EUR/AUD is gaining a bearish bias

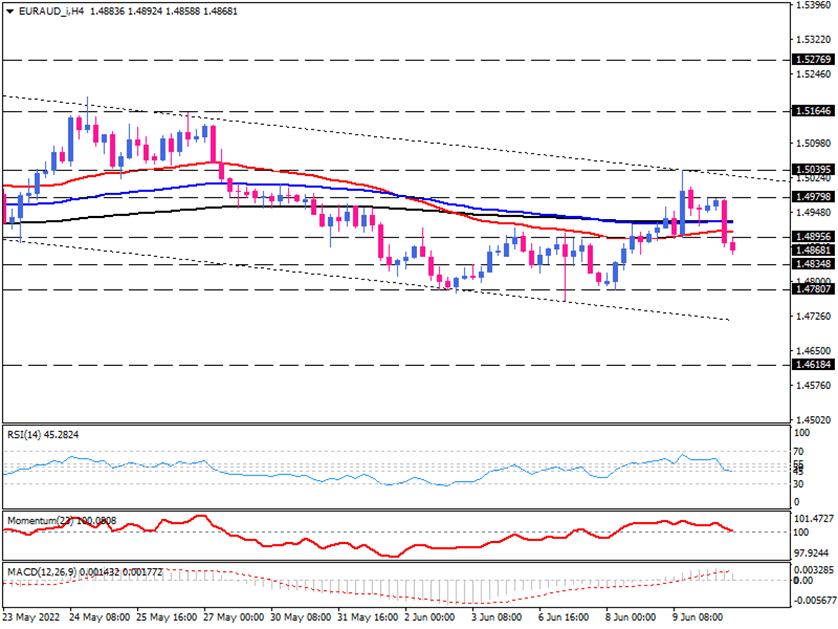

EUR/AUD has been trending downward since May 10, and sellers have broken previous lows, gradually lowering the price from its peak at 1.52800.

On the 4-hour chart, sellers have been in control after the rebound from the falling trendline. The price was able to break below yesterday's low at 1.48956, crossing the 50 exponential moving average.

As long as the bears remain strong, the price can sink to the next support around 1.48348. In the event that the market breaks through this barrier, sellers will be watching the next support at the 1.478007 mark, which has been key support over the past month. A surge in selling forces may succeed in overcoming this critical area, which will extend the downtrend.

Otherwise, if buyers regain strength, the market is expected to continue to move in a range, putting the confluence of moving averages in the spotlight.

Flattening EMAs reflect the mid-term balance, which seems to get ended by sellers attacking yesterday's low.

Momentum oscillators also confirm the current market balance and imply a slight bearish tendency. The RSI is moving down in the neutral zone, and it is also heading towards the 100-threshold. Positive MACD bars, which have crossed below the signal line, are also shrinking to zero.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.