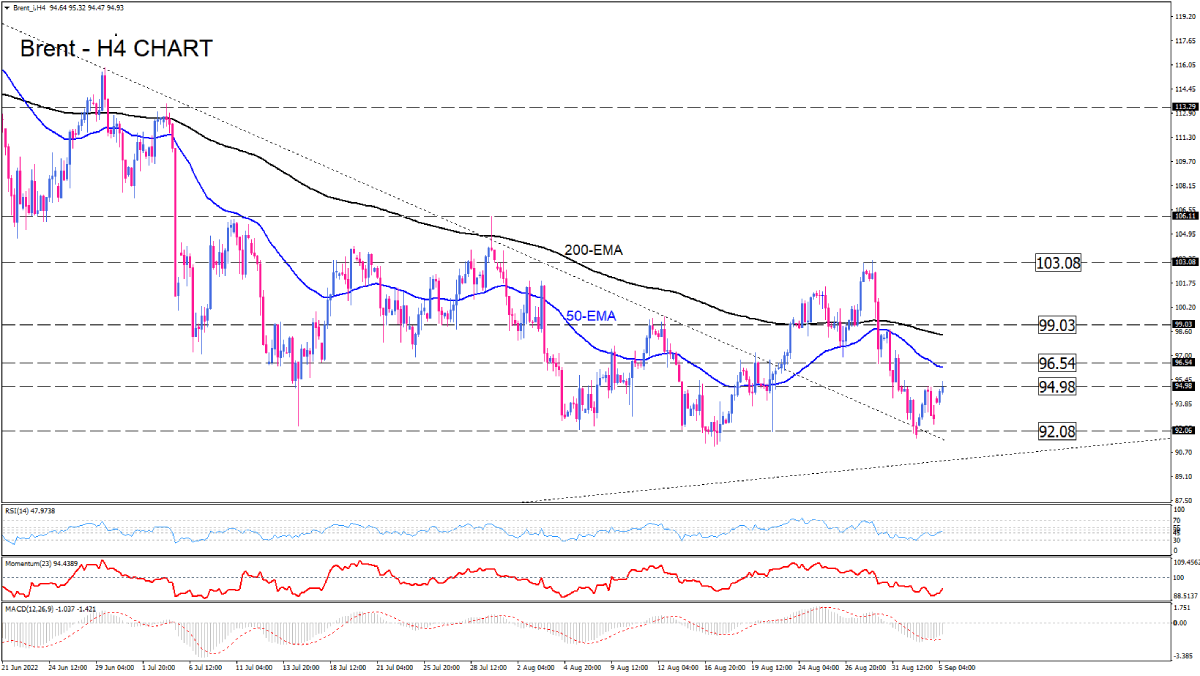

Brent bulls tackle a key resistance to form a reversal

Brent is emerging a bullish reversal on the four-hour chart after rebounding from the broken downtrend line on the verge of the seven-month low around $92. Currently, buyers have tackled the immediate resistance, lining with the last top at $94.98 to complete the reversal and extend the rally higher. If they manage to close above this hurdle, brent is likely to meet the 50-EMA, which is in line with 96.54. A sustained move above this key level can represent the persistent bullish sentiment and make buyers more hopeful of reaching the 200-EMA around $99.03.

On the downside, if the 94.98 resistance level holds, the sellers' attention will turn to $92.08 again. In order to resume the downtrend, bears must break this crucial level.

Short-term momentum oscillators point to waning bearish momentum. RSI has pulled up from the selling area, which means bearish sentiment has faded. Momentum is hovering in the selling area. Still, the oscillator has climbed slightly to put a pause on its downtrend. Likewise, negative MACD bars shrink after crossing above the signal line, and the move implies that bearish momentum is weakening.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.