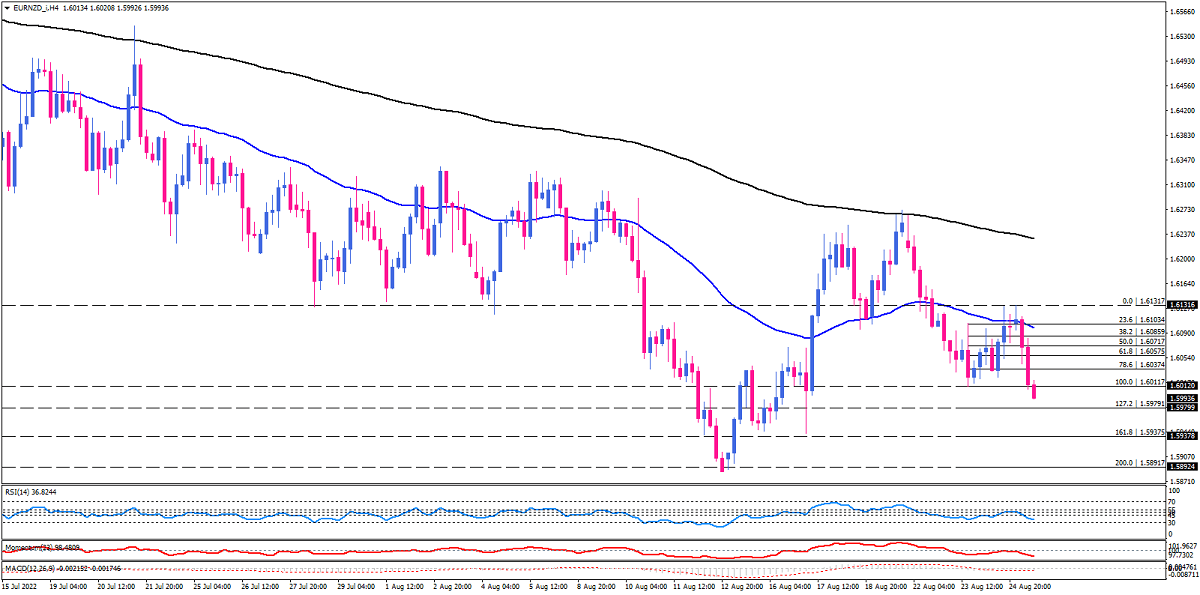

EUR/NZD sellers challenge a crucial support

Euro/NZD is trading in a downtrend on the four-hour chart below both the 50 EMA and 200 EMA. As the price rebounded off the 50-EMA earlier on Thursday, negative momentum has accelerated. Further declines are likely if sellers succeed in dragging the pair below the previous market bottom at 1.60117. In the event that bearish sentiment continues to prevail, 1.59375 could act as a support level. Breaking below this barrier will lead to 1.59375, which is in line with the 161.8% Fibonacci projection of the last upswing. Once this crucial support is violated, EUR/NZD may fall back to as low as 1.58917, which has been the four-month low.

Alternatively, suppose buyers return to the market to bid up the euro. In that case, the price will reverse and put the 50-EMA under threat, which was the case at the previous top at 1.61317. However, to confirm a new uptrend, bulls must break decisively above the 200-EMA, which stands in the vicinity of the August 19 major top of 1.62729.

Momentum oscillators support the bearish run, with RSI falling in the selling area and momentum crawling below 100. Also, the MACD histogram, which is in the negative territory, is also inching down.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.