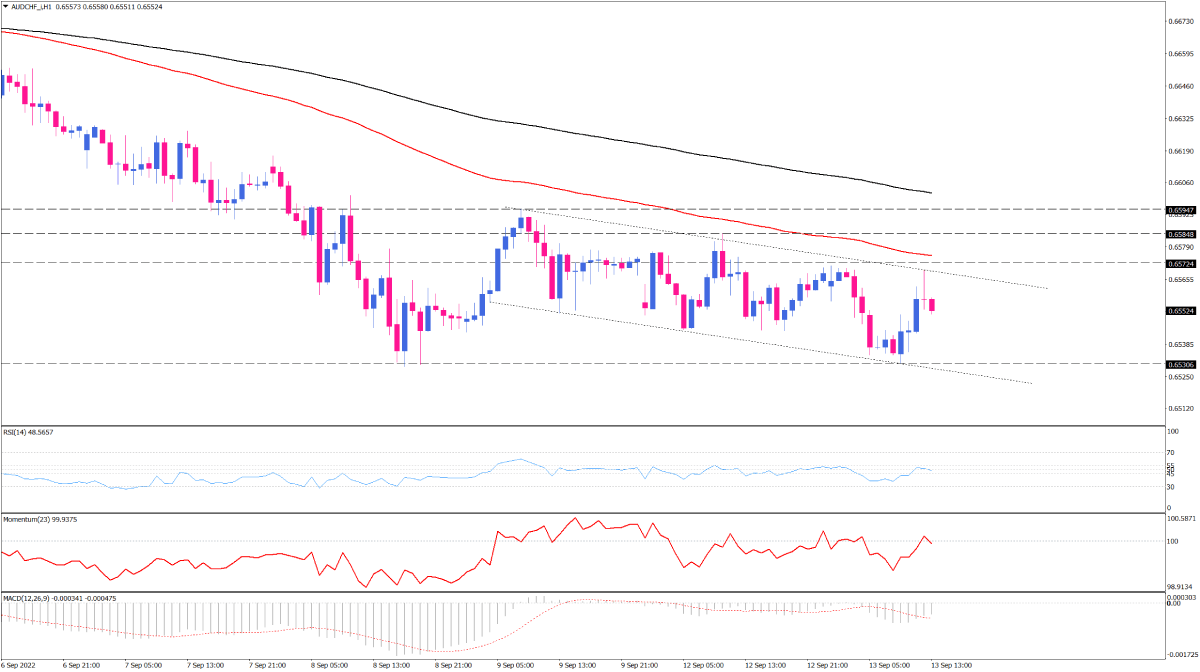

AUD/CHF sellers keep the falling channel intact

On the one-hour chart, AUD/CHF has been trading within a descending channel since September 9. Also, the broader direction for the pair is down as it stands below both the 50 and 200 EMAs for a while. Given that, the channel's upper line, which is in line with the 50-EMA, capped the further traction in the early EU trading session on Tuesday. As this dynamic resistance holds, sellers find the courage to drive the market lower by having an eye on the channel's lower border around the last bottom at 0.65306.

On the flip side, should buyers get back to their seats to beat the falling channel. The immediate resistance can stand the rally around the 0.65724 mark, in a confluence of the upper line, 50-EMA and last swing top.

It is important to notice that the pair doesn't benefit from a clear bearish bias right now. RSI and momentum are both hovering around their thresholds in a neutral zone, indicating a lack of apparent directional movement. While MACD histogram tends to move back toward zero with shrinking bars that cross above the signal line. This can be another indication of fading negative momentum in the short term.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.