CHF/JPY sellers contend with a significant support

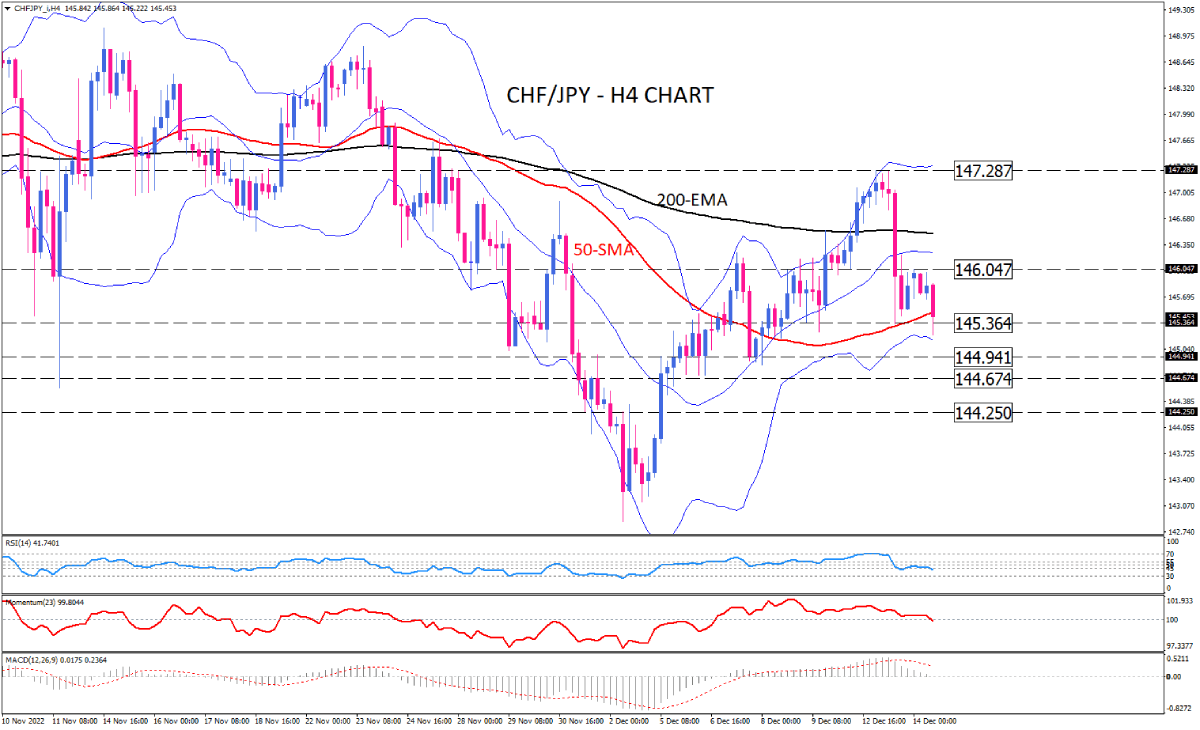

The downward movement of CHF/JPY on the four-hour chart has intensified after retreating from 147.287. During Wednesday's session, sellers face resistance at 145.364, right at the 50-exponential moving average. Moreover, the area has also been clustered with the lower Bollinger band, thereby enhancing the significance of the support area. In the event that sellers manage to overcome this upstanding support, then a subsequent decline could lead to the pair dipping towards the support level of 144.941. If this roadblock is overcome, then lower supports await to thwart the fall, the support at 144.674 and 144.250.

Otherwise, should the current support zone repel sellers strongly, 146.047 would come under attack before tackling the 200-EMA again.

Momentum oscillators indicate a bearish bias emerging over the short term. RSI has entered the selling zone. Momentum has almost crossed below the 100-threshold. MACD bars are shrinking toward zero quickly.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.