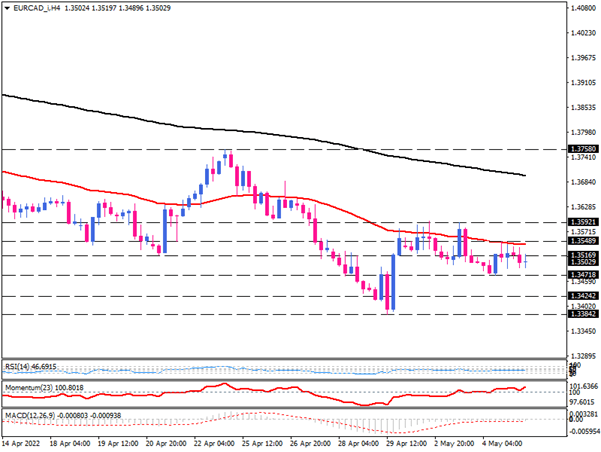

EUR/CAD attempts to find a direction

EUR/CAD is trading in a downtrend below the 50 and 200 exponential moving averages on the four-hour chart. However, recent traction in the pair implies the downtrend is getting out of steam, leaving the pair sideways with buyers holding back near the 50-EMA. Prevailing bullish momentum can lead the price to retest the resistance area of the 50-EMA around 1.35489, which is expected to halt the upward move. If sellers take cues from this significant dynamic resistance, the price may find a new directional signal to down.

If that is the case, the immediate support is estimated at 1.34718. bears need to break this hurdle to resume the downtrend. Suppose they gather enough strength to do so. In that case, we can expect the decline to extend towards 1.34242. Further fall below this barrier may put the 1.33842 handle in the spotlight.

Otherwise, if buyers get back to their seats, they may drive prices higher to tackle the 50-EMA around 1.35489. a successful breach above this roadblock will turn bulls’ attention to the previous level of interest at 1.35921.

Short term momentum oscillators exhibit a mixed picture. RSI is floating in a neutral zone with no clear directional signal. While momentum is moving up in buying region, the MACD histograms are ticking down in negative territory, attached to the flattening signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.