EUR/GBP battles one-week resistance

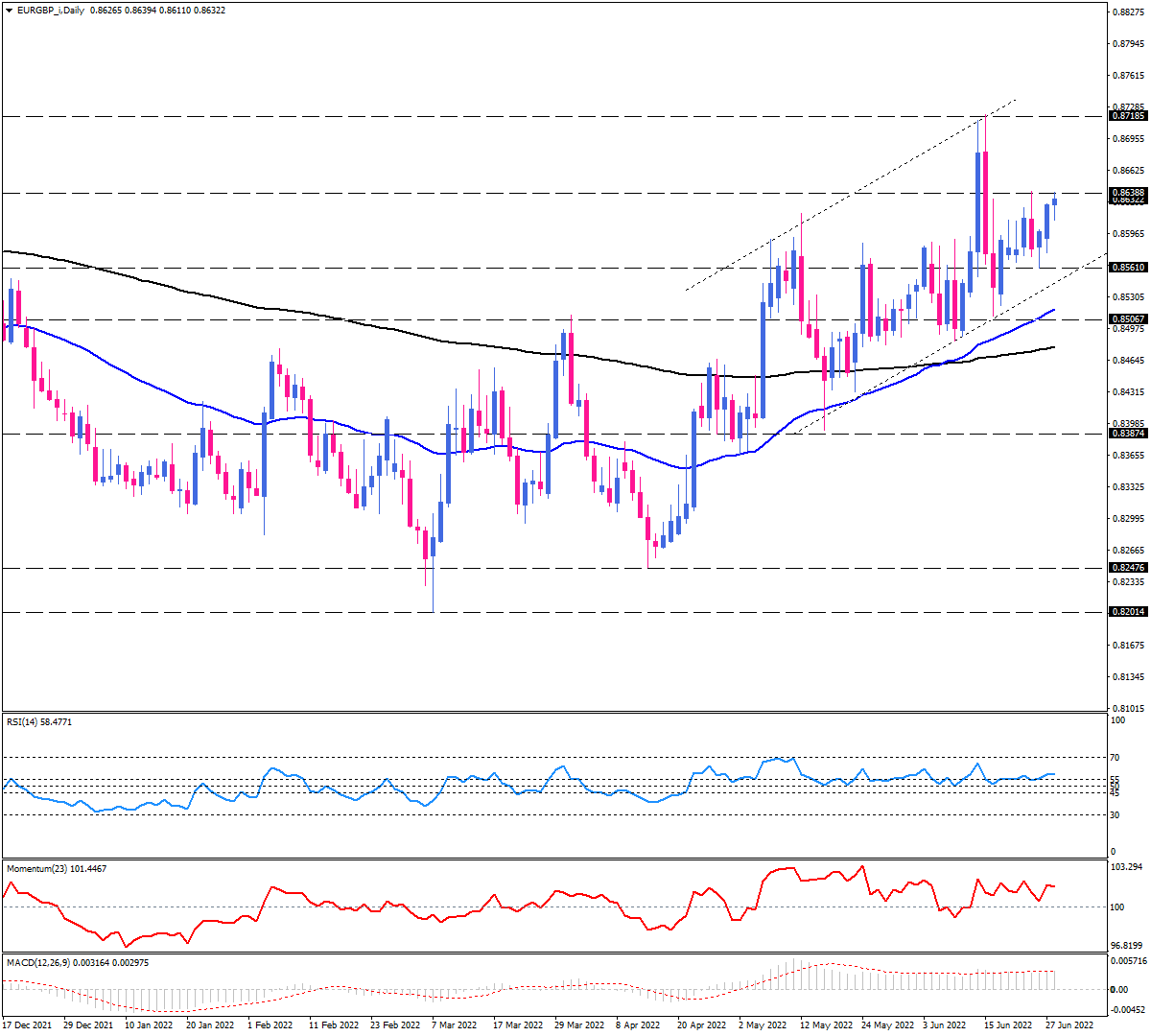

During the past month, EUR/GBP has been in an uptrend with higher tops and higher bottoms, with the price moving within an upward channel, above 200 and 50-day EMAs.

After climbing from the lower line of its ascending channel, EUR/GBP is struggling with a key intraday resistance level of 0.86388 on the daily chart. If buyers are to maintain the upward trend, they must get over this hurdle. If buyers manage to overcome the 0.86388 roadblock, the next resistance will come from the one-year top at the 0.87185 mark. Overstepping this barrier, the upper edge of the channel might confront the rally.

Alternatively, suppose sellers successfully defend the current resistance level for a longer period of time. In that case, the price will likely remain sideways, with sellers attempting to drag the euro back down towards the 0.85610 range's support. However, as long as EUR/GBP holds the channel, the uptrend remains intact.

Following a golden crossover in June, positive sloping moving averages also display a bullish bias. Moreover, short-term momentum oscillators indicate bullish support. RSI is trying to keep the ground above the neutral zone, advancing in the buying area. Momentum is hovering above the 100-threshold, suggesting buyers are in charge. Positive MACD bars are on a slight rise on the verge of the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.