EUR/CAD attampts to find new direction

EUR/CAD has been struggling to make a decisive move in either direction after breaking above its downtrend line yesterday as traders are waiting for the ECB policy announcement. The pair is expected to find a path depending on the ECB announcement.

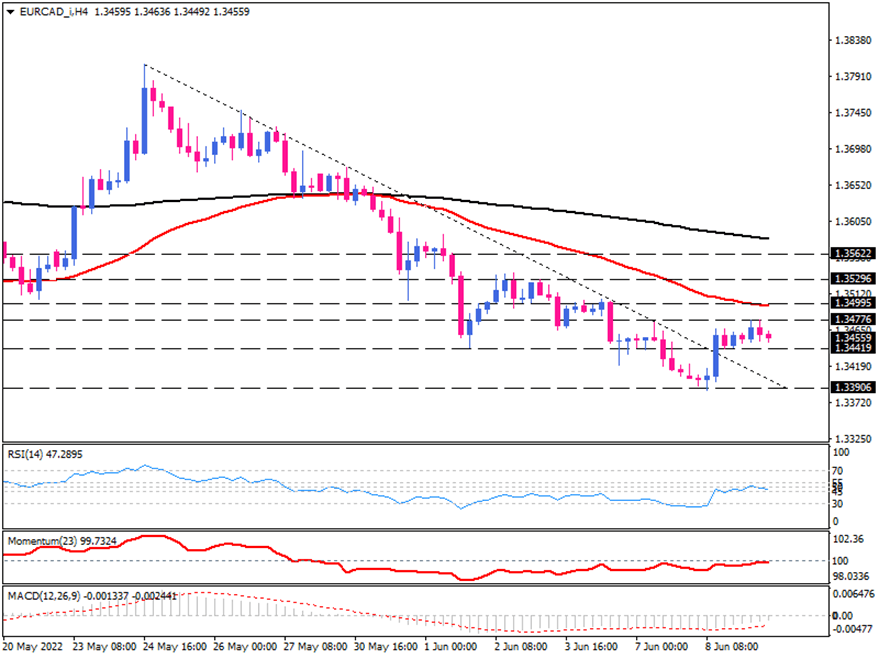

The pair is trading on the verge of Tuesday’s top around the 1.34753 mark. To establish a new uptrend, buyers must break above this hurdle. If they manage to pass this resistance, their focus would turn to the 50 EMA in the smack with the 1.34990 barrier. Further traction above this latter can be seen as a bullish development that provides the euro with a boost, aiming for the next resistance at 1.35291.

On the other side, should fundamental news point to a dovish stance from the ECB, the pair would suffer heavy losses as the euro may lose interest. If sellers retake market control, a sustained break below the base of the sideways at 1.34419 can lead the price to retest the broken trendline. A further decline would suggest a significant lurch below the one-month low at the 1.33906 key support.

Short-term momentum oscillators suggest a bearish bias for the pair. RSI has entered the selling area, moving down. Momentum is also pointing sought after falling below the 100-threshold. Likewise, negative MACD bars are advancing below the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.