AUD/NZD bulls to reclaim two-year high

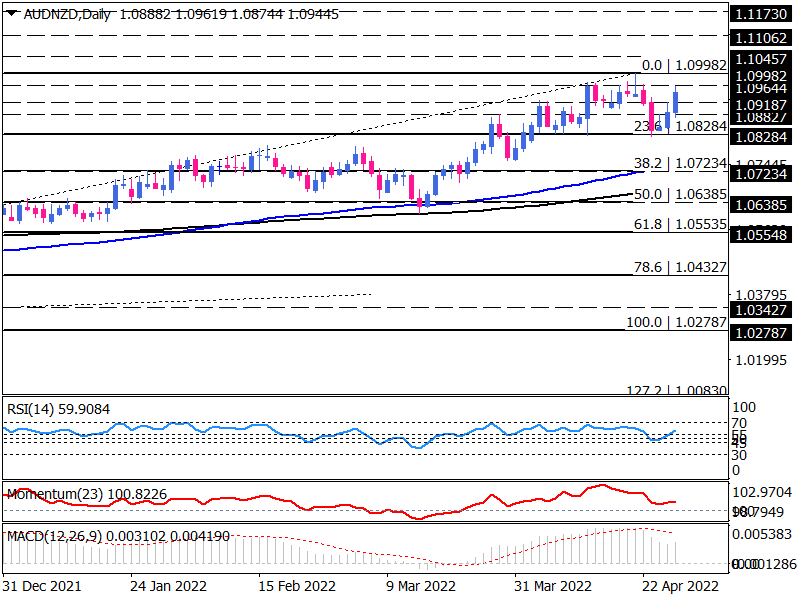

Since last November, the AUD/NZD pair has been trading in an uptrend on the daily chart. After bottoming at 23.6% retracement of this uptrend, bulls have been in charge for the previous three days, aiming for the previous peak at the 1.09982 mark.

If they manage to surpass this hurdle, the following resistance level can be estimated at 1.10457, which is in line with an almost two-year record high. Further traction above this barrier will bring the 1.11062 hurdle to the buyers’ attention. Even if we see some consolidation or negative correction on the way, as long as the price holds above the current top at 1.09982, the uptrend will remain intact. And 1.11730 at four-year highs can be a target for buyers to claim.

On the flip side, should the uptrend get out of steam and bears defend the 1.09982 last market top, the selling interests may drag the price towards 1.08284. By breaking this barrier, bearish momentum may intensify with fresh sellers, aiming for the 100-day EMA around the 1.07234 mark, which lines up with the 38.2% retracement of the current uptrend.

Momentum oscillators suggest bullish bias is picking up. RSI has pulled off the neutral zone into buying region. Momentum has turned upward to hold above the 100-threshold. The positive MACD histogram is rising again to reach the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.