Bitcoin is on the back foot after breaking a crucial support

With bitcoin's losses reaching below 20K, the cryptocurrency market is on pace to post its worst month in 2022. Aside from regulations and exchange crashes in June, mounting fears about a recession have also elevated the odds against risk assets as investors seek safety for their investments, which can be challenging to find in crypto markets, at least in the short term.

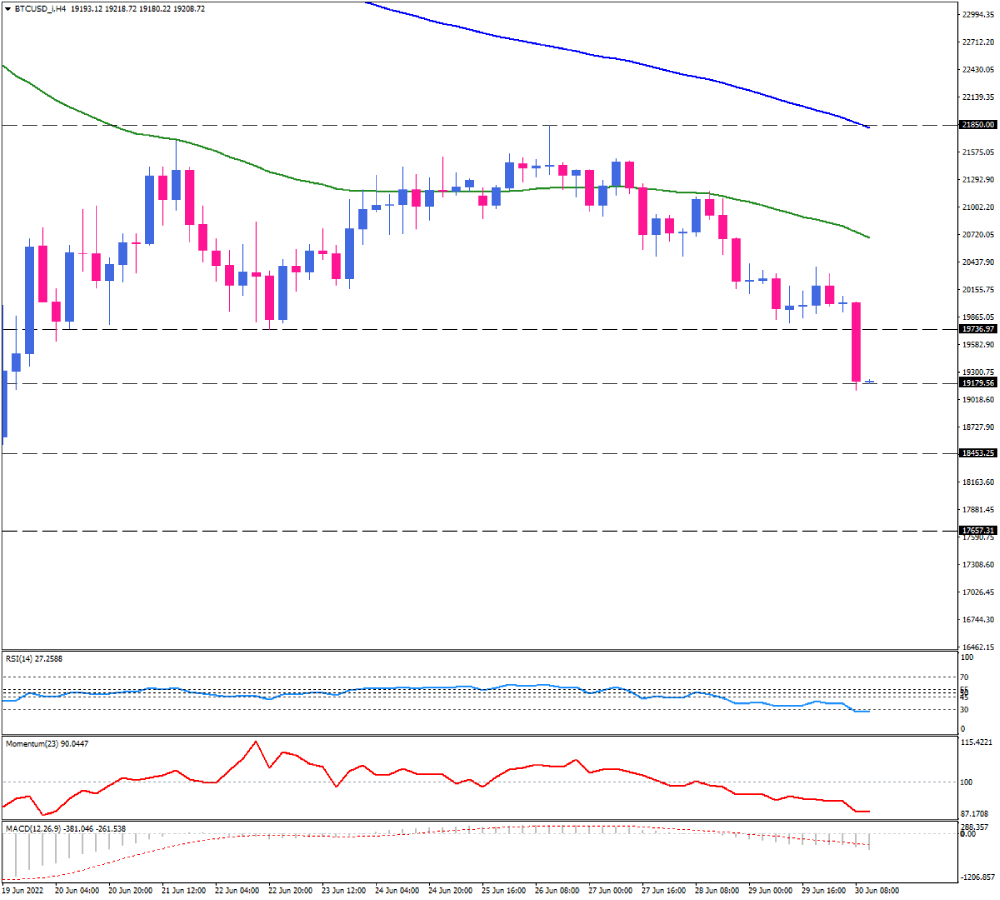

As a result, Thursday's market showed further losses in bitcoin, with sellers taking the ground below a one-week low of $19,737. Bitcoin is struggling to overcome a hurdle of 19180 in the mid-European trading session, as seen in the four-hour chart. The price may overcome this roadblock by intensifying bearish momentum, putting the next support level of sub-$18450 in the spotlight. If sellers succeed in clearing this hurdle, they will be empowered enough to retest the market bottom at 17655, which is the lowest mark in almost two years. A sustained break below this crucial level could be followed by a further decline towards the 16350 level.

Otherwise, given an oversold RSI, if sellers take a breather, allowing buyers to reign, bitcoin may find support at $19180. Should that be the case, buyers would have the opportunity to push the price up to the 19736 previous level of interest. However, the down scenario is expected to persist until the 21850 resistance zone is decisively broken.

The momentum oscillators indicate strong bearish momentum. In the oversold area, RSI is pulling below the 30-level, while momentum is slipping downward in the selling territory. The MACD bars are falling in a negative direction below the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.