GBP/USD's Descent: Unpacking the Bearish Momentum

The GBP/USD, commonly referred to as the "cable," has exhibited clear bearish tendencies recently, drawing considerable attention from traders and investors alike. Here's a detailed analysis of the current technical landscape:

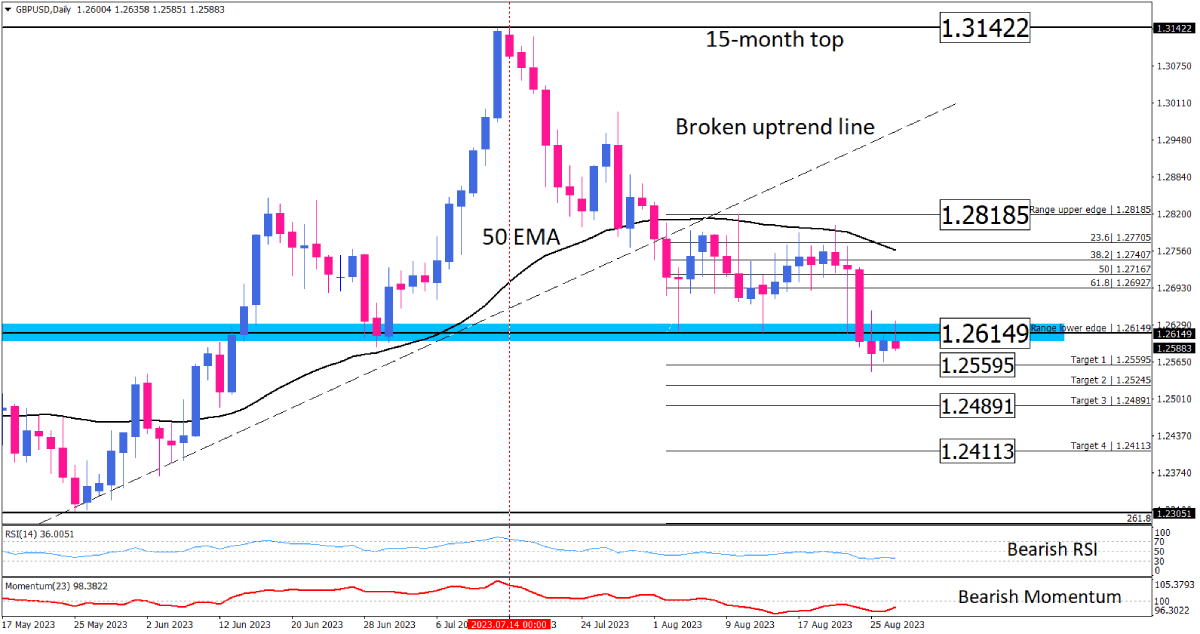

After reaching a 15-month peak at 1.31422 on July 14, 2023, the Sterling has been on a consistent descent against the US Dollar. This downward momentum was further solidified on August 2, 2023, when the pair broke a significant uptrend line, signaling a potential shift in the market sentiment.

Interaction with Moving Averages

The GBP/USD has tested the descending 50-day Exponential Moving Average (EMA) twice, a crucial technical indicator. On both occasions, the pair was rejected, reinforcing the bearish bias. This pattern indicates that the 50 EMA is acting as a dynamic resistance level for the pair.

Current Price & Key Levels

As of Tuesday, the pair is trading below a critical support-turned-resistance level at 1.26149. Should the selling pressure persist and amplify:

- The immediate target for sellers would be 1.25595.

- Subsequent levels to watch are 1.24891 and 1.24113.

These levels represent potential zones where the market might find support or experience a price reaction.

Oscillators & Indicators

The Relative Strength Index (RSI) is currently navigating the selling zone, further endorsing the bearish sentiment. Additionally, the Momentum indicator's position below its 100 threshold suggests that the bearish momentum is gaining traction.

Alternate Scenario

Markets are, by nature, unpredictable. While the primary scenario leans bearish, traders should also be prepared for potential reversals. If buyers regain dominance and push the price back above 1.26149, we could witness a positive correction. In such a scenario, the immediate upside target would be 1.26927.

Conclusion

The technical picture for GBP/USD is currently painted with broad bearish strokes. However, as with all financial instruments, market dynamics can change rapidly. Traders are advised to monitor key levels closely, employ prudent risk management strategies, and stay informed about global economic events that could influence the pair's direction.

Disclaimer: The above analysis is purely for informational purposes and should not be construed as investment advice. Always consult with a financial advisor before making any trading decisions.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.