EUR/AUD bears keep dominance the market after breaking a key support

Despite the growing risk of a Euro Area recession by 2022, the Governing Council increased all three of its deposit, refinancing, and marginal lending facility rates by 50 basis points at this week's ECB meeting. With yesterday's decision, the ECB ended an era of negative interest rates that had lasted for eight years.

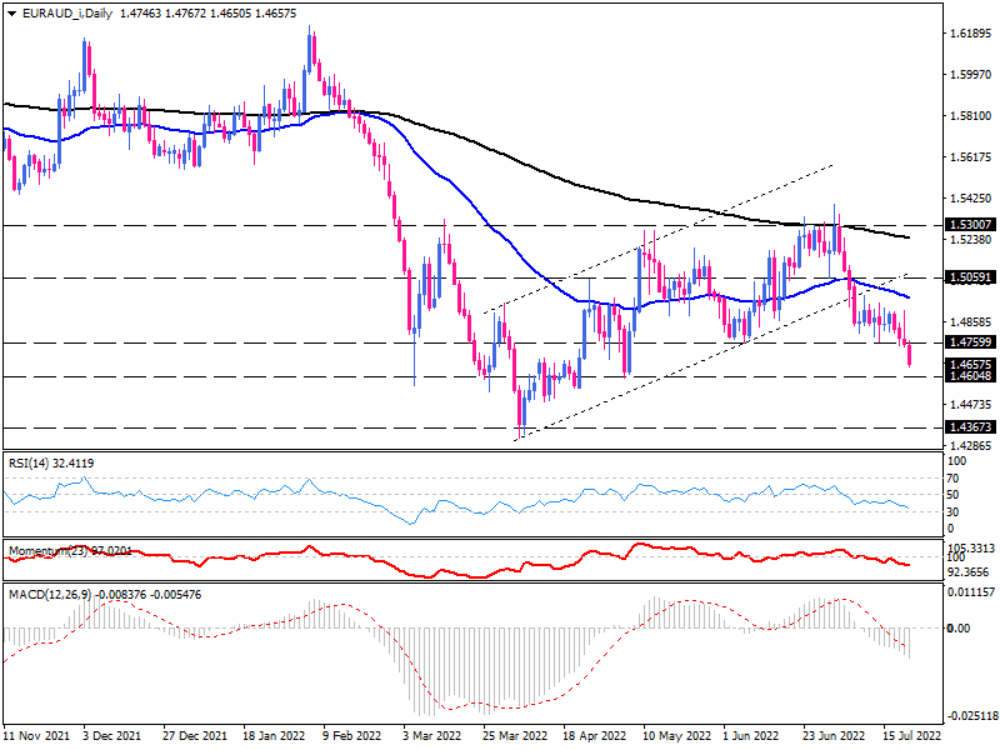

The EUR/AUD reaction was interesting among the other euro crosses. The euro initially rallied against the Australian dollar, as markets were only pricing in around a 50/50 chance of a 50bp hike. However, the euro quickly gave up all of its intraday gains and fell near ten-week lows at 1.47600 on the Australian dollar. Having broken below this barrier, Friday's trading moved further downward. If bearish sentiment persists, the price may keep falling towards 1.46048, the lowest level since early May.

It won't be surprising to see some consolidation around this hurdle as the relative strength index is close to reaching the oversold area, suggesting sellers may get exhausted soon.

Yet, suppose they succeed in occupying a significant portion of the market. In that case, 1.46048 will not be able to halt the sell-off. A decisive breach of this support area can pave the door toward the 1.43673 barrier, the lowest level seen in five years.

Otherwise, should buyers take cues from the oversold condition and regain control, the euro may gain traction to retest Thursday's high around 1.49150, which is in line with the 50 exponential moving average.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.