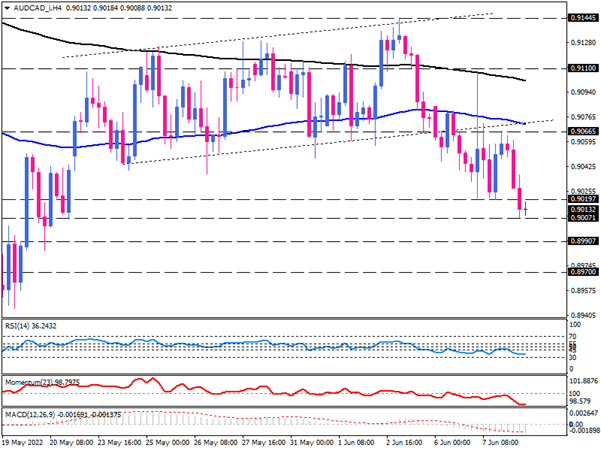

AUD/CAD sellers face a psychological support level

After breaking below its ascending channel, AUD/CAD is trading in a bearish outlook on the four-hour chart. Sellers are attempting to sustain the down move below Tuesday's low at 0.90197. Suppose they gather enough momentum to dominate the market. In that case, the price may fall below psychological support at the 0.90071 mark, encouraging more sellers to rein. The further decline can result in capturing the 0.89907 hurdle. A decisive break through this barrier will send the price towards the 0.89700 mark.

Otherwise, should buyers defend the 0.90071 key support, the price may reverse towards the last market top around 0.90665, which lines up with the confluence of the 100 EMA and the lower edge of the broken channel. Overstepping this latter can motivate bulls to reclaim the 0.911 round resistance level on the verge of the 200 exponential moving average before aiming for the channel's upper line, which is in line with the June 3 market top at 0.91445.

Short-term momentum oscillators are reflecting bearish bias with both RSI and momentum laying in the selling area below their thresholds. RSI is moving below 50 in the distance from the 30 level, which shows sellers can be in charge in the meantime. At the same time, MACD bars are growing on the negative side, attempting to get below the signal line, which is an interpretation of gaining negative momentum.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.