AUD/CAD bulls poised to retrace the rally

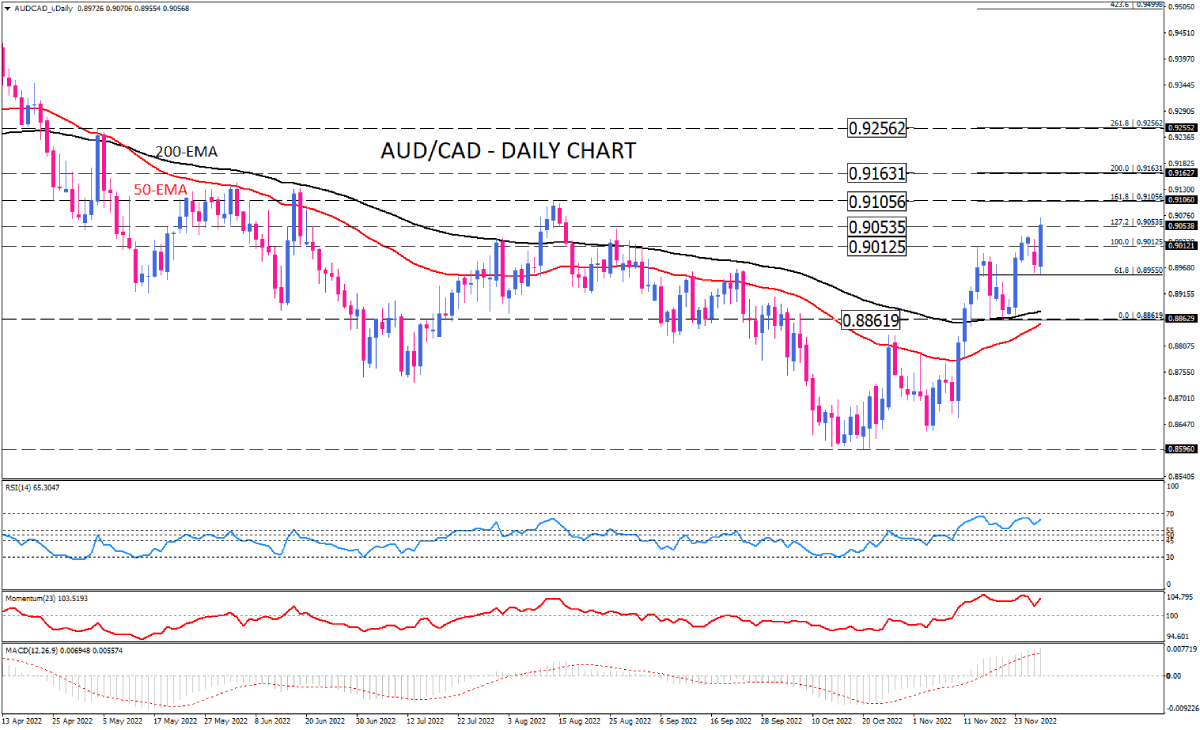

AUD/CAD is poised to continue its upward trend after breaking its downtrend line and passing a crucial resistance level on the daily chart. The Australian dollar's bulls bounced strongly from a two-and-a-half-year low of 0.85960 in October, successfully breaching the 50- and 200-day moving averages to set the stage for further upward movement.

The currency pair gained strength from buyers in Tuesday's trading as it managed to reach the resistance area of 0.90535. If the upward momentum continues, overcoming this key barrier could lead to more buyers flocking to the market in an attempt to reach 0.91056, the highest price level since August. In the event that this key resistance is breached, we could be looking at levels like 0.91631 and 0.92562.

Alternatively, for sellers to stop the rally, they need to lower the price to the last price floor at 0.89550. With this level of interest broken, the November 21 price floor at 0.88619, which is in line with the 200-day moving average, will come into the spotlight.

Increasing buying forces are indicated by the convergence of short and long-moving averages with an upward slope. Additionally, short-term momentum oscillators reflect bullish momentum. The RSI is moving up in the buying zone. Momentum is hovering above the 100-threshold, indicating a predominance of buying sentiment. Likewise, MACD bars that have overtaken the signal line in the positive area indicate a bullish bias.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.