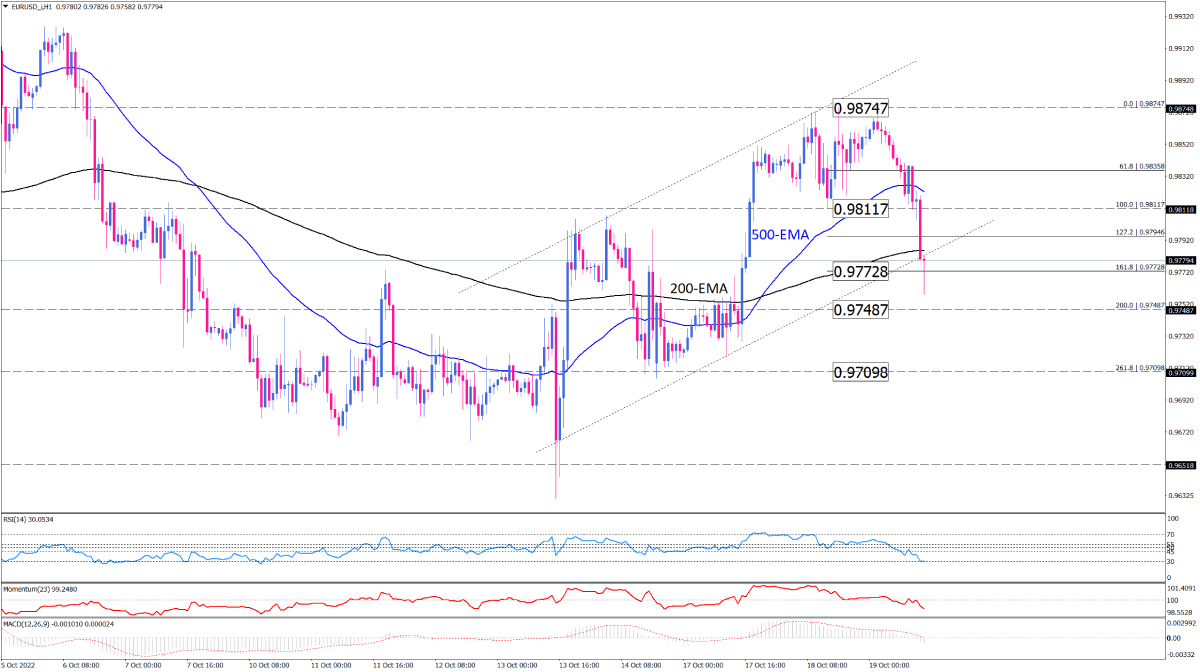

EUR/USD sellers attempt to hold the ground below a key level

As seen on the one-hour chart, EUR/USD selling pressure has been intensifying on Wednesday with sellers bringing the pair all way down from the two-week top at 0.98747 to below the lower border of the short-term ascending channel. The extension of the bearish move has resulted in a decisive breach of the channel and the 200-EMA, keeping more sellers hopeful of driving the market even lower towards the lower support around the 0.97487 barrier. Suppose this immediate support fails to cap the drop. In that case, further downside risk will keep the pair on the back foot, putting the 0.97098 hurdle in the spotlight.

Otherwise, with RSI pointing to the oversold condition, the price might find a chance to retest the broken channel line in the vicinity of the 200-EMA. A sustained break above this resistance confluence would warn of a more sustainable recovery towards the 0.98117 mark, in line with the 50-EMA.

Other short-term momentum oscillators also suggest that sellers are in charge. Momentum is sliding down in the selling area. Likewise, MACD bars are deepening in the negative territory, while the signal line has not crossed zero yet.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.