EUR/USD facing more downside pressure

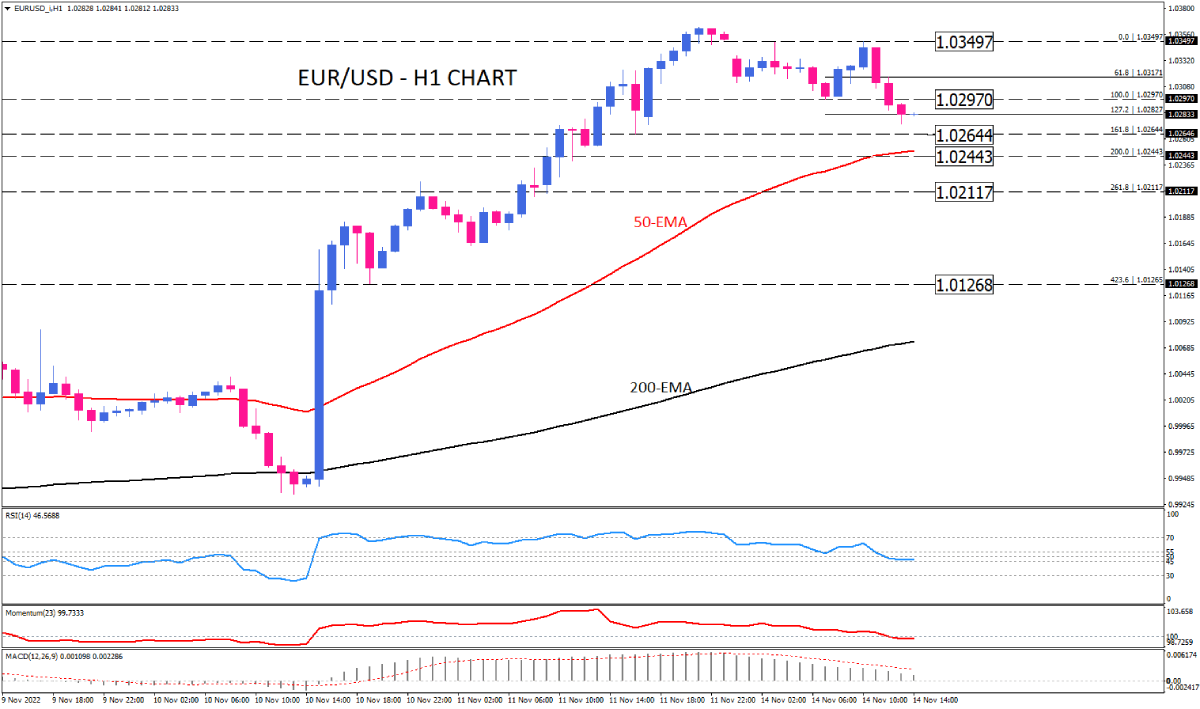

There has been some downside pressure on EURUSD during Monday's mid-day trading session as sellers managed to break the key support level of 1.03 following retreating from three-month peaks around 1.035.

As the market rose sharply over the past week, investors were cashing in on a significant part of the gain. It is essential to note that this surge was primarily triggered by lower-than-expected US inflation figures during October, which led to speculation that the Federal Reserve may slow the rate hikes in the future.

Regarding a modest recovery in the dollar index, EUR/USD is now on the back foot towards the immediate obstacle at 1.02644. If buyers lose this support, intensifying bearish sentiment can prompt further declines to the 50-EMA, which is located at 1.2443. A sustained break below this hurdle can motivate more sellers to get the price down to 1.02117.

Otherwise, should buyers manage to halt the fall, they need to break above the last top of 1.03497 to resume the uptrend.

Nevertheless, short-term momentum oscillators indicate that there is likely to be a reverse in sentiment in the market as sellers are likely to take control. RSI is trending down on the verge of the lower boundary of the neutral zone. Momentum is challenging the 100-threshold to cross it into selling region. MACD bars are shrinking in the positive area, suggesting the bullish bias is losing steam. At the same time, the signal line is moving down toward zero.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.