CAD/CHF sellers attempt to retain the downtrend

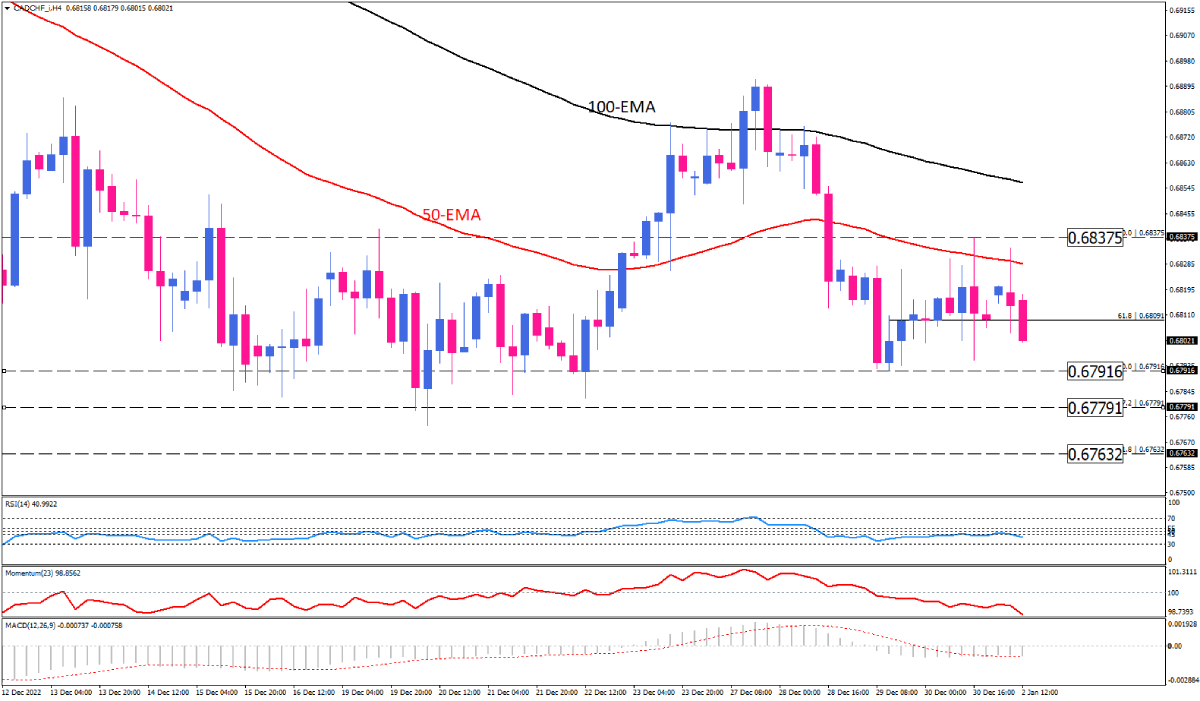

CAD/CHF is trading between the 0.68375 resistance and 0.67916 support on the four-hour chart. However, the broad outlook is considered bearish as the price is holding below both the 50 and 100 exponential moving averages. On the holiday-impacted trading session on Monday, bears are attempting to post a rebound from the 50-EMA towards the 0.67916 level of interest. If negative sentiment across the pair continues to prevail, sellers may test the 0.67916 price floor, which has proved to be an influential level before. A sustained break below this barrier can motivate more sellers to join the market, aiming for 0.67791. Accelerating bearish bias can result in breaking this obstacle which will pave the way towards the next target at 0.67632.

Otherwise, should buyers retake their seats, the 50-EMA will become under attack again with bulls aiming for pushing the price through the intraday top at 0.68375. Even if that happens, the outlook won’t change unless we see a clear penetration of the 100-EMA.

The short-term momentum oscillators indicate a bearish bias. The RSI is moving downward in the selling zone. Momentum is declining below the threshold, and MACD bars are negative.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.