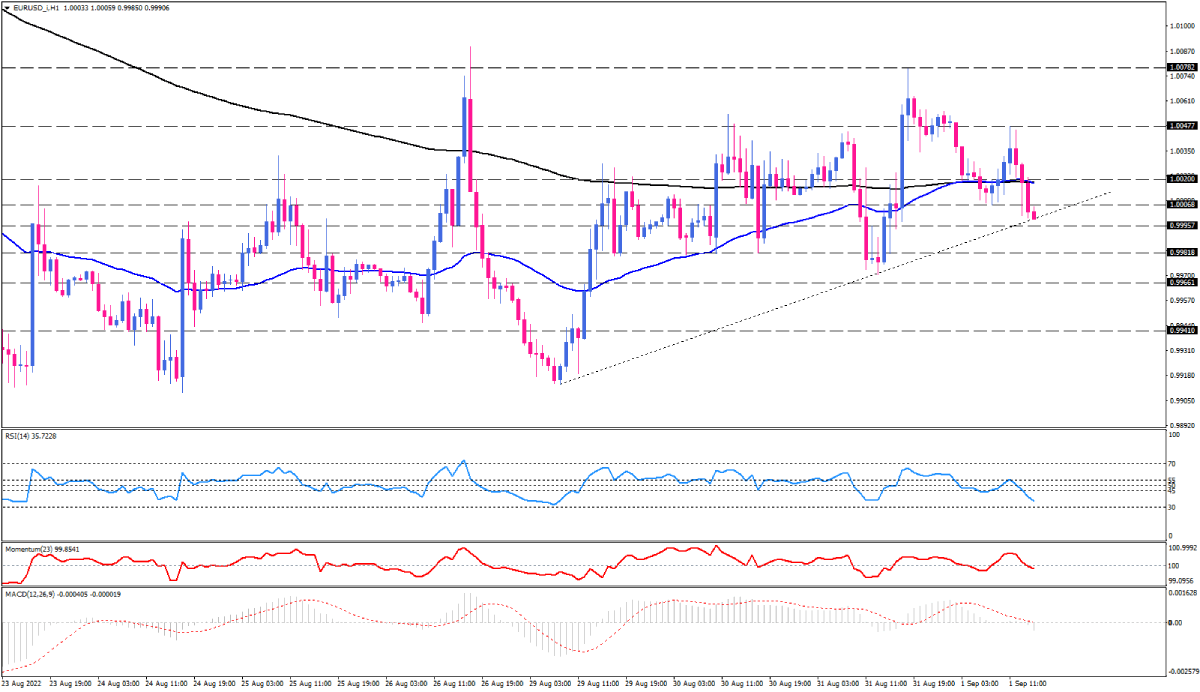

EUR/USD sellers tackle the uptrend line

EUR/USD is on the verge of its short-term uptrend line on the one-hour chart after buyers failed to keep the ground above 1.00477. In the mid-day trading session on Thursday, sellers broke the support of 1.00068, pushing the pair lower towards the parity, which is right in smack with the uptrend line. If selling pressure continues to grow, sellers will become able to overcome the confluence of support levels, aiming for 0.99818. The further decline can send the euro back down to 0.99661, around Wednesday’s low. By breaking this hurdle, the next support is expected to encounter a fall at 0.99410.

Otherwise, if the trendline holds, the price can increase to test the confluence of flattening moving averages around 1.00200. For the uptrend to be intact, buyers must overstep the 1.00477 resistance level.

Short-term momentum oscillators support bearish momentum. RSI is moving lower in the selling area. Momentum is below the 100-threshold, and MACD bars crossed below the zero line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.