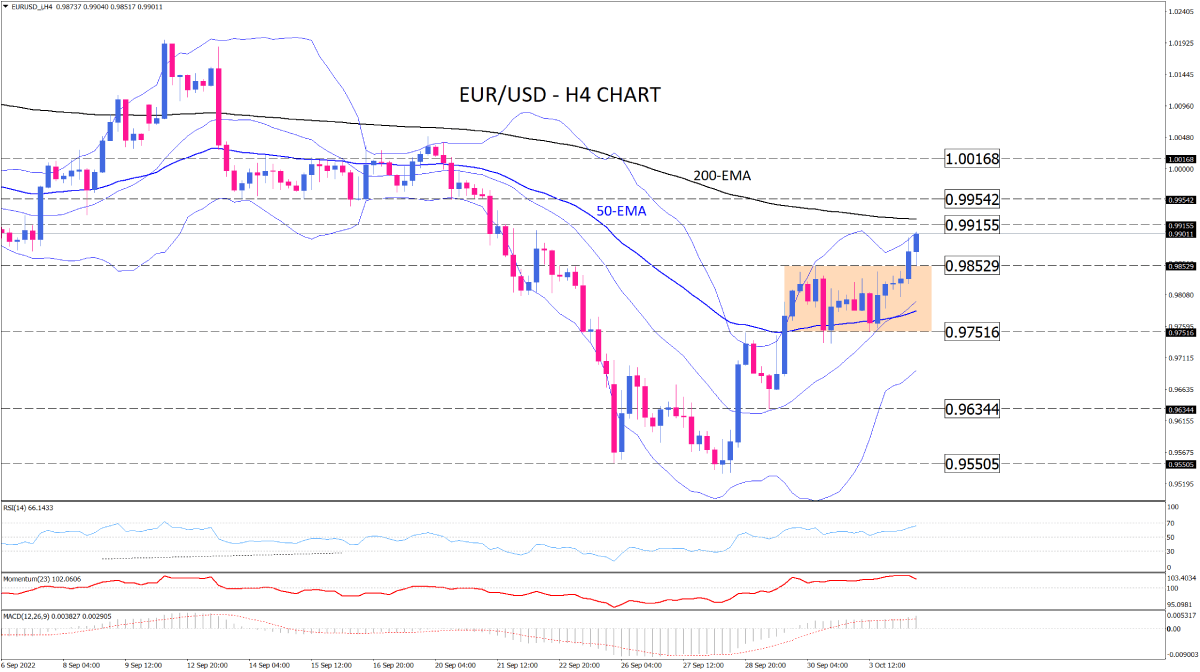

A wall of resistance challenges EUR/USD rally

EUR/USD is benefitting from a weaker dollar, climbing in the upper half of Bollinger bands. Intensifying bullish sentiment had the pair overcome the one-week top at 0.98529 earlier in the session. Upward-sloping Bollinger bands with the rising 50-EMA exhibit that buying pressure is gearing up in the short term. Additionally, the middle band has crossed the 50-EMA.

EUR/USD buyers are now inching close to testing the 200-EMA, which lines up with the 0.99155 mark. A break above this hurdle could pave the way towards 0.99542 before reaching the 1.00168 crucial resistance level.

Otherwise, if 200-EMA serves as a reliable resistance, the rally will stall and more sellers may join the market, bouncing the price lower to retest the middle band. If the euro can’t find enough buyers around this barrier, the pair can keep falling to 0.97516, around the last market bottom.

Short-term momentum oscillators reflect a bullish vibe. RSI is moving higher beneath the 70-overbought-zone, suggesting that buyers may get exhausted soon. Momentum is retreating slightly from its peak, telling us buying forces might be taking a rest. While, MACD is growing on the buying side, attempting to crossover the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.