AUD/USD buyers take a breather before hitting five-month highs

The Aussie has been outperforming during 2022. The booming commodities market and a robust domestic economy will likely keep the Australian dollar well supported. However, an adverse risk could undermine its gains.

Due to the market's desire to price in RBA hikes earlier than official commentary indicates, the downside to the AUD will be limited despite the contrast between the Reserve Bank of Australia and the Federal Reserve policy.

With metals prices rallying sharply, the Aussie is finding support against the dollar in its 0.75 range, which means it is attracting more flows against the greenback.

Technical view

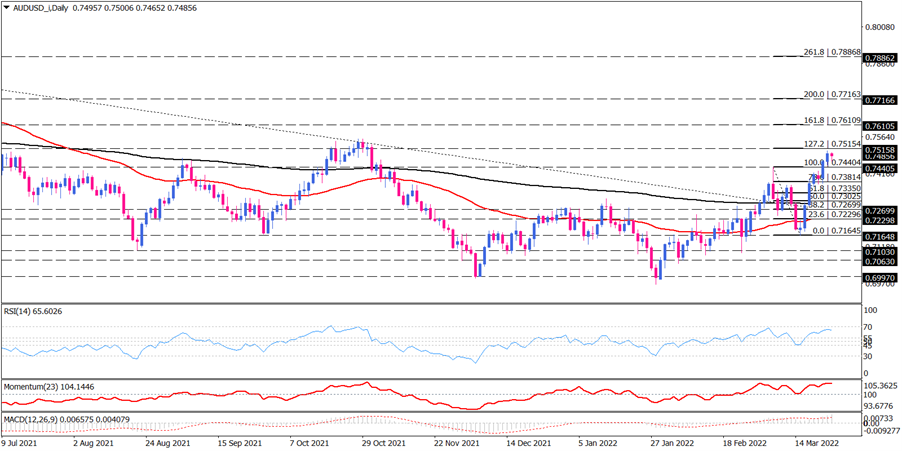

On the daily chart, after completing a double-bottom pattern followed by a pullback to the 50-day EMA, Aussie buyers have taken a breather on Thursday on the verge of the 127.2% Fibonacci level at 0.75154. If positive momentum gain traction to overcome this barrier, the pair can rise towards 0.76109, which lines up with 161.8% Fibonacci extension to reclaim the 5-month highs. Suppose commodities prices hold the back of the Australian dollars. In that case, Buyers may overstep this hurdle, targeting the 0.77163 as the next resistance.

As long as the price moves above the exponential moving averages, the overall outlook for AUD/USD is bullish. However, on the flip side, if the US dollar finds more fans against the Aussie, the price can drop to the previous top of 0.7440. If buyers ignore this level, sellers may drive the market lower towards the support area of exponential moving averages. The further decline can send the price towards the 0.71645 barrier.

Momentum oscillators support bullish bias. RSI is moving in buying territory. Momentum is above 100-baseline. And positive MACD bars advance above the signal line, which is also trending upwards.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.