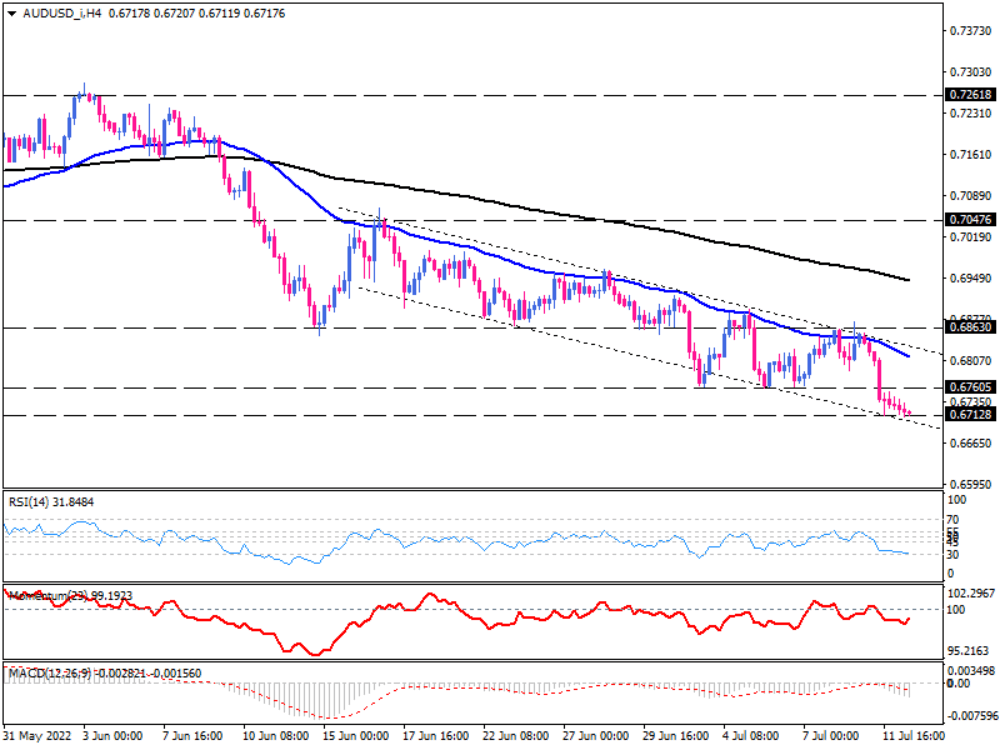

AUD/USD bears flirt with falling channel's support

Since risk-off sentiment and recession fears have intensified, commodity currencies like the AUD have come under greater pressure, while the safe-haven dollar is strengthening after hitting its 20-year high. Let's say commodity prices continue to fall due to weaker demand. In such a scenario, it may be gloomy for the Australian dollar against the US dollar.

AUD/USD on the four-hour chart is trading right below the 50-EMA within a descending channel. As the channel line holds the resistance, extensive selling pressure has dragged the price down, breaking below the lowest level since May 2020 at 0.67605. Currently, the pair is hanging out with the channel's support line. However, the shortening bodies of the candles imply a diminishing bearish bias near this crucial support level. If this hurdle remains intact, AUD buyers may attempt to ride towards the broken support at 0.67605. Should fundamentals come in favour of Aussie bulls, they may make their way towards the 50-EMA, which lines up with the channel's upper band.

On the other hand, a continued bearish bias can keep the pair along with the channel's support and allow it to step lower to 0.66900 and 0.66749.

Short-term momentum oscillators reflect easing bearish pressure. RSI is on the verge of the oversold area. In the event of further declines, there is a possibility that sellers will soon be exhausted. With waning pressure, momentum oscillates north in the selling area. As seen by both the RSI and the Momentum during the last two weeks, there has been a divergence between the oscillators and the price since they posted higher lows against the lower price bottoms.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.