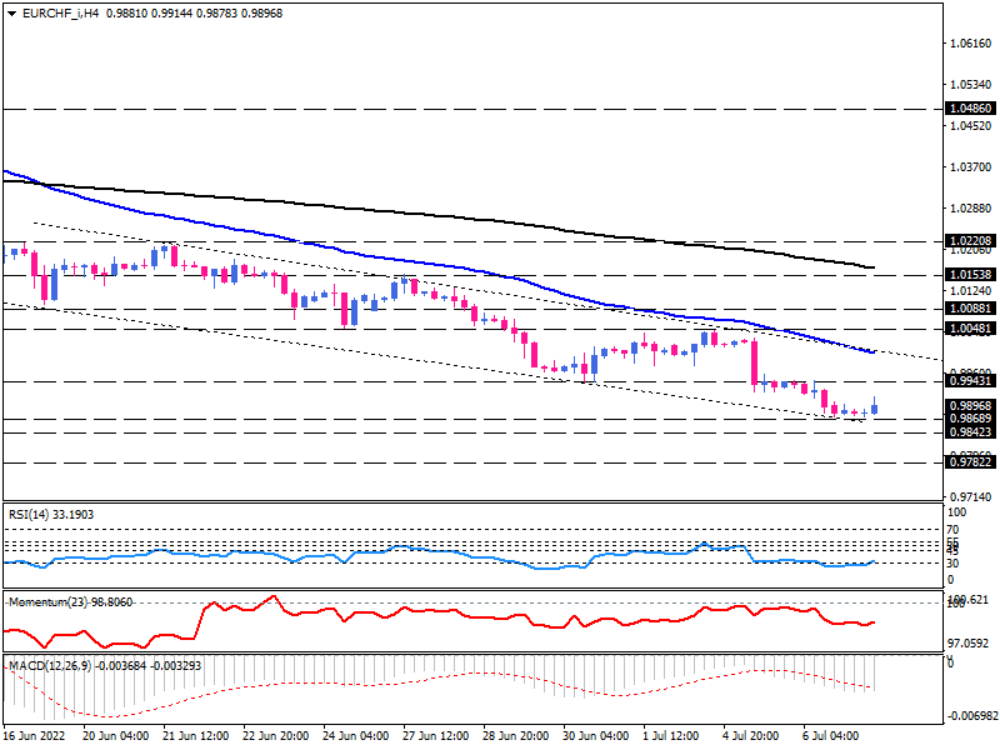

Descending channel set to lend support to EUR/CHF

On the four-hour chart, EUR/CHF has been trending downward below the 50 and 200 EMAs. In the Thursday trading session, the pair hit the support line of its falling channel, which lines up with the lower Bollinger band around 0.98689. At the same time, RSI hint at an oversold condition with a reading below 30-level, suggesting the exhaustion of sellers. The convergence of bands also reflects a fading bearish momentum that can result in increasing the price towards the 0.99431 mark as the immediate resistance level in the confluence of the middle Bollinger band. In the event that buyers strengthen enough to overcome this barrier, the market will go for retesting the channel line, coinciding with the 50-EMA. This crucial resistance has been held since the downtrend began and will likely attract more sellers to load their position to keep the channel intact. A sustained breakout of the descending channel can signal the end of the downtrend. Buyers may break above this latter if bullish momentum intensifies, aiming for 1.00481 around the upper band. Further traction above this barrier will reverse the outlook to bullish, putting the 200-EMA in the spotlight.

Otherwise, should the middle band hold resistance, the pair will remain in the lower half of the Bollinger bands, suggesting further decline may be on the cards, with sellers back the price down towards the last trough at 0.98689. A decisive break of this level will signal more drop toward the 0.98423 mark.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.