EUR/GBP is set to post a fresh weekly high

As the Bank of England announced its policy decision, EUR/GBP caught aggressive bids, rallying to a fresh weekly high. As the focus shifts to the post-meeting press conference, the cross is trading just above 0.8400.

This marked the biggest increase in the benchmark rate since 1995, as the Monetary Policy Committee voted unanimously to raise it to 1.75%, the highest level since late 2008. Since the jumbo rate hike had already been priced in the markets, the British pound showed more attention to the economic slowdown.

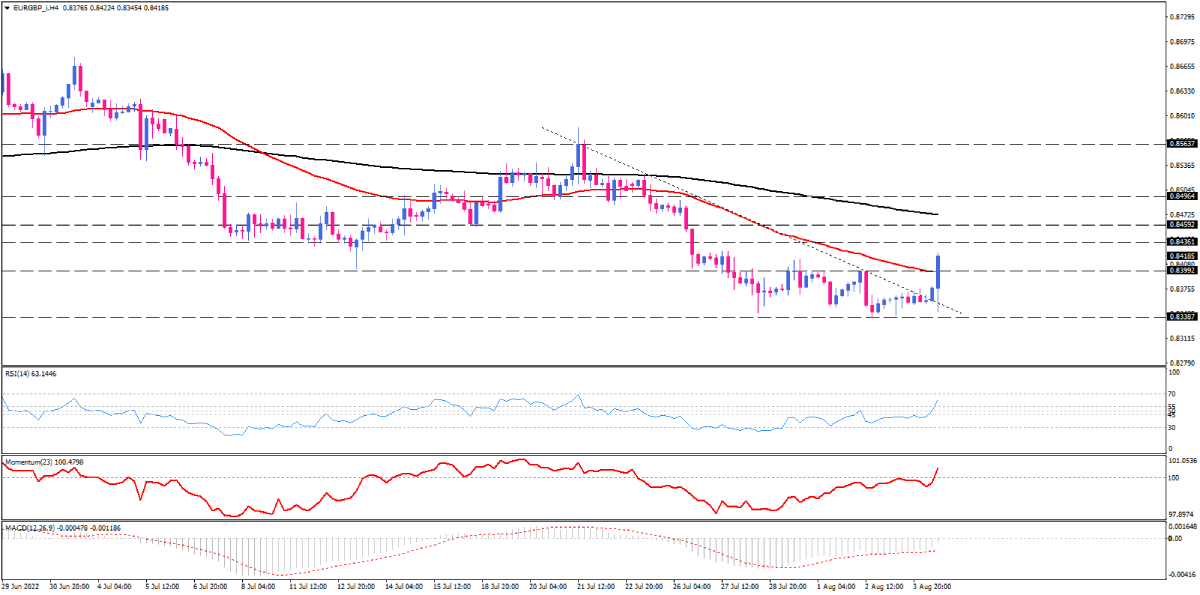

On the four-hour chart, EUR/GBP bulls succeeded in breaking the short-term down trendline to the upside as they gained ground above the crucial resistance level of 0.83992 in the vicinity of the 50-EMA. If buying pressures intensify on the back of recession fears in the UK, sterling is expected to depreciate further. Such a move can contribute to more gains for EUR/GBP, heading towards 0.84360 as the immediate resistance level. If buyers manage to overstep this hurdle, the price is seen to reach the 0.84592 mark, which is in line with the 200-EMA.

Otherwise, if sellers retake control, the 0.83387 support will be waiting for the fall. Sellers need a sustained break below this barrier to resume the downtrend.

According to short-term momentum oscillators, bullish sentiment is on the rise. RSI has stepped into the buying zone, continuing to move higher. Also, momentum has crossed above the 100-threshold. The MACD histogram is very close to crossing the zero line due to sellers retreating from their positions.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.