EUR/USD short-term uptrend is getting out of steam

ECB president Lagarde's most recent comments have increased speculations that a rate hike could begin as soon as this summer, causing the single currency to appreciate against the dollar as investors assume the policy divergence between the ECB and Federal Reserve has narrowed. Euro/dollar rallied after bottoming at 1.03585, putting the pair on the front foot. Having crossed above the 50 and 200 exponential moving averages, it appears investors are re-evaluating the possibility of a more hawkish ECB.

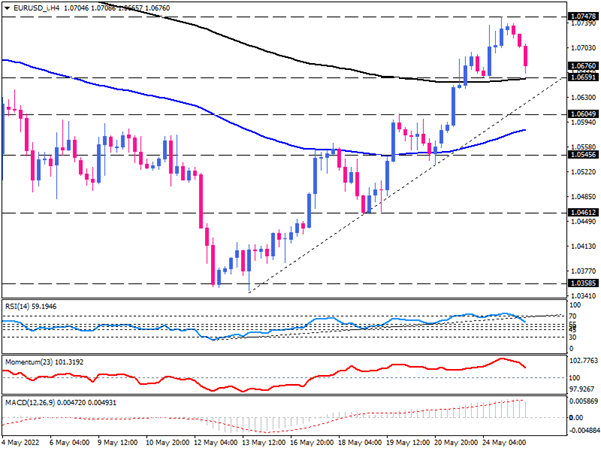

On the four-hour chart, EUR/USD retreated from the one-month top around 1.07412, with sellers aiming to retest the 200-EMA, which lines up with Tuesday's low at 1.06591. If this barrier acts as reliable support, the price may bounce up towards the 1.07412 previous level of interest.

Overstepping this hurdle can lead the pair to confront the next resistance at the 1.08024 mark. Suppose this level is broken by intensifying bullish momentum. In that case, buyers will target the 1.08353 hurdle before reaching the critical resistance level at 1.09215.

Conversely, if sellers gain enough strength to break below the 200-EMA, the next support will likely be found at the confluence of the 1.06049 hurdle and the 50-EMA, right near the ascending trendline. If selling pressure intensifies, the pair may drop below this area towards the 1.05456 support level. A sustained move below this handle will make 1.04612 prominent.

Momentum oscillators suggest positive momentum is fading. RSI is moving down from the overbought territory, breaking below its up trendline. Likewise, momentum is pointing down after peaking at about its three-month extreme levels. At the same time, decreasing MACD bars fell below the signal line, implying that buying forces take a breather.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.