EUR/NZD edges lower to face one-week lows

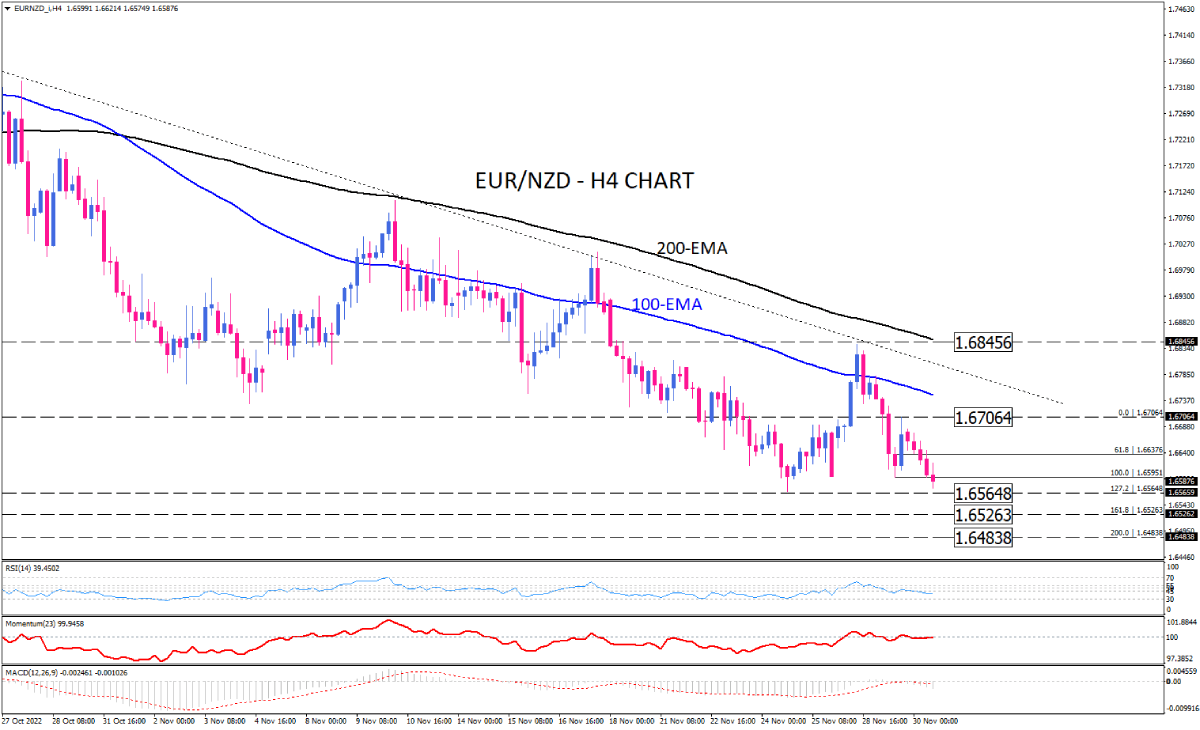

EUR/NZD started its downtrend in late October by falling below the 100 and 200-period exponential moving averages. Since then, sellers have formed major lower tops and bottoms until the price hit the two-month low of around 1.65648 last Thursday. Following a rebound from this key barrier, descending trendline capped the rally and a new round of declines has been prompted by breaking the last swing bottom at 1.6595. if bears gather enough momentum to overcome the 1.65648 hurdle, the next obstacles are waiting to confront the fall at 1.65263 and 1.64838, respectively. Prevailing bearish momentum below these levels can poise the downtrend to capture the 1.64150 mark.

Alternatively, should buying forces defend the current support level, the downtrend will get out of steam, pushing the prices higher towards the 1.67064 barrier, which stands in the confluence of the 100-EMA and the falling trendline. The cluster of all three resistance levels has built up a significant resistance zone against any further traction.

Short-term momentum oscillators point out a mixed situation. RSI is hovering beneath the neutral area with a bearish tendency. Momentum, as well, is crawling attached to the 100 threshold, suggesting a lack of effective presence from either buy or sell forces. Likewise, MACD bars are waiting in the selling territory for sellers to gain persistent control of the market.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.