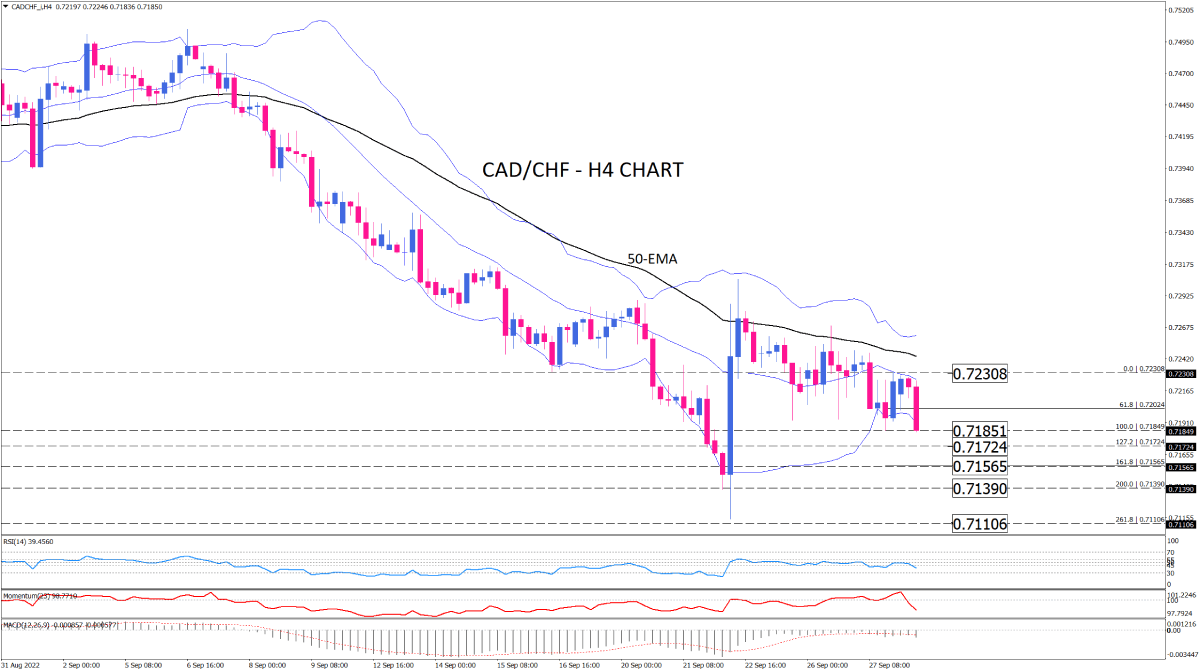

CAD/CHF sellers attempt to break a range

CAD/CHF is trading in a bearish manner on the four-hour chart. The pair has been trending downward since early September and after a short-term consolidation between 0.72308 and 0.71851, sellers attempting to resume the downtrend by attacking the range support at 0.71851. the narrowing Bollinger bands also exhibit the consolidation, demonstrating a condition called squeeze, signalling a probable new movement is going to emerge.

If the current bearish bias that Wednesday’s morning trade is witnessing persists, the price will likely break the 0.71851 hurdle. Such a move can put the 0.71724 next support in the spotlight. A further decline below this level can result in settling the price around the 0.71565 mark, which is in line with the %161.8 Fibonacci projection from the last upswing that occurred on Tuesday. Suppose sellers clear this obstacle. In that case, the way will be opened towards the lower supports at 0.71390 and 0.71106, respectively.

Otherwise, if buyers get back to the market, defending the 0.71851, the price may stay in the current range, attempting to reach the immediate resistance around the previous top of 0.72308, which lines up with the 50-EMA, in the upper side of the Bollinger bands.

Short-term momentum oscillators support a bearish sentiment. RSI is edging down in the selling region, suggesting bears are in charge. Momentum also keeps falling below the 100-threshold. Likewise, MACD bars are plunging into negative territory.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.