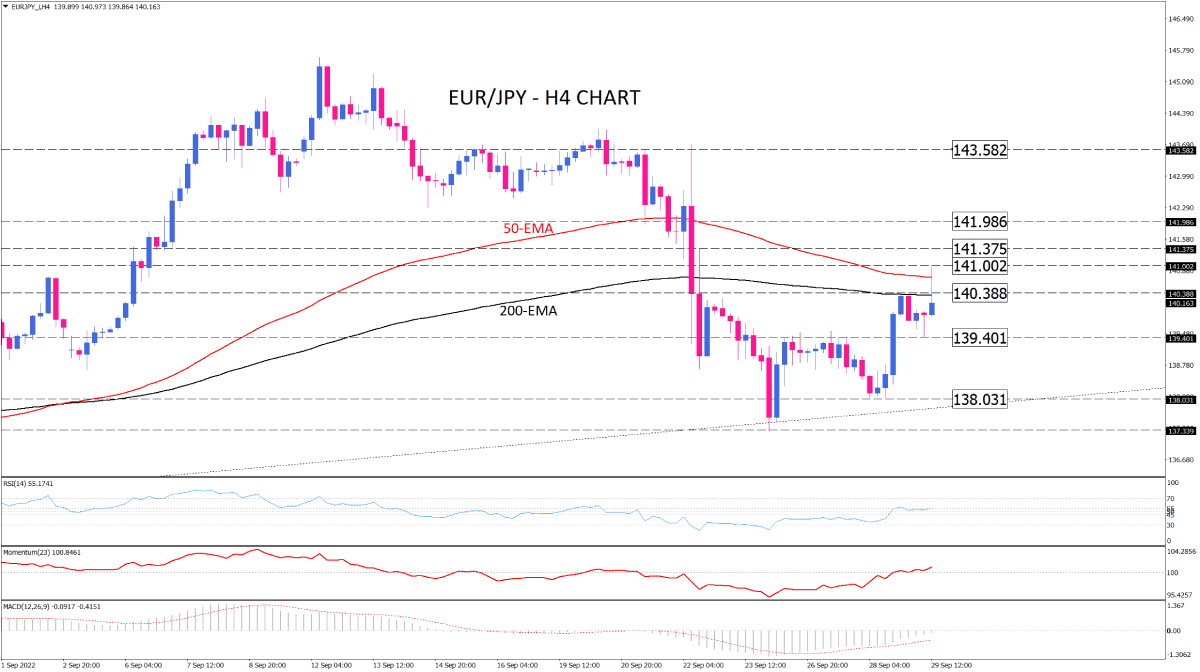

EUR/JPY rally stalled at a key resistance zone

With EUR/JPY buyers breaking the 139.401 mark on the four-hour chart, the pair is hanging out around the 140.388 barrier, which is at the boundary of the 200 and 50 exponential moving averages resistance zone.

After a pullback from the long-term uptrend line around the 138.031, the bulls are now struggling to overcome a resistance zone in the vicinity of the EMAs.

If buyers maintain their position above this key level of interest, then the upside trend may continue with having 141.002 on the radar. By clearing this hurdle, the pair may run-up towards 141.375. When the price is able to sustain a break above this barrier, the price is likely to accelerate upwards the next hurdle at 141.986.

Alternatively, if the current EMAs zone stalls the rally, sellers may get back to their seats, aiming for the day low at 139.401. Breaking below this level can trigger further declines towards the 138.031 barricade.

Short term momentum oscillators imply intensifying bullish bias, as the RSI is trending upwards, trying to get above the neutral area. Momentum is also picking up above its 100-baseline. The MACD has been shrinking toward zero and now is about to cross its threshold to the positive territory.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.