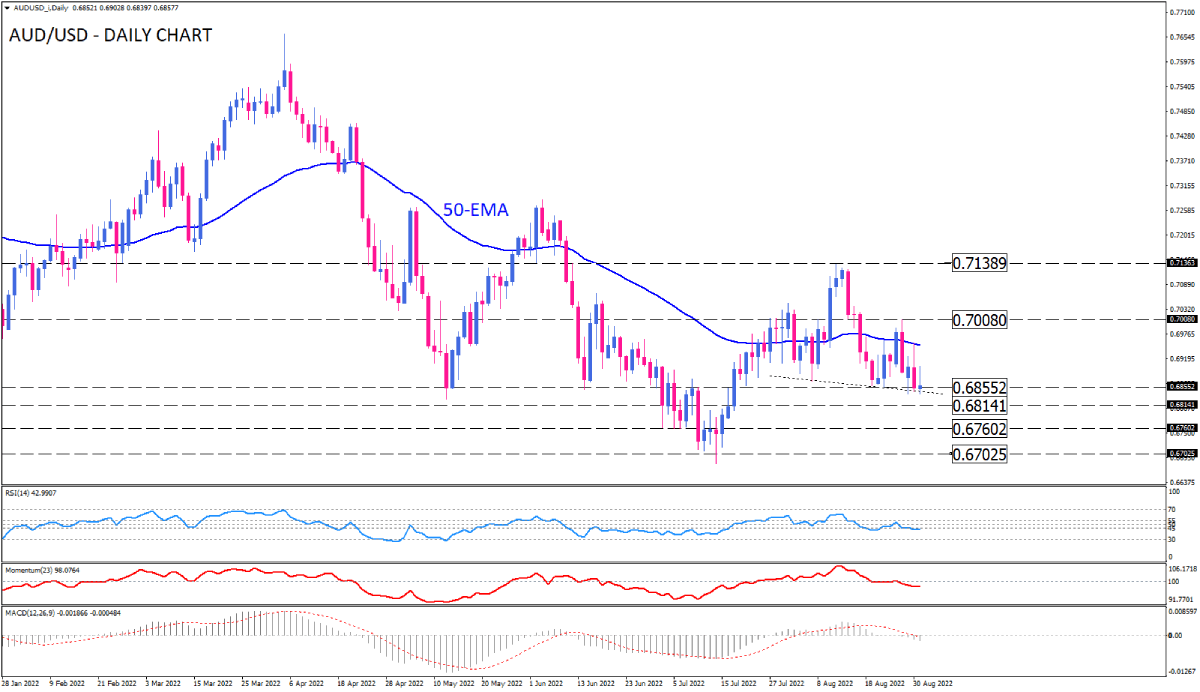

AUD/USD sellers attempt to push through a key support level

AUD/USD selling pressure is intensifying for the second day in a row, with bears driving the price below the 0.68552 crucial support. The pair, which has been in a downtrend since April, has fallen under the 50-day exponential moving averages after sellers’ efforts resulted in forming a head and shoulders pattern to end the short-term rally by making a 0.70080 new top, lower than the 0.713363 rally’s peak.

Suppose sellers win the session, breaking the neckline, lining up with 0.68552. In that case, AUD/USD can extend losses toward the 0.68141 barrier. A clear break of this level will turn attention to 0.67602, as the following standpoint for sellers. If this level also fails to halt the fall. The pair will get towards two-year lows around 0.67025, seen on July 14 last time.

Alternatively, should buyers defend the current support at 0.68552, AUD/USD will remain sideways, with bulls trying to push back higher towards the right shoulder at 0.70080. a decisive break of this barrier can invalidate the reversal pattern and raise hopes for getting to 0.71363.

Short-term momentum oscillators reflect bearish sentiment. RSI is moving into the selling area. Momentum decreases below the 100-threshold, and MACD bars have crossed the zero line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.