EUR/NZD struggles with a crucial support

The Euro is declining against the New Zealand Dollar for the eighth straight day as sentiment for the Euro remains fragile in the wake of the economic slowdown and energy worries across the continent. At the same time, the Reserve Bank of New Zealand raised its official cash rate by 50 basis points to 2.5%.

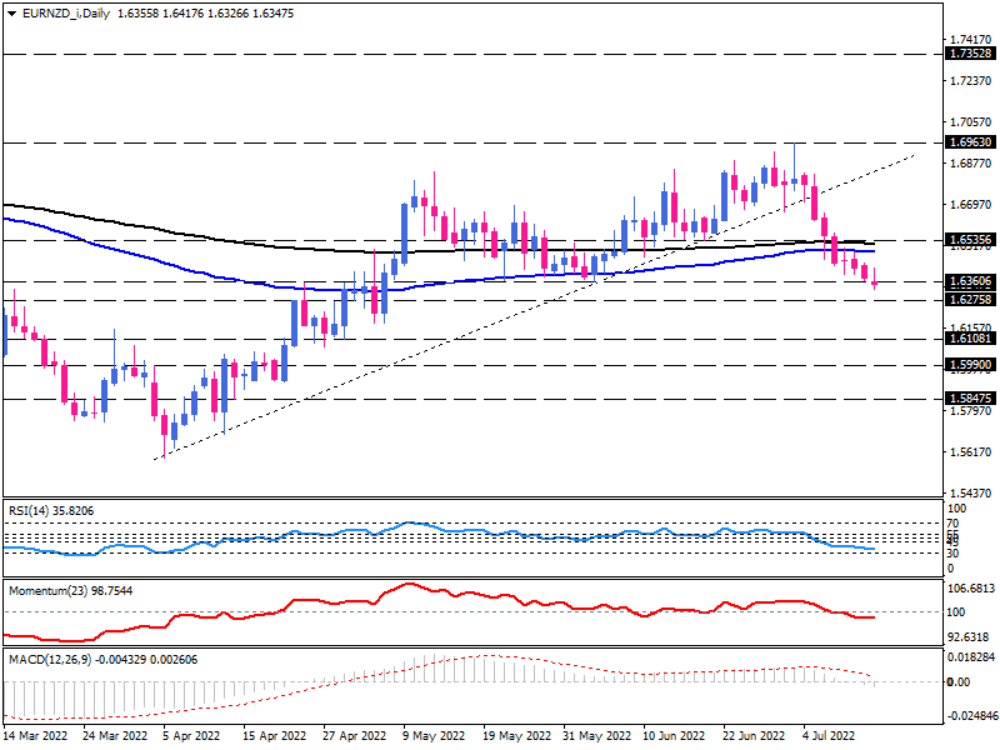

On the daily chart, the EUR/NZD rally failed after a cross below the 100, and 200-day exponential moving averages followed the penetration of the rising trendline, resulting in a dive below two-month lows around 1.63606. This barrier may fail to limit losses if selling pressure continues, and the subsequent support will probably be found at 1.62758. Obtaining this hurdle would trigger further falls, leading to 1.61081 as the next level of interest.

Otherwise, should buyers defend the support level of 1.63606, the pair will have a chance of rising back to the 200-day EMA, which is around the 1.65356 mark.

Short-term momentum oscillators reflect a sharpening of selling forces along with the price action on the chart. RSI is on its way down in the selling region, suggesting bears are in control. The momentum stays below the 100-threshold, indicating the general sentiment is negative. Likewise, MACD bars are getting more profound in the negative area after crossing below the zero-line on Monday.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.