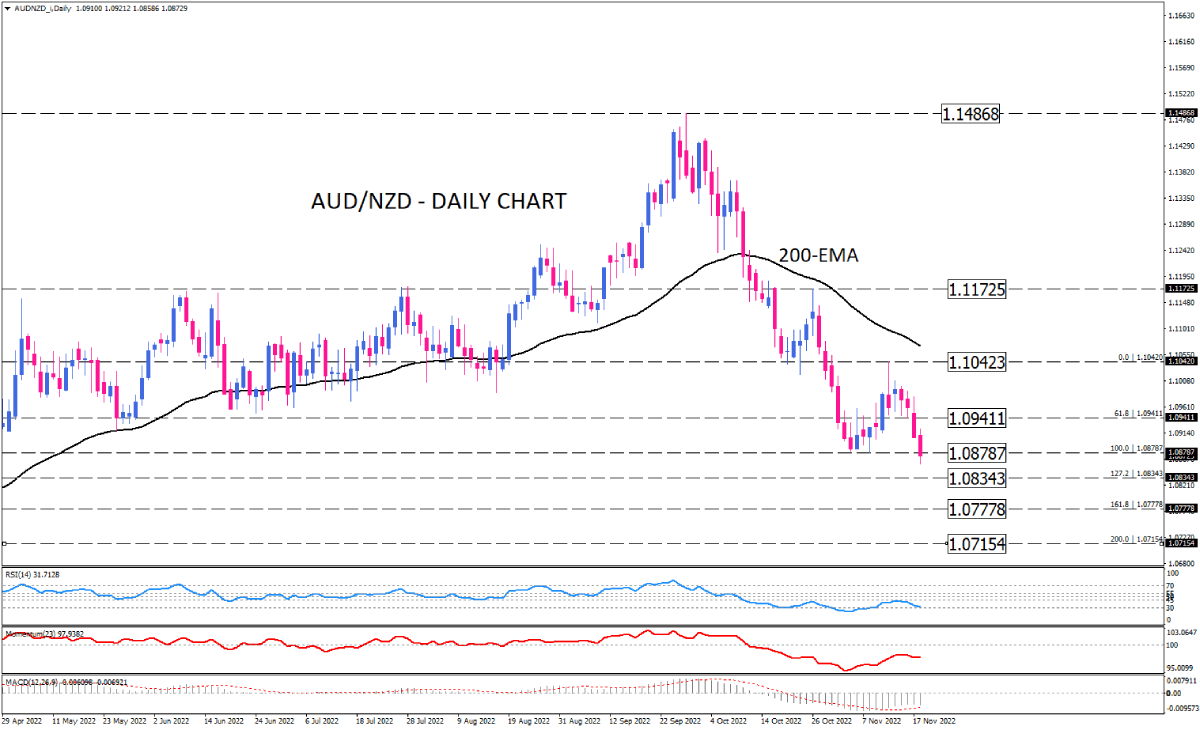

AUD/NZD sellers face a crucial barrier around 7-month lows

AUD/NZD is trading in a downtrend since late September since sellers dragged the price below its 200-exponential moving average, forming lower tops and lower bottoms. AUD/NZD is hanging out at the lowest level seen in the last seven months. Accelerating bearish momentum has resulted in tackling the 1.08787 hurdle following the first attempt on November 8. If sellers find a way to break this barrier the decline will likely be extended towards the immediate support of 1.08343. In the event that this level also fails to halt the fall, the pair can retrain the downtrend to land on the 1.07778 mark. Should selling forces remain in the play, a sustained move below this level can turn attention to 1.07154.

Otherwise, with buyers coming to defend the current support level, managing to hold the 1.08787 mark, the price may pare some losses towards the immediate resistance of 1.09411. However, even if buying pressure fuels further traction, it needs to overcome the 1.10423, coinciding with the 200-EMA, to reverse the trend.

Short-term momentum oscillators imply a bearish bias, suggesting that sellers may take a break to reinforce their strength before going further down. RSI is pointing down at the verge of the oversold area, suggesting that bearish momentum is on its extreme, while momentum is hovering in the selling area with a distance from its threshold. We see also MACD bars flattening for a while in the negative territory, waiting for more push from sellers to cross the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.